- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- missed depreciation on rental

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

missed depreciation on rental

From prior messages i see that I must do a 3115 for missed rental property depreciation.

Twice I have called TurboTax help line and been told that if I did not take it I do not need to deal with recapture upon sale of the property.

I believe this is false..??

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

missed depreciation on rental

You are correct- to resolve this you probably need to file a 3115. Upon disposition, you must recapture depreciation allowed or allowable (meaning the amount missed gets included here which is not a good result.)

If you only filed one year with missed depreciation, you can choose to go back one year and amend, or file a 3115. That's because an error becomes your "accounting method" when done for 2 years or more, then the option goes away and you must file a 3115.

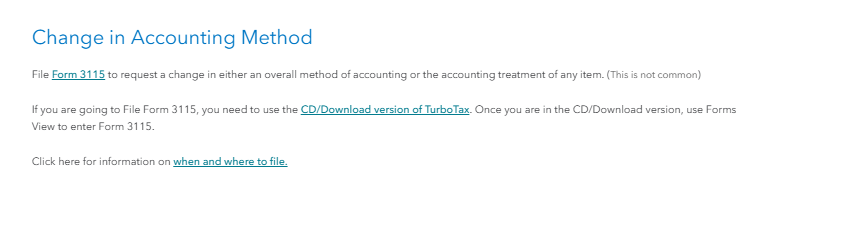

Form 3115 is not supported for e-file or TurboTax Online, so use a Desktop version and paper file.

Here is an article you may find helpful: What should I do if I didn’t take depreciation on my rental property?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

missed depreciation on rental

@cjnes wrote:for missed rental property depreciation.

Just a bit of a clarification: It isn't merely for "missed" depreciation; it is for missing depreciation due to an incorrect Accounting Method.

If you did not take depreciation in the first or second year of it being "placed in service", yes, you need Form 3115 to start claiming depreciation and to 'catch up' on the missed depreciation. If you originally started taking depreciation in the first and/or second year, but then later stopped claiming depreciation, that can only be corrected by amending.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

missed depreciation on rental

Thanks- I had never taken depreciation as I was not even making much money on the rental and was advised I did not need to take it. I now hear this was incorrect-----info provided by turbotax online agent (twice).

I will do 3115 this year to catch-up.

will this drastically affect what i owe this year (2024) in taxes?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

missed depreciation on rental

You are correct- not "missed" actually never taken (7 years)

So if I do form 3115 for 2024 I also take the depreciation for 2024 on schedule E correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

missed depreciation on rental

Yes, Form 3115 needs to be filed, which will allow you to enter the 'catch up' depreciation. And you will claim the current-year depreciation as well.

Yes, the additional deduction due to the 'catch up' depreciation could significantly impact your tax return. But rental property usually is a "passive" activity which sometimes limits your current-year deduction, so it is possible some of that deduction will need to be carried forward (depending on your specific circumstances).

I recommend going to a good tax professional this year to do that.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

missed depreciation on rental

thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

missed depreciation on rental

I had been taking rental depreciation for 4 years on a rental condo then somehow missed taking the depreciation for the next 3 years. Can I still use Form 3115 to catch up on the missed depreciation? Or can 3115 only be used for missed depreciation if I had never claimed depreciation in prior years?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

missed depreciation on rental

Yes, you need to file Form 3115 and adopt a change in accounting method: This option allows you to go back as far as you need. Make the adjustment on your current year tax return to expense the missing depreciation.

- Why am I adopting a change in accounting method? Not claiming depreciation in two or more years indicates that you've chosen an accounting method without depreciation. In this case, you must now elect to change your accounting method to include depreciation.

See this post for complete instructions: What should I do if I didn’t take depreciation on my rental property?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

missed depreciation on rental

@Luna36 wrote:I had been taking rental depreciation for 4 years on a rental condo then somehow missed taking the depreciation for the next 3 years. Can I still use Form 3115 to catch up on the missed depreciation? Or can 3115 only be used for missed depreciation if I had never claimed depreciation in prior years?

If depreciation was correctly claimed in the first and/or second year, the only way to claimed the missed years is to amend.

Form 3115 does not apply when depreciation was correctly taken in the first and/or second year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

missed depreciation on rental

I appreciate you response. Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

missed depreciation on rental

Appreciate the response.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

syounie

Returning Member

alvin4

New Member

melillojf65

New Member

iqayyum68

New Member

user17524531726

Level 1