- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

You are correct- to resolve this you probably need to file a 3115. Upon disposition, you must recapture depreciation allowed or allowable (meaning the amount missed gets included here which is not a good result.)

If you only filed one year with missed depreciation, you can choose to go back one year and amend, or file a 3115. That's because an error becomes your "accounting method" when done for 2 years or more, then the option goes away and you must file a 3115.

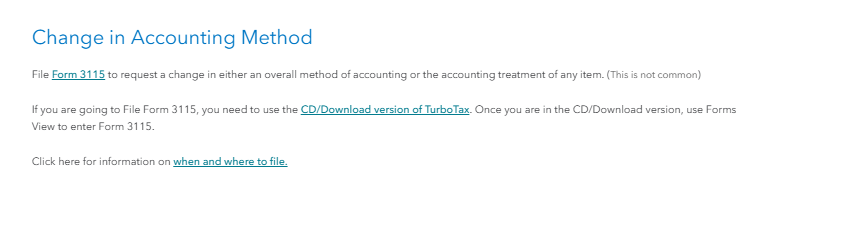

Form 3115 is not supported for e-file or TurboTax Online, so use a Desktop version and paper file.

Here is an article you may find helpful: What should I do if I didn’t take depreciation on my rental property?

March 3, 2025

4:58 PM