- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- In Form 1116 it says I need to enter Adj Basis of Tot Inv Ast and that it can't equal 0, but I didn't declare any investment assets to begin with. How do I get around it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In Form 1116 it says I need to enter Adj Basis of Tot Inv Ast and that it can't equal 0, but I didn't declare any investment assets to begin with. How do I get around it?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In Form 1116 it says I need to enter Adj Basis of Tot Inv Ast and that it can't equal 0, but I didn't declare any investment assets to begin with. How do I get around it?

When you look at your brokerage statement, it lists every country and the percentage invested in each country. Multiply the percentage by your investment in the fund to get the amount invested in that particular country.

If you have a form 1116, you paid foreign tax to another country. You have money invested in that country. How much money do you have invested in that country? It must be answered.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In Form 1116 it says I need to enter Adj Basis of Tot Inv Ast and that it can't equal 0, but I didn't declare any investment assets to begin with. How do I get around it?

Thank you for your reply. The problem is that I do not have a brokerage statement nor any investments. I just work as an employee outside the US.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In Form 1116 it says I need to enter Adj Basis of Tot Inv Ast and that it can't equal 0, but I didn't declare any investment assets to begin with. How do I get around it?

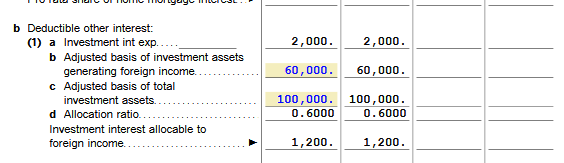

This starts with Form 4952 “Investment Interest Expense Deduction”. The amount in line 8 is transferred to Schedule A line 9. A copy is then sent to the f1116 worksheet 4(b)(1)(a). The screenshot data is from the example in the f1116 instructions on p.16 for a stock portfolio. Bring up the f1116 worksheet. What do you see? Is there an entry in (a)? If so then you would insert the amounts in (b) and (c) , then TT completes the rest.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In Form 1116 it says I need to enter Adj Basis of Tot Inv Ast and that it can't equal 0, but I didn't declare any investment assets to begin with. How do I get around it?

@tpierelliturbo You may have to delete the Form 1116 that shows you have a 'Foreign Investment' first.

Click this link for more info on How to Delete a Form in TurboTax Online.

If you live and work outside the US, click this link for instructions on Reporting Foreign Income.

Once you have entered your income, in the Foreign Tax Credit section, choose the 'general income category' and indicate that Yes, you have reported your income.

In this section, you will enter the income amount and tax amount paid. You are not being taxed again; Form 1116 needs to know the Income/Tax amounts to calculate a ratio for your Foreign Tax Credit.

Click this link for more info on How to Claim a Foreign Tax Credit.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

h86those7taxes84ever

Level 3

navyas

Returning Member

PippaGolden

Returning Member

ghettodawg

Level 2

user17581408466

Level 1