- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- I sold ESPP stock that included reinvested dividends. I see where to enter the stock purchase portion of these sales but not the dividend portion. Where do I enter this

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold ESPP stock that included reinvested dividends. I see where to enter the stock purchase portion of these sales but not the dividend portion. Where do I enter this

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold ESPP stock that included reinvested dividends. I see where to enter the stock purchase portion of these sales but not the dividend portion. Where do I enter this

If you sold some of the stock acquired through dividend reinvestment along with stock acquired through the ESPP, then you do have to adjust the "ESPP" stocks' basis but you don't have to adjust the "dividend" stocks' basis.

Only shares actually acquired at a discount through an ESPP need any "special" treatment. The shares acquired via dividend reinvestment are plain-vanilla "stock", no different than a stock you'd buy through your stock broker.

When entering this information into TurboTax, break your sale into two parts- one for "ESPP" stock and one for "ordinary" stock (which is the portion of this sale that came from those reinvested dividends). You do not need to indicate that this ordinary stock originated from dividend reinvestment.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold ESPP stock that included reinvested dividends. I see where to enter the stock purchase portion of these sales but not the dividend portion. Where do I enter this

Enter More Purchase Lots

After subtracting the shares purchased from the shares sold, more shares are needed via purchases, stocks splits or reinvested dividends.

Total shares sold 191.0000

Total entered so far 186.9630

____________

Balance needed to cover the shares sold 4.0370

Note: Unless you have additional shares from a stock split or dividend reinvestment, you should enter at least 4.0370 more shares to cover the 191.0000 shares you sold.

Do you want to enter another purchase lot?

The 4.037 balance needed to cover the shares sold is the amount of reinvested dividends. Where do I enter the 4.037?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold ESPP stock that included reinvested dividends. I see where to enter the stock purchase portion of these sales but not the dividend portion. Where do I enter this

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold ESPP stock that included reinvested dividends. I see where to enter the stock purchase portion of these sales but not the dividend portion. Where do I enter this

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold ESPP stock that included reinvested dividends. I see where to enter the stock purchase portion of these sales but not the dividend portion. Where do I enter this

If you sold some of the stock acquired through dividend reinvestment along with stock acquired through the ESPP, then you do have to adjust the "ESPP" stocks' basis but you don't have to adjust the "dividend" stocks' basis.

Only shares actually acquired at a discount through an ESPP need any "special" treatment. The shares acquired via dividend reinvestment are plain-vanilla "stock", no different than a stock you'd buy through your stock broker.

When entering this information into TurboTax, break your sale into two parts- one for "ESPP" stock and one for "ordinary" stock (which is the portion of this sale that came from those reinvested dividends). You do not need to indicate that this ordinary stock originated from dividend reinvestment.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold ESPP stock that included reinvested dividends. I see where to enter the stock purchase portion of these sales but not the dividend portion. Where do I enter this

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold ESPP stock that included reinvested dividends. I see where to enter the stock purchase portion of these sales but not the dividend portion. Where do I enter this

I've copied and pasted the "missing link" answer:

You really need to "break" the sale into "ESPP" stock and "Dividend Reinvestment" stock and enter the two pieces as separate sales. So if you sold 100 shares, 98 of which you purchased through the ESPP, and 2 of which came to you through dividends that were reinvested, you'd enter the two sales separately. The first you'd enter using the ESPP step by step process and the second you'd enter using the default spreadsheet-like "fill in the boxes" 1099-B entry form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold ESPP stock that included reinvested dividends. I see where to enter the stock purchase portion of these sales but not the dividend portion. Where do I enter this

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold ESPP stock that included reinvested dividends. I see where to enter the stock purchase portion of these sales but not the dividend portion. Where do I enter this

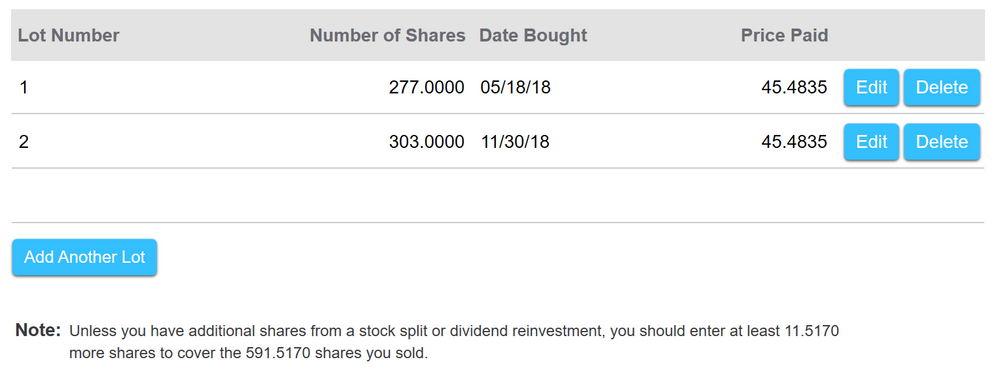

I am still not sure how to do it. This section is based on the imported 1099-B. I added the purchase lots by myself under the ESPP.

From the Note in below, it says "unless you have additional dividend reinvestment. ..." So I think I can just ignore it from there. But in the final report check it will report an error about it.

Can anybody use a picture to explain how to get around it? RSU section has the option to add dividend but not for ESPP.

TurboTax should fix this issue to make life easier.

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold ESPP stock that included reinvested dividends. I see where to enter the stock purchase portion of these sales but not the dividend portion. Where do I enter this

Another approach worked for me. After entering the ESPP lots in the step by step section, go to View > Forms and select the capital gains worksheet that pertains to the ESPP stock sale. In Part V Reinvested Dividends, enter the stock purchase lots for only the reinvestment transactions in the spreadsheet. The spreadsheet expands to the number of rows needed. TurboTax will include these lots in the final list of lots on the worksheet with "N/A" in the first column of the record. The total number of stocks will add up to the total sale properly (after all typos are fixed). Note that I could not find a step-by-step question in TurboTax to lead me to this worksheet. Probably most people figured it out themselves, which can explain why this answer wasn't found in this forum.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

g456nb

Level 1

claire-hamilton-aufhammer

New Member

sierrahiker

Level 2

abcxyz13

New Member

user17524358924

Level 1