- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

Thanks for the advice @Mike9241

The potential duplication of related items on the K1 was one of my concerns if I split it into two.

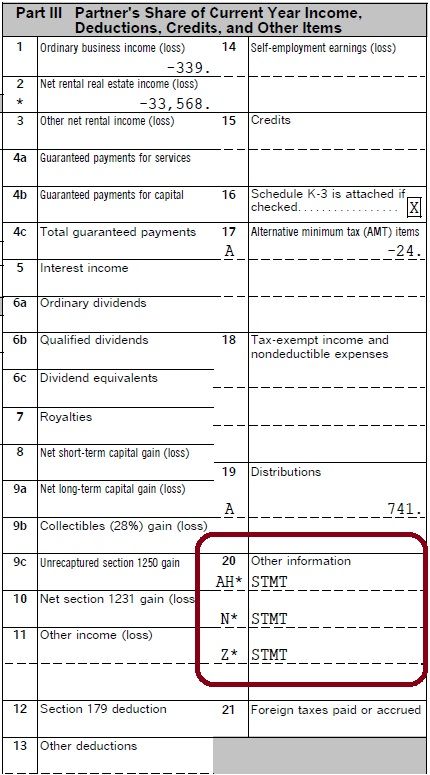

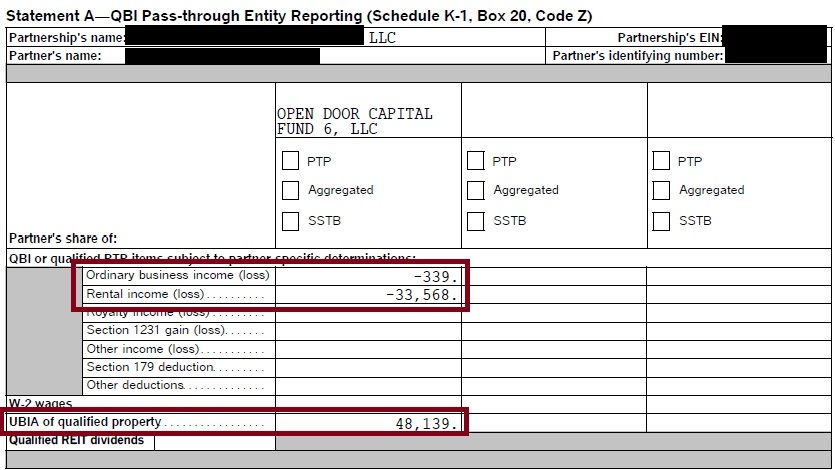

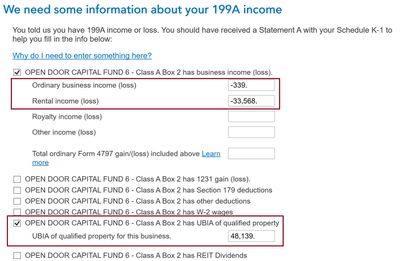

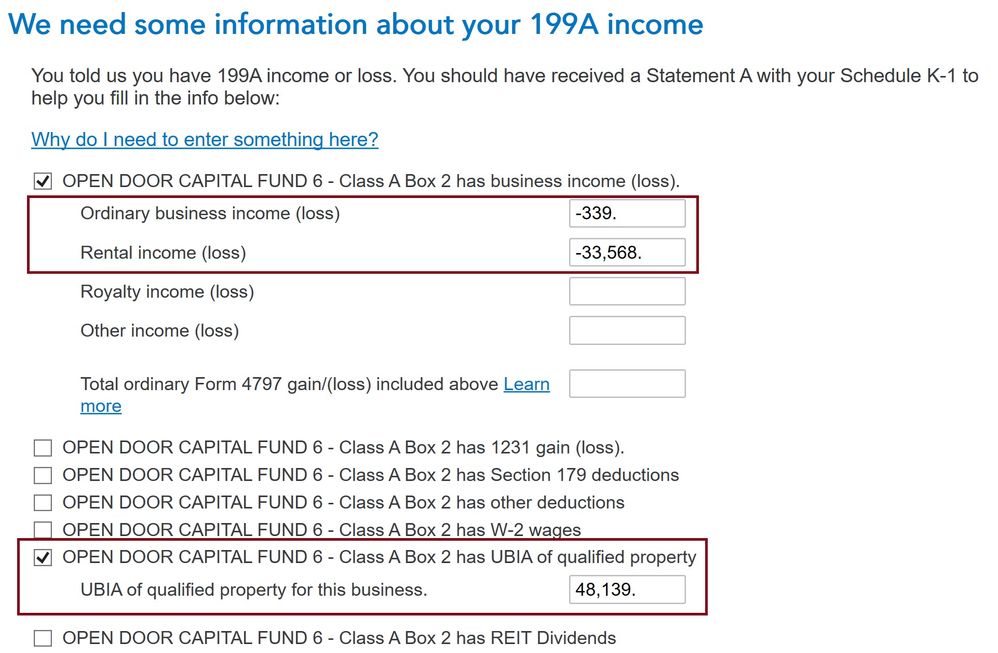

Since my loss on box 1 (-$399) is significantly smaller than box 2 (-$33,568), I decided to record all the related items (AMT, Distributions, Other Info) on the box 2 K1 entry on TT. The box 1 K1 entry on TT only records the -$399 of loss and no related items.

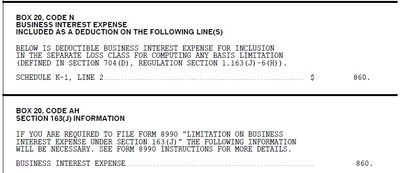

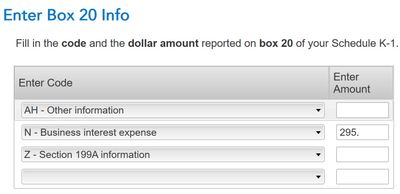

By the way, am I entering the AH, N, and Z statements correctly on TT? This is the first time I've done this on TT so wasn't sure if I am doing it correctly. Also, are the items on box 20 more of an FYI to the IRS, or are these numbers relevant when I exit the partnership deal in the future? I have a basic understanding of K1s and my assumption is the key information to track is boxes 1 and 2 (-$399 and -$33,568) because they can potentially offset gains in the future.