- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Is accumulated depreciation on a rental property identified anywhere in my prior year tax return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is accumulated depreciation on a rental property identified anywhere in my prior year tax return?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is accumulated depreciation on a rental property identified anywhere in my prior year tax return?

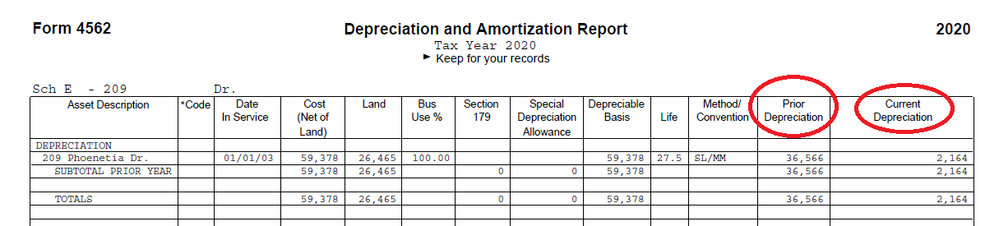

In TurboTax, that figure will appear on two worksheets; the Asset Entry Worksheet and the Depreciation and Amortization Report.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is accumulated depreciation on a rental property identified anywhere in my prior year tax return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is accumulated depreciation on a rental property identified anywhere in my prior year tax return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is accumulated depreciation on a rental property identified anywhere in my prior year tax return?

Prior year depreciation is not reflected anywhere on the SCH E or the 1040. Only the current year's "allowed" depreciation is shown on SCH E line 18. For prior year depreciation you have to look at the IRS Form 4562 which is *NOT* filed with your tax return unless there is a change to or the additional/removal of an asset.

Now there are three 4562's and they are not all the same. One prints in portrait format and is generated *only* if there is a change. The other two print in landscape format and are only printed when you elect the option to print/save *ALL" forms and worksheets. One of those two is titled "Amortization & Depreciation Report" and is the one you're most likely interested in. The other is titled "Alternative Minimum Tax Depreciation Report" and only comes into play for less than 5% of those reporting rental income. So you want the first one mentioned that prints in landscape format.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is accumulated depreciation on a rental property identified anywhere in my prior year tax return?

Now when looking at the 2017 IRS Form 4562, to get your prior year's depreciation for 2018, you have to add together the amounts in the "Prior year depr" and "current year depr" in order to get the total prior year's depreciation for your 2018 tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is accumulated depreciation on a rental property identified anywhere in my prior year tax return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is accumulated depreciation on a rental property identified anywhere in my prior year tax return?

You mean to say, there is a line in the IRS form 4562 which states cumulative depreciation for any given investment property? Could you please provide more details. such form number and line number.

I notice accumulated losses for a property upto last year, current year and carried forward losses (In form 8582) but I do not notice any accumulated depreciation anywhere. I wonder when we sell a property after several years, are we supposed to pull out the IRS tax returns of the year we purchased the specific property and add the depreciation year after year to derive the depreciation recapture amount?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is accumulated depreciation on a rental property identified anywhere in my prior year tax return?

There are actually 3 IRS form 4562's, and for the totals you seek you're only interested in one of them. Of the 3 forms, two of those 4562's print in landscape format. One is titled "Depreciation and Amortization Report" and the other is "Alternative Minimum Tax Depreciation". The first one will show you current year depreciation for each asset listed on that form, as well as the total of all prior years depreciation already taken on each individual asset listed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is accumulated depreciation on a rental property identified anywhere in my prior year tax return?

Thank you Carl. so this is a turbotax specific additional report and not part of regular IRS forms or worksheet?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is accumulated depreciation on a rental property identified anywhere in my prior year tax return?

The reports are TurboTax-specific reports and not the official form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is accumulated depreciation on a rental property identified anywhere in my prior year tax return?

Thank you and good to know. That is a great custom turbotax report. It will be very handy to calculate depreciation recapturing details when we sell an investment property. It would save time otherwise going through several past years returns and forms I guess to derive the depreciation recapturing numbers.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is accumulated depreciation on a rental property identified anywhere in my prior year tax return?

Carl. so this is a turbotax specific additional report and not part of regular IRS forms or worksheet?

The one that gets filed with the tax return prints in portrait format, and can be seen at https://www.irs.gov/pub/irs-pdf/f4562.pdf. This one doesn't always have all the details folks are usually looking for.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is accumulated depreciation on a rental property identified anywhere in my prior year tax return?

@Carl wrote:The one that gets filed with the tax return prints in portrait format, and can be seen at https://www.irs.gov/pub/irs-pdf/f4562.pdf.

Form 4562 only gets filed in certain circumstances, which are limited to:

-

Depreciation for property placed in service during the 2020 tax year.

-

A section 179 expense deduction (which may include a carryover from a previous year).

-

Depreciation on any vehicle or other listed property (regardless of when it was placed in service).

-

A deduction for any vehicle reported on a form other than Schedule C (Form 1040), Profit or Loss From Business.

-

Any depreciation on a corporate income tax return (other than Form 1120-S).

-

Amortization of costs that begins during the 2020 tax year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is accumulated depreciation on a rental property identified anywhere in my prior year tax return?

@Carl wrote:

Carl. so this is a turbotax specific additional report and not part of regular IRS forms or worksheet?

Those two versions I pointed out are official IRS forms.

The depreciation and amortization reports are not official IRS forms; they are specific to TurboTax.

Various other tax preparation software programs have different forms, worksheets, and/or reports.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Jeff-W

Level 1

atn888

Level 2

jhmagill1

Level 1

Larryandginny

New Member

FRSJR

Returning Member