- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- K1 Ordinary Business Income/Loss (box1) VS Net Rental Real Estate/Loss (box2)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 Ordinary Business Income/Loss (box1) VS Net Rental Real Estate/Loss (box2)

Hello TurboTax Community,

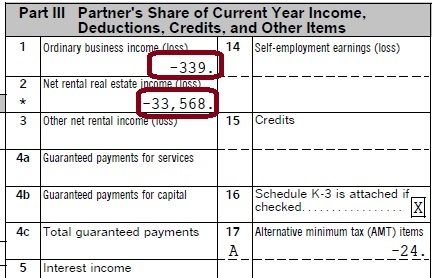

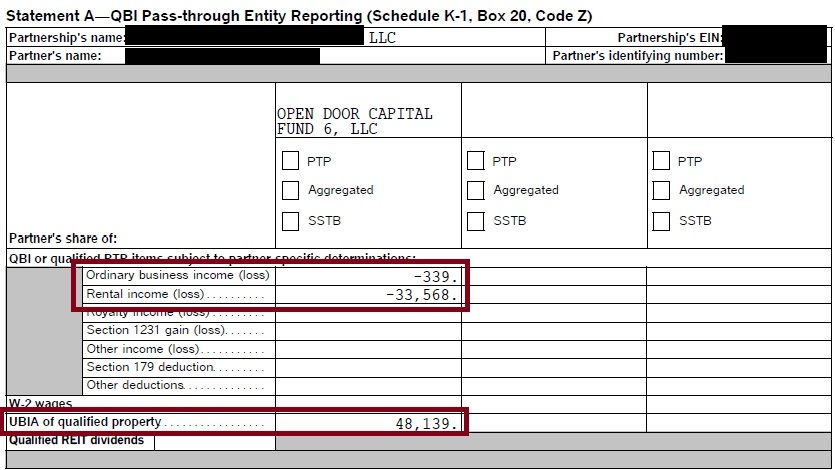

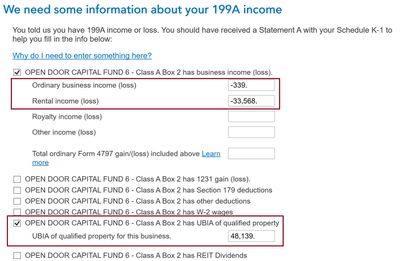

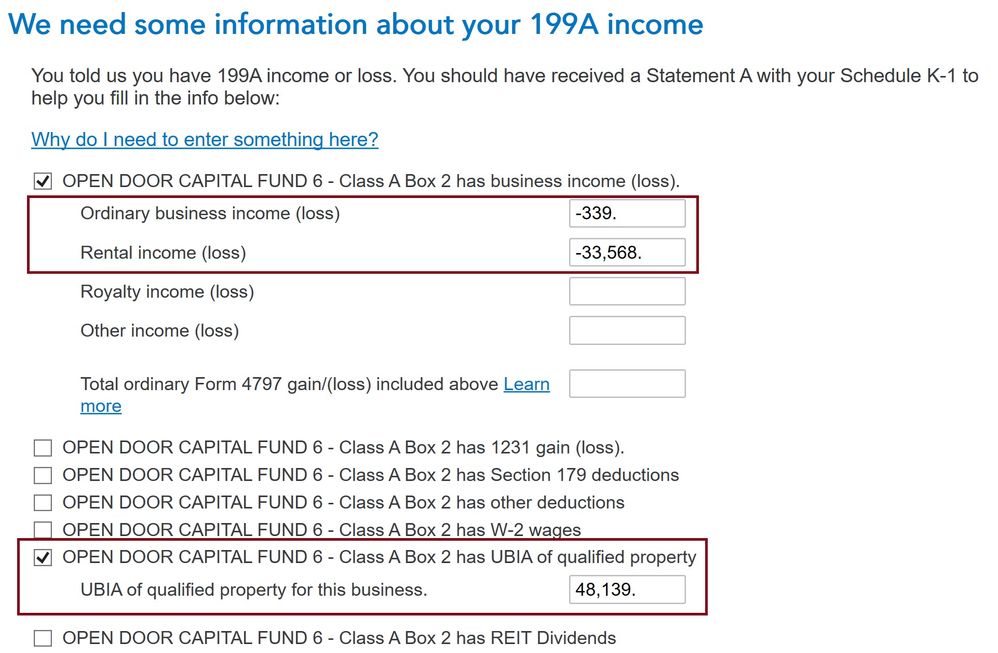

I am trying to enter my K1 on TT. My K1 shows losses in both box 1 (Ordinary business income) and box 2 (Net rental real estate income).

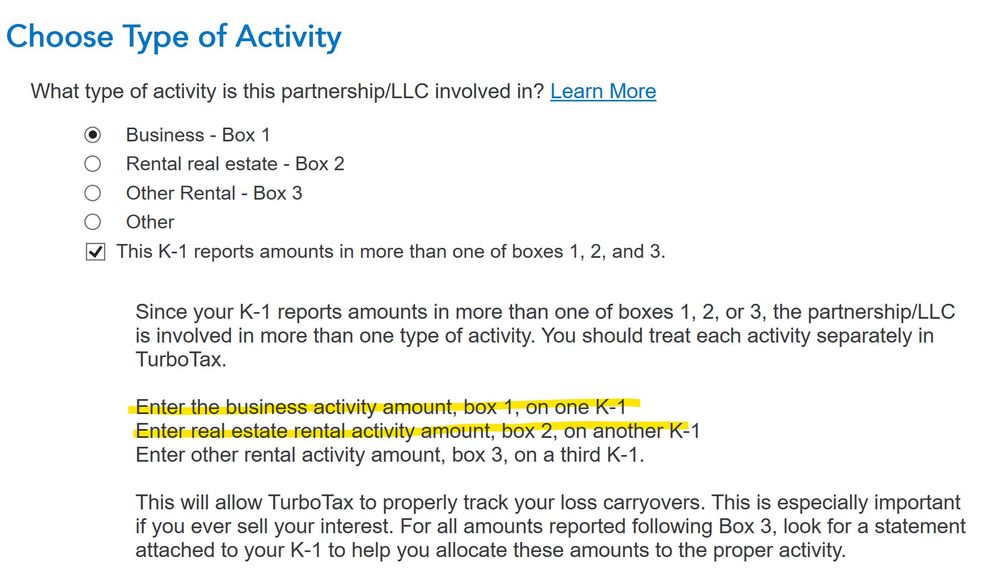

TT is saying that I have to treat each activity separately.

I entered them separately as TT has instructed.

Question:

1. Do I need to adjust some of the information on the K1? For example, box 17 AMT is -24. Do I need to pro-rate against box1 and box2, or do I just enter it as -24 for both K1 entries on TT?

2. I am doing this on TT because I need to amend my return. My tax preparer combined both box1 and box2 amounts and reported it under box 2 (total of -33907). The K1 partnership is related to real estate (mobile home parks). Can I just follow this approach since the partnership is related to real estate?

Thanks.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 Ordinary Business Income/Loss (box1) VS Net Rental Real Estate/Loss (box2)

sadly turbotax is not able to handle the first 3 lines on one k-1. you're supposed to enter line 1 and related items on one k-1 and line 2 and related items on a second k-1. do not duplicate numbers. if you had interest income of $50 (line 5) enter it on only one k-1.

any QBI and certain other items must be entered only on the k-1 they pertain to.

amt would most likely realte to line 2 only

if you want to follow your CPAs approach - 1- k-1 that's up to you. It could be that the partnership return was prepared incorrectly and line 1 is properly part of line 2. (there's no way for this forum to know for sure) but if those expenses arose or were directly connected to the rental activity, line 2 seems proper.

the other side of the issue is the IRS. will it raise an issue about combining the amounts - unknown.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 Ordinary Business Income/Loss (box1) VS Net Rental Real Estate/Loss (box2)

sadly turbotax is not able to handle the first 3 lines on one k-1. you're supposed to enter line 1 and related items on one k-1 and line 2 and related items on a second k-1. do not duplicate numbers. if you had interest income of $50 (line 5) enter it on only one k-1.

any QBI and certain other items must be entered only on the k-1 they pertain to.

amt would most likely realte to line 2 only

if you want to follow your CPAs approach - 1- k-1 that's up to you. It could be that the partnership return was prepared incorrectly and line 1 is properly part of line 2. (there's no way for this forum to know for sure) but if those expenses arose or were directly connected to the rental activity, line 2 seems proper.

the other side of the issue is the IRS. will it raise an issue about combining the amounts - unknown.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 Ordinary Business Income/Loss (box1) VS Net Rental Real Estate/Loss (box2)

@j-ong The issue you're running into is the tax code requirement that "You can deduct a prior-year unallowed loss from the activity up to the amount of your current-year net income from the activity."

"Rental" activity is considered different, to the IRS, than "Ordinary" activity. So they require that you account for them separately so that the losses from one aren't recognized in the future unless the same activity generates income. TT implements that by requiring separate K-1s.

Only you, or the partnership, will know which activity all the other entries on the K-1 relate to, so you'd have to make the decision on which K-1 to use for each (or how to split them). TT / the forum can't do that for you. Similarly, the decision to combine last year's box 1 into the "rental" bucket may have been a mistake, or your accountant's taking the position that they were somehow related in an way that's acceptable to the IRS.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 Ordinary Business Income/Loss (box1) VS Net Rental Real Estate/Loss (box2)

Thanks for the advice @Mike9241

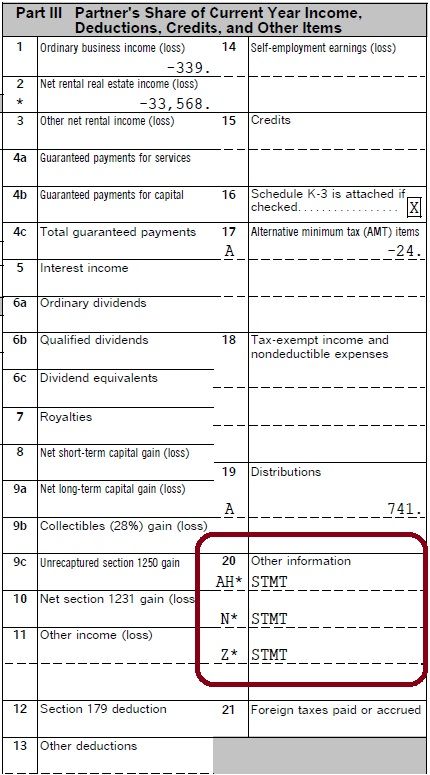

The potential duplication of related items on the K1 was one of my concerns if I split it into two.

Since my loss on box 1 (-$399) is significantly smaller than box 2 (-$33,568), I decided to record all the related items (AMT, Distributions, Other Info) on the box 2 K1 entry on TT. The box 1 K1 entry on TT only records the -$399 of loss and no related items.

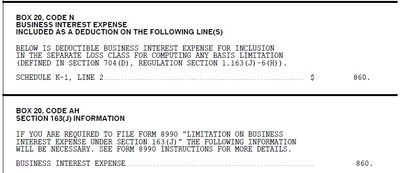

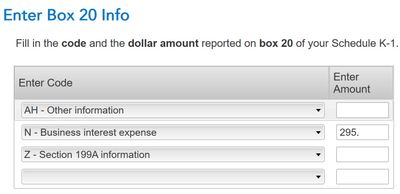

By the way, am I entering the AH, N, and Z statements correctly on TT? This is the first time I've done this on TT so wasn't sure if I am doing it correctly. Also, are the items on box 20 more of an FYI to the IRS, or are these numbers relevant when I exit the partnership deal in the future? I have a basic understanding of K1s and my assumption is the key information to track is boxes 1 and 2 (-$399 and -$33,568) because they can potentially offset gains in the future.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 Ordinary Business Income/Loss (box1) VS Net Rental Real Estate/Loss (box2)

Thanks @nexchap! Appreciate the explanation!

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Mlocken

New Member

ms44444

Returning Member

bruced63

New Member

j-zee

New Member

KarenL

Employee Tax Expert