- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- How to get code L on Form 8949 in TurboTax 2023?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to get code L on Form 8949 in TurboTax 2023?

Perhaps I am missing it somewhere...

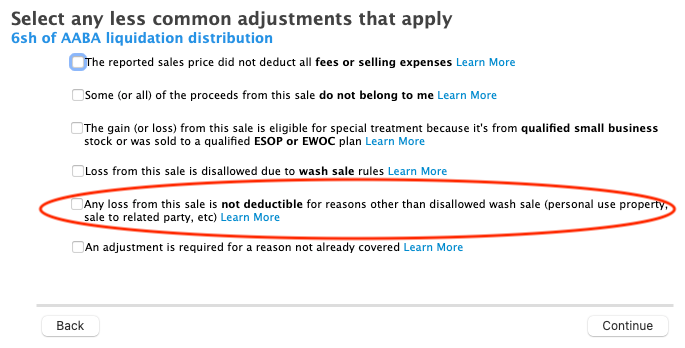

In past TurboTax years, I was able to assign code L on Form 8949 for liquidation distributions that I could not report a loss yet. This was done by checking a box in “Select any less common adjustments that apply” that said “Any loss from this sale is not deductible for reasons other than disallowed wash sale...” By assigning code L to the distribution, the loss was “zero’ed out” by an adjustment in column g, and resulted in 0 in column h (Gain or Loss). However this section and option appears to be removed from TurboTax 2023.

I can in TurboTax 2023 assign code W (wash sale) to the distribution, to zero out the loss. But the distribution is not a wash sale by definition…right??

Please advise.

(Reason I can not report loss: Distributions less than basis. If the total liquidating distributions you receive are less than the basis of your stock, you may have a capital loss. You can report a capital loss only after you have received the final distribution in liquidation that results in the redemption or cancellation of the stock.)

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to get code L on Form 8949 in TurboTax 2023?

You are correct. This is not a wash sale.

Below is how you can get to adjustment code L outside of the interview process. Beware that going outside of the interview voids the TT correct calculation guarantee and could miss some things.

I express no opinion about whether code L is appropriate in your circumstances.

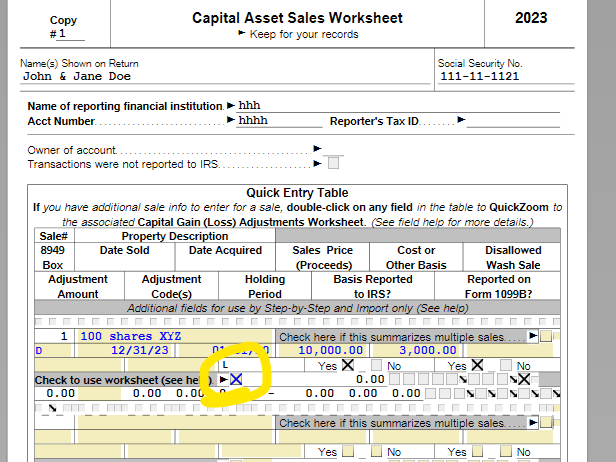

If you are using the desktop TT it appears you can go into forms mode and set adjustment code L in the "Cap Asset Sales Adjustments Worksheet"

Start in the Capital Asset Sales Worksheet check the checkbox next to "check top use worksheet"

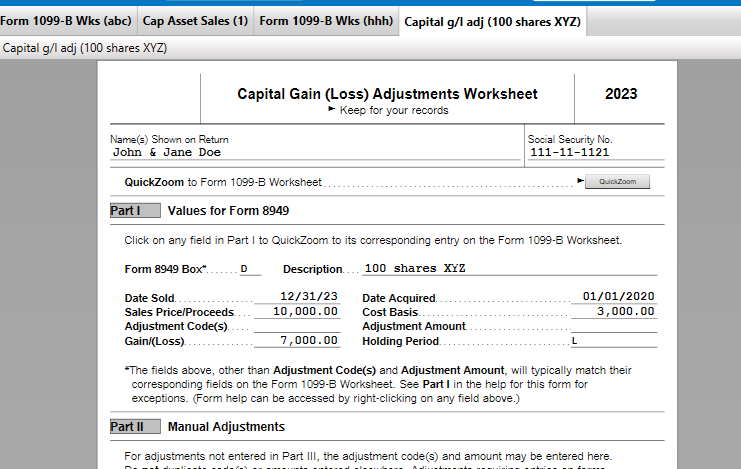

then click on any of those boxes and the magnifying glass (or just double click) to get to

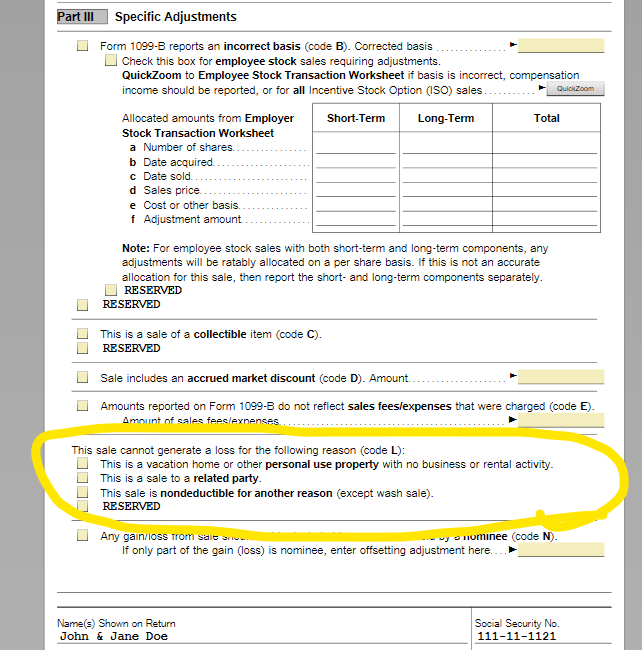

and down in Part III, you will find the code L adjustments

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to get code L on Form 8949 in TurboTax 2023?

Thank you @jtax for the detailed instructions.

Any way to get this section (taken from TurboTax 2022) to show up, so I can get code L during the interview/EasyStep process and not void the TT correct calculation guarantee? If not, very unfortunate TurboTax removed it in their 2023 version. (Please don't tell me they removed it from Premier version, which I've been using all these years)

As a workaround, I suppose I could also enter a cost basis equal to the liquidation distribution (aka proceed), to net zero. Although the true cost basis is different.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to get code L on Form 8949 in TurboTax 2023?

I do not see it in the obvious place in the interview. But I'm just a volunteer. Maybe it is hiding in another part.

I suspect the TT team is constantly trying to decide about how many detailed questions to ask and perhaps removing ones that only apply to a few people. But I don't know. (This is an uncommon one). At least you can still get at it in forms mode (as is required for a few complicated/uncommon situations).

Personally I don't know how valuable the calculation guarantee is in practice. TT seems to get the calcs right all the time. I have only very rarely seen a calc I don't think is right and have never had a problem with a tax authority over anything calculated by TT.

Your choice as what to do

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to get code L on Form 8949 in TurboTax 2023?

@jtax Thank you for the suggestion and transparency. I will try contacting TT support see if they have any other info.

Another option I suppose is to enter everything into the return except for the nondeductible liquidation distribution. Run through all the checks. Then go back and add it in via forms mode. It shouldn't change any totals.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

air1erb

Returning Member

shirleyzeng

Returning Member

Larry793

New Member

Bob in Plano

Level 3

casraecav

New Member