- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- If I need to fix something on my return before I file what section do I go to to find my certificate of rent paid..I thought it was under property taxes but I can’t find

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I need to fix something on my return before I file what section do I go to to find my certificate of rent paid..I thought it was under property taxes but I can’t find

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I need to fix something on my return before I file what section do I go to to find my certificate of rent paid..I thought it was under property taxes but I can’t find

Your CRP information can be found in your state return. It does seem like it should be with property tax (federal entry), but Rent Paid credits are only entered on state returns, so CRPs are never entered on the federal return. Depending on your state, the rent paid/property tax credit section is usually near the end of the state interview.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I need to fix something on my return before I file what section do I go to to find my certificate of rent paid..I thought it was under property taxes but I can’t find

Thanks. It said something about having to put it on my federal or something..I put it on with dots like it showed on the crp but I just need to take the dots out

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I need to fix something on my return before I file what section do I go to to find my certificate of rent paid..I thought it was under property taxes but I can’t find

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I need to fix something on my return before I file what section do I go to to find my certificate of rent paid..I thought it was under property taxes but I can’t find

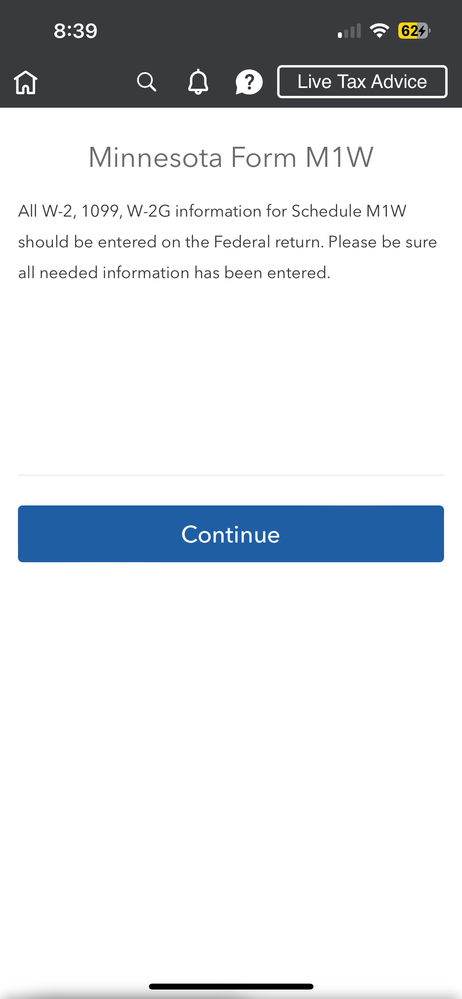

That form is for your MN taxes withheld; it doesn't relate to your CRP. You can delete any entries you have entered for that form on your Minnesota return. If you entered any w-2s or 1099s that had tax withholding for Minnesota, the tax forms are entered in the federal sections. TurboTax automatically transfers any amounts for MN tax withheld to your M1W - you don't need to enter anything on that form when going through the MN return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kemp5774

New Member

jrosarius

New Member

c0ach269

New Member

vithlanisamay

Returning Member

raforrister

New Member