- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- QOZ/QOF Form 8997

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

QOZ/QOF Form 8997

Greetings! For those of you that had to use Taxact for your QOZ, any trouble with form 8997? I cannot get it to populate Parts II and III. Thank you.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

QOZ/QOF Form 8997

Did you use the download version of that product? If so, does it have some sort of forms mode?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

QOZ/QOF Form 8997

Thanks for your reply, I’m using online version. Answered interview questions successfully but software apparently not set up to fill in the 8997 form. The form is available to be added using the “form assistant”.

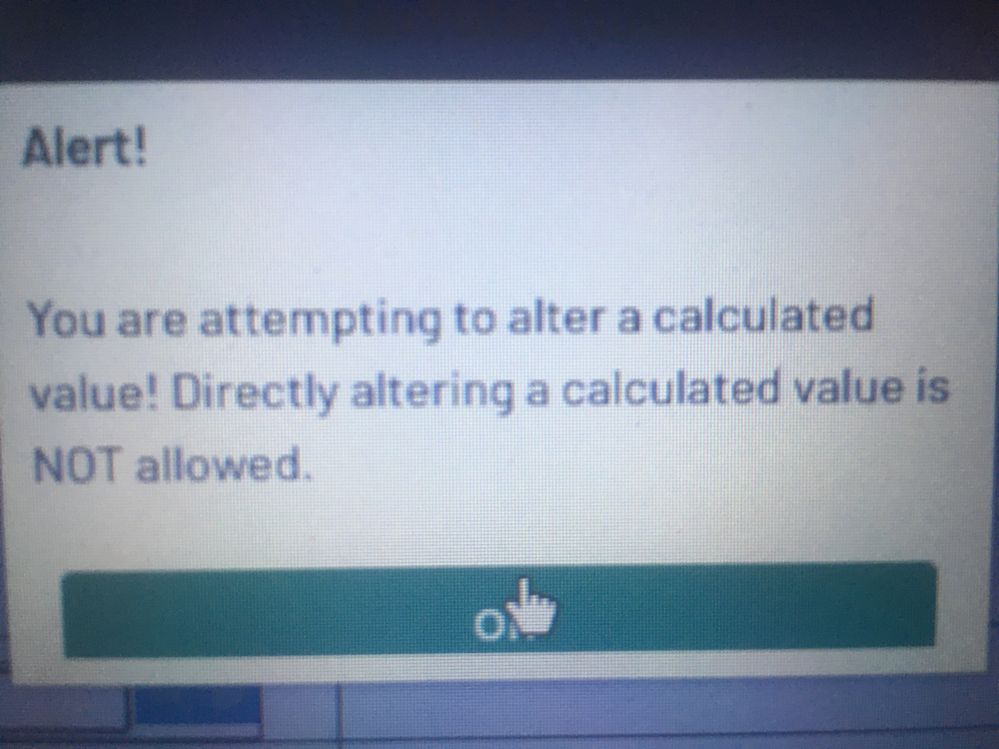

When I attempt to fill part II I receive the error message below.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

QOZ/QOF Form 8997

Ironically it does allow me to fill part I, which actually does not apply to me. I had filled part I in error before realized did not apply. Went back erased everything and even deleted form and re-added to no avail.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

QOZ/QOF Form 8997

This TurboTax support community is run by Intuit, the company that makes TurboTax, to help its customers use TurboTax to prepare their tax returns. If you need help with TaxAct you should go to the TaxAct support site.

The people who posted in this community about using TaxAct for QOZ are not going to see your question here. You could try posting in one of the existing threads where using TaxAct is discussed. Some people might still be following those threads.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

QOZ/QOF Form 8997

Thank you. I’m well aware, I’m a 10+ year TT user. Unfortunately, TT is not providing support for the QOF, which forces me to use another tax service. Thanks for the advice though, I am reaching out using the avenue you suggested. Taxact does not have support on weekends and just trying to get it done.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

QOZ/QOF Form 8997

I agree! I spent several days completing my tax return on Turbo Tax, just to find out at the very end that I couldn't enter 8997 information. SO FRUSTATING

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

QOZ/QOF Form 8997

I have given up on Turbotax since it will not allow me to account for the QOZ capital gains deferrals. So, i have had to hire an accountant for thousands each year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

QOZ/QOF Form 8997

I, too, have the woes you all have, and I had to quit Turbo Tax because they would not support form 8997. I switched to TaxActOnline in 2020 as, at the time, they were the only company I found that supported Form 8997. They do a very nice job of it, but I don't recommend TaxActOnline unless you know what you are doing. The software is written, well, not for tax dummies. I have an accounting degree and I had to do searches and finally call Customer Support to figure out how to report an initial investment. When you do the input for the form 8949, there is a code, it's a Z, I believe. This Z sends it to Form 8997. But trying to get the Z to come up in the drop down menu was a royal pain.

I did some googling and found out TaxSlayer Pro is now supporting the Form 8997. I will continue to use TaxAct Online.

Someone else suggested using Turbo Tax without the form 8997 and file a manual 1040X Amendment to include the Form 8997. OH GOD NO! You do NOT want to file a Form 1040X if you can avoid it. TaxActOnline allows you to do a Form 1040X free if you used their service for your Form 1040. Ok, I didn't need to change my 8997, but the company my QOF is invested in gave me a "Corrected" Schedule K-1 with additional income. I filed a Form 1040X and paid my tax. Ok, the IRS says it takes 20 weeks to process a Form 1040X? What they DON'T tell you is if they think they can squeeze you for extra money THEY FAST TRACK THOSE THINGS! Well, ONE MONTH after I filed (electronically) my form 1040X, the IRS wrote back, acknowledging receipt of my Form 1040X and my payment of tax, and well, they decided I owed an additional $1500! HUH? I protested. I included a copy of my previously filed Form 1040X. Well, the IRS processed my COPY as a SECOND Form 1040X and again claimed I owed an additional $1500. After numerous calls to TaxPayer Advocate office of IRS, I finally got an astute agent. If you have Capital Gains and Dividends, your tax is calculated using QDCGTW (Qualified Dividends Capital Gains Tax Worksheet). Well, on my amended form, the IRS applied the Tax Table instead of the QDCGTW rate. So I had to send in another protest letter (making sure I DID NOT include a copy of my 1040X). It took me three months to resolve it, but I had to call continuously and be a squeaky wheel. Finally got the IRS to back down on me owing an additional $1500.

DO NOT put yourself in any position where you need to file a Form 1040X. If you find you need to because you owe additional money, I have heard this as "advice." DON'T. Just let the IRS figure it out and contact you.

Meanwhile, the online "where is my 1040X" still shows my 1040X is not processed yet, even though it has been.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

bnr

New Member

whatusername

Level 2

skannas11

New Member

vrouse

Level 1

gzhuwea

Level 2