- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 Ordinary Business Income/Loss (box1) VS Net Rental Real Estate/Loss (box2)

Hello TurboTax Community,

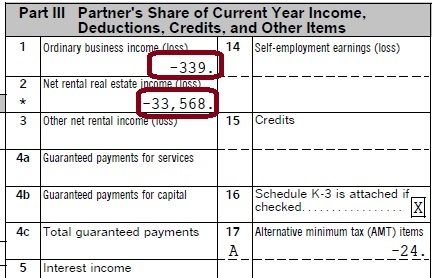

I am trying to enter my K1 on TT. My K1 shows losses in both box 1 (Ordinary business income) and box 2 (Net rental real estate income).

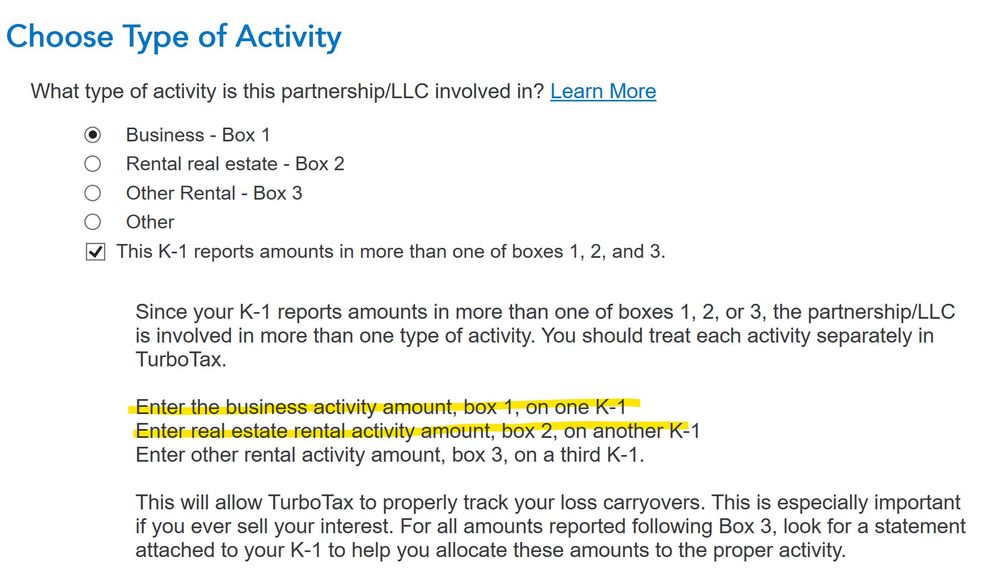

TT is saying that I have to treat each activity separately.

I entered them separately as TT has instructed.

Question:

1. Do I need to adjust some of the information on the K1? For example, box 17 AMT is -24. Do I need to pro-rate against box1 and box2, or do I just enter it as -24 for both K1 entries on TT?

2. I am doing this on TT because I need to amend my return. My tax preparer combined both box1 and box2 amounts and reported it under box 2 (total of -33907). The K1 partnership is related to real estate (mobile home parks). Can I just follow this approach since the partnership is related to real estate?

Thanks.