- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- I purchased stock through Robinhood to make money. I received a promotional stock, valued at $3.50. It was included on my 1099. Is this a Self-Employed business?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I purchased stock through Robinhood to make money. I received a promotional stock, valued at $3.50. It was included on my 1099. Is this a Self-Employed business?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I purchased stock through Robinhood to make money. I received a promotional stock, valued at $3.50. It was included on my 1099. Is this a Self-Employed business?

Use the box number in which the income is reported on the 1099 to report your income, and answer the TurboTax questions accordingly.

If the form is a "1099-MISC", click the "magnifying glass Search" icon on the top row, enter "1099-MISC" in the search window and press return or enter, and then click on the "Jump to 1099-MISC" link to enter your 1099-MISC.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I purchased stock through Robinhood to make money. I received a promotional stock, valued at $3.50. It was included on my 1099. Is this a Self-Employed business?

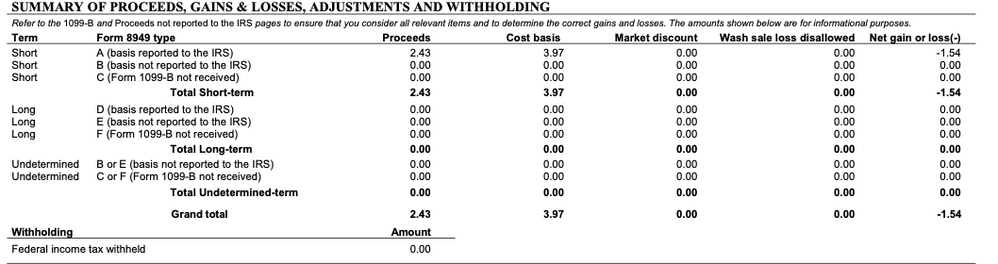

I have a similar question. The only thing which I did in the year 2019 was to sell the free stock which I got from Robinhood in the tax document everything is zero's except the 1099-MISC will it fine if I just file 1099-MISC without other 2019 1099-B etc( Everything was written as zero dollars)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I purchased stock through Robinhood to make money. I received a promotional stock, valued at $3.50. It was included on my 1099. Is this a Self-Employed business?

You have a "basis" in the promotional stock equal to the amount you reported as income when you received the stock (which is equal to the fair market value when you receive the stock). So, when you sell the stock, the difference between what you received and that cost basis is a gain or loss.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I purchased stock through Robinhood to make money. I received a promotional stock, valued at $3.50. It was included on my 1099. Is this a Self-Employed business?

Got it. I ended up in loss. I'm filling taxes with stock related income for the first time so I'm not sure which forms I need to submit. Is it just 1099-MISC form. I have some entries in 1099-B. Since its already reported to IRS do I need to Submit any other form

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I purchased stock through Robinhood to make money. I received a promotional stock, valued at $3.50. It was included on my 1099. Is this a Self-Employed business?

You do not need to submit any forms with you tax return to the IRS. If the IRS has a question or would like you to submit the forms, they will ask you for them.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I purchased stock through Robinhood to make money. I received a promotional stock, valued at $3.50. It was included on my 1099. Is this a Self-Employed business?

I have also receiver 1099-Misc from the Robinhood for $7.

I am H1B and can't be self-employed!

Turbotax tried to report that $7 as self-employed income. How to fix this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I purchased stock through Robinhood to make money. I received a promotional stock, valued at $3.50. It was included on my 1099. Is this a Self-Employed business?

If the broker provided ONLY Form 1099-MISC, and you received it for free:

This can be handled in the Less Common Situations. To enter in TurboTax, follow these steps:

- From the left menu, select Federal

- Wages & Income scroll all the way down to Less Common Income and click Show More

- Select the last listed option for Miscellaneous Income 1099-A, 1099-C, click Start

- Next, select the last listed option Other Reportable Income

- Did you receive any other taxable income, click yes

- Other Taxable Income: Enter your description and the amount and click Continue and Done. Disregard the comment "Do not enter income from Form 1099-MISC here" because this is meant to guide taxpayers reporting typical 1099-MISC income. Your case is less common and this is how you can report it in TurboTax.

If the broker

- gave you stock

- that you subsequently sold

- but Robinhood reported it to you on Form 1099-MISC and

- if you had basis in it, meaning you paid Robinhood something in exchange for this stock

then follow what TurboTax Expert DavidS127 advised. When you receive shares of stock, not cash, then it could be reported as a stock transaction.

Secondly, in this scenario, to be in compliance with the IRS and report the Form 1099-MISC you received, you need to report it as "an in and out." Do this:

- Follow Steps 1-6; for the description write: Robinhood Form 1099-MISC as received

- Repeat Steps 1-6 and enter the income amount as a negative

- For the second description write: Robinhood Form 1099-MISC reported on Schedule D

If this is your scenario, the instructions above will

- get the proceeds to Schedule D where they belong,

- prevent the proceeds from being considered self-employment,

- prevent the proceeds from being double taxed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I purchased stock through Robinhood to make money. I received a promotional stock, valued at $3.50. It was included on my 1099. Is this a Self-Employed business?

Even after I've followed steps 1-6 for this 1099-misc from Robinhood turbotax still complains about the amount not being reported on a form or Schedule. How do I get around that.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I purchased stock through Robinhood to make money. I received a promotional stock, valued at $3.50. It was included on my 1099. Is this a Self-Employed business?

"TurboTax still complains about the amount not being reported." What is the exact error message that you are receiving and at what screen?

Are you able to view the 1040 and Schedule 1 where this income would be entered? You can review the 1040 in TurboTax Online by following these directions.

- Down the left side of the screen, click on Tax Tools.

- Click on Tools.

- Under Other helpful links, click on View Tax Summary.

- Down the left side of the screen, click on Preview My 1040 to see the actual tax return that you prepared.

- Down the left side of the screen, click Back to return.

You can print or view your full tax returns prior to filing after you have paid for the software.

After the 1099-Misc is entered using the directions above, you should be able to see the income entered on Schedule 1 Part I line 8. The total of Schedule 1 is entered on the 1040 line 7a.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I purchased stock through Robinhood to make money. I received a promotional stock, valued at $3.50. It was included on my 1099. Is this a Self-Employed business?

So just so I am comprehending this correctly...

Robinhood sends me a 1099-misc for the value of the free stock compensation they gave me for signing up with the software.

1. I've entered that value in turbotax as a 1099-misc. but Turbotax says that income is not reported on a schedule and I should claim it as self-employment income...

2. To work around that I entered that value as "other income" through the "less common income/miscellaneous income/other reportable income" software links previous discussed (steps 1-6).

Turbotax still wants me to report it on a schedule..

Seems to me the only way to clear that is to remove the actual 1099-misc form I entered, leaving just the "other income" I entered on line 8 of schedule 1.

Is this corrrect?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I purchased stock through Robinhood to make money. I received a promotional stock, valued at $3.50. It was included on my 1099. Is this a Self-Employed business?

yes you need to delete the 1099-Misc.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I purchased stock through Robinhood to make money. I received a promotional stock, valued at $3.50. It was included on my 1099. Is this a Self-Employed business?

Hi,

Similar situation for me too, but I didn't sell my stock.

Does your answer to this person's question allow me to have the free version of TurboTax fill in all the information I need to that complies with the IRS's policy?

I remember back when I was filing my taxes with TurboTax (last month March 2020) that it was difficult and confusing figuring out what information that needed to go on the 1099-MISC portion, and that it said that in order to file them correctly that I would have to buy the Premier service.

This didn't sit well with me, since TurboTax always claims to be a free and easy service. I don't like how TurboTax tries to get me to buy the "Premier" product, especially since I'm just starting to figure out my personal finances. I'm probably their target demographic.

I'd get more out of Premier services in the future, since the only real finances I'm managing are my income and stock investments. I feel like I was scammed out of $99 because TurboTax Free wouldn't allow me to continue filling out stuff otherwise. And what makes me more upset is that I didn't even sell the free stock I was given--I just have it sitting there. It looks an awful lot like Robinhood has partnered with TurboTax just to increase sales on their paid services. Scummy move.

On top of that, it didn't even check the box that says I can be claimed as a dependent on my tax return, meaning that I reported incomplete information that whoever claims me as a dependent now has to deal with.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I purchased stock through Robinhood to make money. I received a promotional stock, valued at $3.50. It was included on my 1099. Is this a Self-Employed business?

The stock you received is treated as taxable income because you received an economic benefit by getting something without having to pay for it. When you sell it, you can deduct the amount you reported as income this year from the sale proceeds and it will reduce your taxable gain.

You cannot use the free TurboTax product since that product only includes routine tax entries for forms such as W-2's. As your income and deduction entries become more complicated, you need to use the paid versions of TurboTax to compensate the company for the extra programming effort necessary to process more complicated entries.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I purchased stock through Robinhood to make money. I received a promotional stock, valued at $3.50. It was included on my 1099. Is this a Self-Employed business?

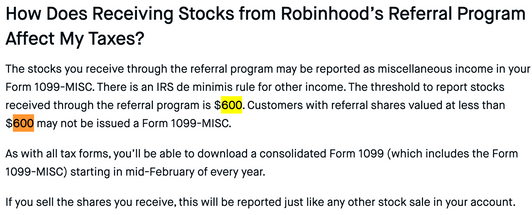

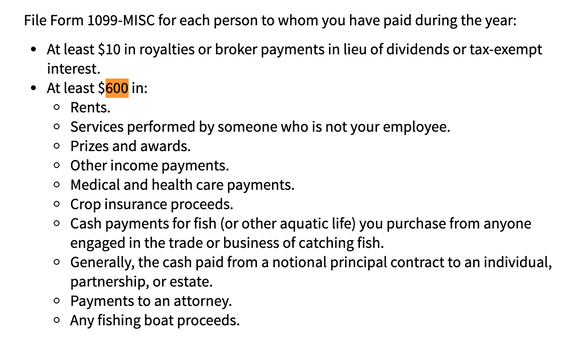

In Robinhood and IRS documentation it's mentioned the value should be at least $600 in order to 1099-MISC to be issued.

But why is the 1099-MISC issued for 2 or 4$ shares as well

https://robinhood.com/us/en/support/articles/common-tax-questions/

https://www.irs.gov/forms-pubs/about-form-1099-misc

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

MKW31

Level 1

smithkid1214

Level 2