- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- I received CRITICAL NOTICE: for Rental Properties and Royalties (Sch E) but I have not filed Form 4562 Depreciation and Amortization Report last year, what should I do?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received CRITICAL NOTICE: for Rental Properties and Royalties (Sch E) but I have not filed Form 4562 Depreciation and Amortization Report last year, what should I do?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received CRITICAL NOTICE: for Rental Properties and Royalties (Sch E) but I have not filed Form 4562 Depreciation and Amortization Report last year, what should I do?

The instructions available at the link below should provide a resolution to your issue.

How do I fix my Rental Properties and Royalties (S... (intuit.com)

Note that you need the Form 4562-Depreciation and Amortization Report and not the actual Form 4562.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received CRITICAL NOTICE: for Rental Properties and Royalties (Sch E) but I have not filed Form 4562 Depreciation and Amortization Report last year, what should I do?

I'm not fully grasping what you're talking about with "CRITICAL NOTICE". Can you provide more details? Maybe you got some kind of notice in the form of a letter from the IRS? Maybe it's from whatever state taxes your personal income? Or something completely different?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received CRITICAL NOTICE: for Rental Properties and Royalties (Sch E) but I have not filed Form 4562 Depreciation and Amortization Report last year, what should I do?

Thanks for fast respond. The notice was in an email I received from TurboTax, because obviously last year TurboTax made mistakes in the processing.

here is what was in the email:

|

|

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received CRITICAL NOTICE: for Rental Properties and Royalties (Sch E) but I have not filed Form 4562 Depreciation and Amortization Report last year, what should I do?

That's the clarification needed. Now chances are better I can actually help here. If any of my assumptions are wrong, please let me know and provide the correct information.

- You only have one rental property.

- The rental property is Residential Rental Real Estate, and not commercial rental real estate

- The property was placed "in service" in 2019 or before. (Helps if I know what year)

- You have more than one asset listed in the Assets/Depreciation section for that rental property.

- If you have more than one rental property, then you know which specific one did not import the depreciation information from your 2019 tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received CRITICAL NOTICE: for Rental Properties and Royalties (Sch E) but I have not filed Form 4562 Depreciation and Amortization Report last year, what should I do?

Most of the assumptions are right. A few notes:

The property is a duplex. One side has been rented for the whole time since 2018 that I purchased it.

The other unit, I used it for rental in 2018, lived in it around 6 months in the 2019 and rented it again.

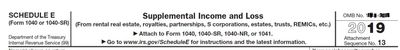

My tax filing of last year didnt have Form 4562 in it. But on schedule E of 1040 there is some numbers at the line 18

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received CRITICAL NOTICE: for Rental Properties and Royalties (Sch E) but I have not filed Form 4562 Depreciation and Amortization Report last year, what should I do?

The instructions available at the link below should provide a resolution to your issue.

How do I fix my Rental Properties and Royalties (S... (intuit.com)

Note that you need the Form 4562-Depreciation and Amortization Report and not the actual Form 4562.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received CRITICAL NOTICE: for Rental Properties and Royalties (Sch E) but I have not filed Form 4562 Depreciation and Amortization Report last year, what should I do?

The other unit, I used it for rental in 2018, lived in it around 6 months in the 2019 and rented it again.

On this unit, did you just leave it classified as a rental for the entire year and claim 6 months of personal use? Or did you convert it to personal use for six months, then back to a rental?

Here's what we need from your 2019 tax return, so we can manually enter the depreciation history in the 2020 return.

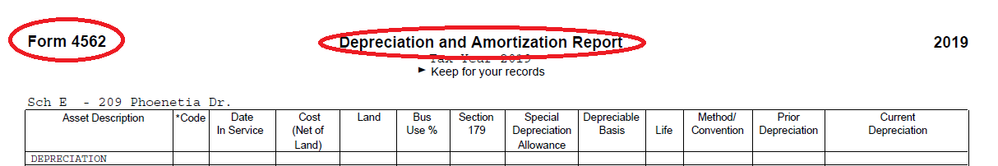

For each rental property listed, there are two IRS Form 4562's in the 2019 PDF file. One is titled "Depreciation and Amortization Report" (and will most likely be the one needed most) and the other is titled "Alternative Minimum Tax Depreication". Both forms print in landscape format. So with two rentals you should have 4 of these forms.

If you had any carry over losses in 2019, then you'll also need the IRS Form 8582 from the 2019 return. WIth the changes in tax law in 2018, it's perfectly possible you won't have any carry over losses. So if the form 8582 is not present in the 2019 PDF, that's fine.

Can you go ahead and print out those 4562's and the 8582 if applicable? Trying to do this with the forms open on the screen while the TTX program is open is to much of a PITA. Simpler if you just print out the forms. In the print dialog just select to print the page currently being displayed in the Adobe Reader program, and that way you don't waste paper.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received CRITICAL NOTICE: for Rental Properties and Royalties (Sch E) but I have not filed Form 4562 Depreciation and Amortization Report last year, what should I do?

- I used it for personal then back to rental

- The problem I face is that there is no 4562 in my 2019 return.

- Another thing is that I sold this property in late 2020 and I have a large capital gain. Wouldn't it be better if I just go ahead and cancel the depreciation from last year and put those costs in my cost basis? Is that even a possibility?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received CRITICAL NOTICE: for Rental Properties and Royalties (Sch E) but I have not filed Form 4562 Depreciation and Amortization Report last year, what should I do?

I used it for personal then back to rental

So that means you "should" have 3 properties entered on your 2019 tax return, "unless" you converted it to personal use on the 2018 tax return. Hopefully, you adjusted the cost basis properly when you converted it back to a rental. If you did not, then since you sold it in 2020 it's a fair bet the IRS will catch it 24-36 months after you report the sale on the 2020 tax return.

- The problem I face is that there is no 4562 in my 2019 return.

A major thing to check on the 2019 tax return then.

Line 18 of the 2019 Schedule E, does it show a positive amount for all rentals? If it does, then there's no need to amend. So long as depreciation was taken on the rentals in 2019, amending just because you're missing the depreciation history is like....... dumb. It's like when a bank teller cashes a check that you forgot to sign, and then signing the cancelled check after the fact. Why bother? It's already been cashed, right?

Then you'll need those same 4562's from the 2018 return, as well as the 8582 if it's present.

Wouldn't it be better if I just go ahead and cancel the depreciation from last year

Only if you want to be hanging out a sign that reads "HEY! IRS! AUDIT ME NOW HURRY! QUICK! FAST! I WANT TO PAY LOTS OF FINES, PENALTIES AND BACK TAXES!" Generally, on the tax return where you report the sale, if the depreciation recapture is not right, the IRS *will* catch it during their "slow time of year" reviews of processed returns. That's when you get the "audit my mail" nasty gram from the IRS pointing out your mistake, along with a bill for the back taxes, interest, and possibly fines too.

So get the form 4562's from the 2018 tax return, and we can work with those just fine, assuming the 2019 tax return has positive numbers on line 18 of the SCH E, it'll actually be a piece of cake.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received CRITICAL NOTICE: for Rental Properties and Royalties (Sch E) but I have not filed Form 4562 Depreciation and Amortization Report last year, what should I do?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received CRITICAL NOTICE: for Rental Properties and Royalties (Sch E) but I have not filed Form 4562 Depreciation and Amortization Report last year, what should I do?

The 2019 Schedule E line 18 has positive numbers. That said, IRS has not yet processed my return. I filed it and needed to send detailed 8949 in paper.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received CRITICAL NOTICE: for Rental Properties and Royalties (Sch E) but I have not filed Form 4562 Depreciation and Amortization Report last year, what should I do?

Here's what the top of the form looks like.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received CRITICAL NOTICE: for Rental Properties and Royalties (Sch E) but I have not filed Form 4562 Depreciation and Amortization Report last year, what should I do?

So this should have been in my 2019 return, right? Because I cant find anything like this. The only form with depreciation on it is this:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received CRITICAL NOTICE: for Rental Properties and Royalties (Sch E) but I have not filed Form 4562 Depreciation and Amortization Report last year, what should I do?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received CRITICAL NOTICE: for Rental Properties and Royalties (Sch E) but I have not filed Form 4562 Depreciation and Amortization Report last year, what should I do?

nevermind, I downloaded the file from the site and it seems like the file I had was an abstract. Thanks for the support

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

c0ach269

New Member

SB2013

Level 2

Farmgirl123

Level 4

eedavies4

New Member

alvin4

New Member