- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Lack of 1099-B from a startup that shutdown. Declaring loss on return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Lack of 1099-B from a startup that shutdown. Declaring loss on return

I bought 10,000 shares of common stock from a startup where I worked until 2017. Last year, I got a letter saying that they were shutting down. I didn't get a 1099-B from them.

I tried live online help, and I don't think the person could help me since they thought that 1099-B was necessary. I received none.

I did the following while entering my tax return. I followed this post:

- I chose "Long Term did not receive 1099-B form"

- Total Proceed - Enter $0

- Total Cost - Entered the actual cost of purchase

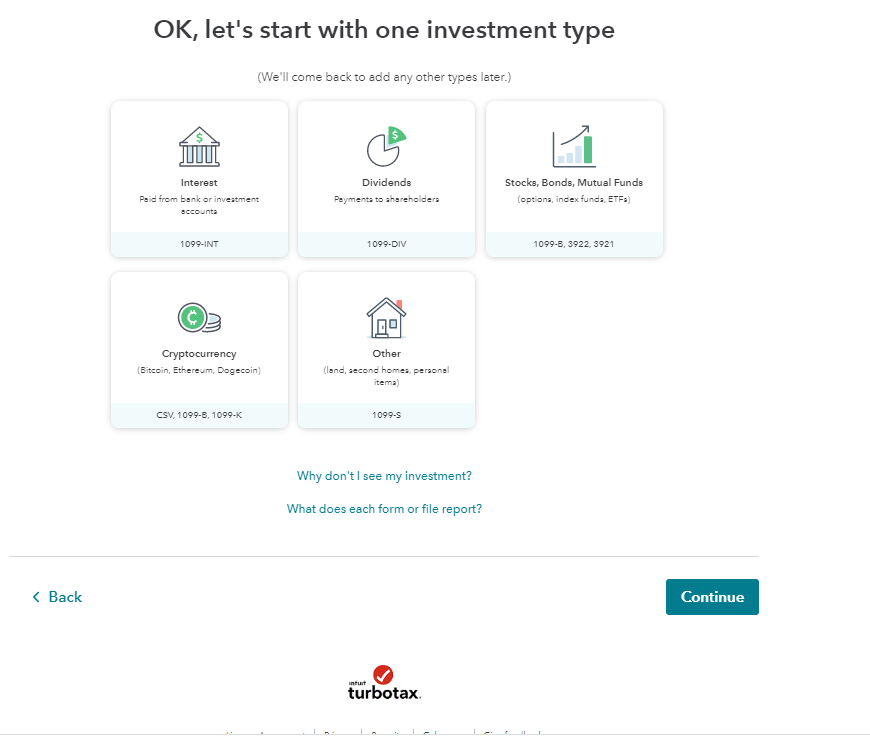

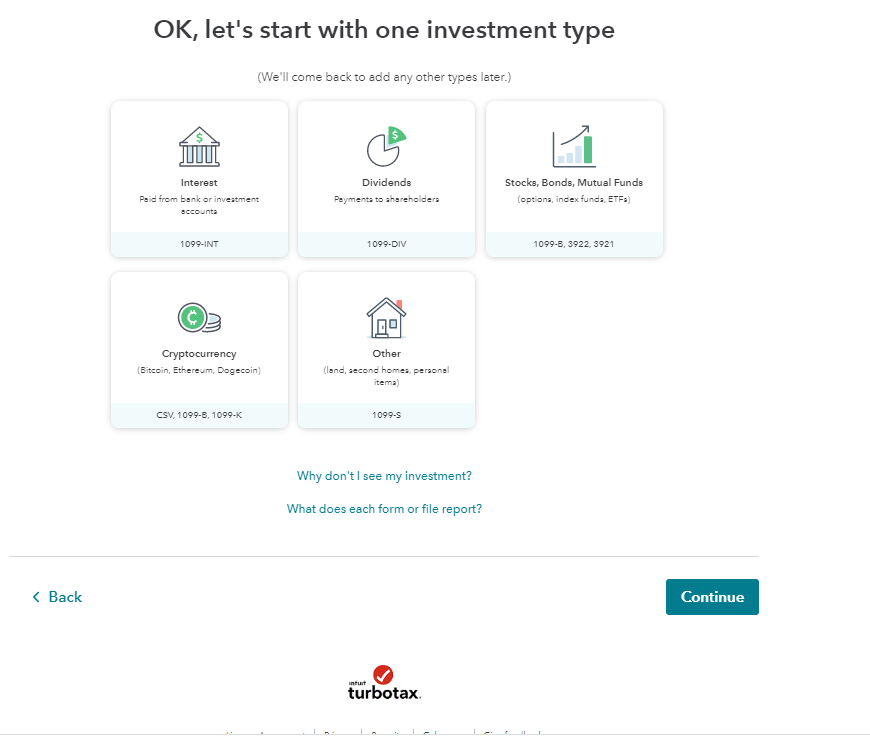

It still asks for 1099-B as shown in the snapshot below:

I am still being asked for a 1099-B. I didn't receive one.

How do I declare this stock purchase as worthless?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Lack of 1099-B from a startup that shutdown. Declaring loss on return

Do not add as Stock, Bonds, Mutual Funds, instead select Other.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Lack of 1099-B from a startup that shutdown. Declaring loss on return

Do not add as Stock, Bonds, Mutual Funds, instead select Other.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

josepha01

Level 1

tonyrock

Level 1

confused_tax_filer

Level 1

unlocked_academy

Level 1