- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- New Home used as primary residence and rental

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Home used as primary residence and rental

If I bought and immediately rented out 2 bedrooms in my 3 bedroom single-family home (we share common areas except for the bathroom), how do I properly account for depreciation and home expenses (utilities, alarm, internet, etc.)?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Home used as primary residence and rental

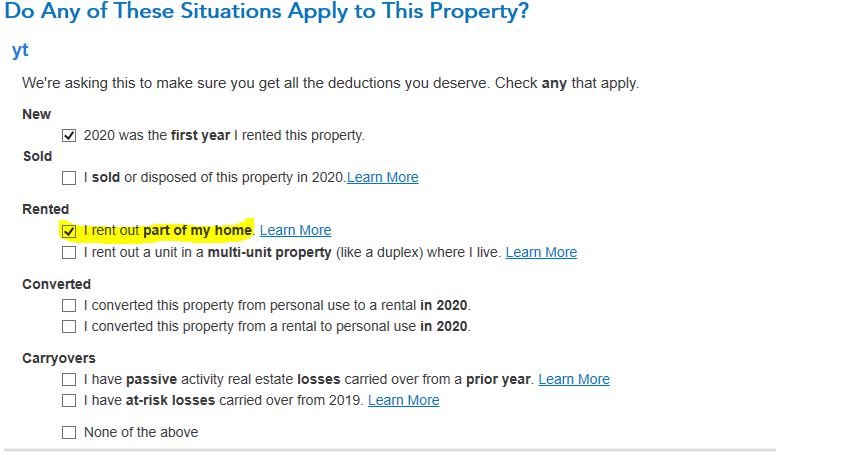

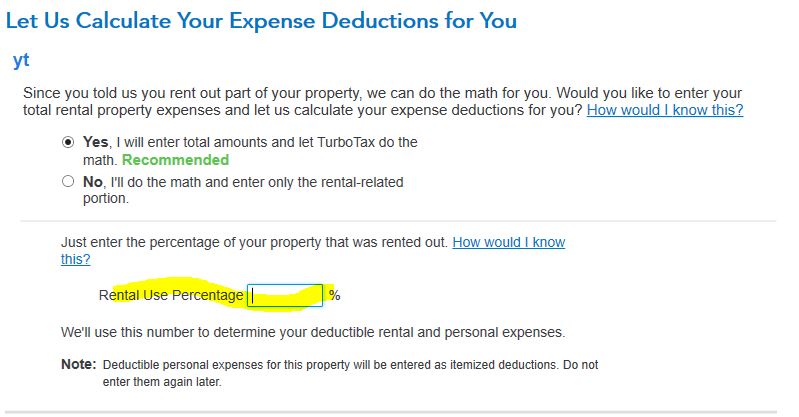

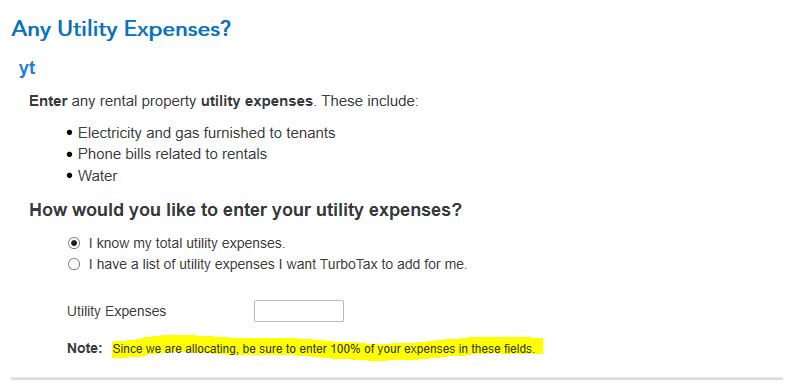

When you enter the rental in TurboTax, you will be asked if you rent out a portion of your home and what percentage of your home is rented. That percentage will be used to allocate common expenses like utilities to your rental space.

You will enter the house cost as an asset and multiply the cost by the rental percentage mentioned above and enter that adjusted cost for the asset. TurboTax won't do the allocation mentioned above for the house, you need to do that before you make your entry.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Home used as primary residence and rental

When you enter the rental in TurboTax, you will be asked if you rent out a portion of your home and what percentage of your home is rented. That percentage will be used to allocate common expenses like utilities to your rental space.

You will enter the house cost as an asset and multiply the cost by the rental percentage mentioned above and enter that adjusted cost for the asset. TurboTax won't do the allocation mentioned above for the house, you need to do that before you make your entry.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

17678056393

New Member

user17577323767

Returning Member

jimmost

New Member

user17671286960

New Member

howverytaxing

Returning Member