- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- I am working on my state taxes and Turbo Tax keeps asking if my home address is the location of my rental property. I don't own a rental property. How can I fix this?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am working on my state taxes and Turbo Tax keeps asking if my home address is the location of my rental property. I don't own a rental property. How can I fix this?

The solution for the Vermont (VT) return can be accomplished. The following information may be helpful for you to move past the rental section since you own your home. A rental section is not required when you own your home.

- You have to go through the 'rental' form.. > in 'address of property you rented' make it blank,

- Enter the SCAN number, then enter '0' months rented.

- If you can get to Done with State, next e-file now and go the left of the screen

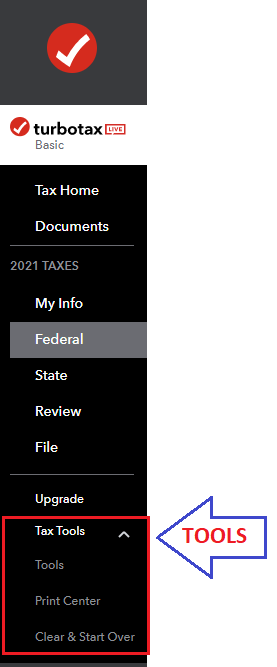

- Select 'Tools', then select 'Delete Forms'. At the bottom of that screen you'll see form FormRCC146 and delete that form

- Then file the return (this worked to address this experience)

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am working on my state taxes and Turbo Tax keeps asking if my home address is the location of my rental property. I don't own a rental property. How can I fix this?

But how do we get the homestead tax credit? It’s not giving it to me. Instead it’s saying I don’t qualify for the rental tax credit (which is obvious).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am working on my state taxes and Turbo Tax keeps asking if my home address is the location of my rental property. I don't own a rental property. How can I fix this?

It's saying you don't qualify for the RENTALcredit, which

of course yo don't. It WILL generate the Homestead and Income

forms..you can scan the entire PDF for just to be sure it's there.

Another member showed me this fix and it's has worked for me

and at least one other person that I know of.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am working on my state taxes and Turbo Tax keeps asking if my home address is the location of my rental property. I don't own a rental property. How can I fix this?

I'm also experiencing this with my Vermont state tax return filing.

My token number: 911498

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am working on my state taxes and Turbo Tax keeps asking if my home address is the location of my rental property. I don't own a rental property. How can I fix this?

turboTax is aware of this issue and is working to get it resolved. There is no fix date available. I suggest checking back often to see if the software has been updated and you can file your return.

In the meantime, you can try clearing your cookies and rebooting your computer to see if that helps.

Cookies are small files that temporarily store data on your computer. We use them to personalize your experience so you see information you already entered and not items that are irrelevant or repetitive.

On rare occasions, they may make your browser think you already did something that you still need to do. To fix that, you'll need to delete (clear) the cookies from your browser.

Each browser has a slightly different method for deleting cookies. Choose the browser you're using:

- Internet Explorer

- Mozilla Firefox

- Google Chrome

- Safari

- Safari for iOS (mobile devices)

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am working on my state taxes and Turbo Tax keeps asking if my home address is the location of my rental property. I don't own a rental property. How can I fix this?

Same issue as everyone else in Vermont. I had 3 rejections within 5 minutes of efiling. I made some changes to renter rebate form and efiled again. Now it has been pending for 3 days. I called Vermont tax Department and they don't have it and suggested that i delete the form and resend it. I can't because it is pending!! I called Turbo Tax support and they said they can't help me with this and I can't do anything while it is pending. How can I get this officially rejected??

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am working on my state taxes and Turbo Tax keeps asking if my home address is the location of my rental property. I don't own a rental property. How can I fix this?

Just an update. I have already received my refund from federal and state has been accepted. I would file with HR block, no problems and no having to find a work around.

- « Previous

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

josephmarcieadam

New Member

chiroman11

New Member

IslandMan1

New Member

jlfarley13

New Member

admin

New Member