- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

You are correct. This is not a wash sale.

Below is how you can get to adjustment code L outside of the interview process. Beware that going outside of the interview voids the TT correct calculation guarantee and could miss some things.

I express no opinion about whether code L is appropriate in your circumstances.

If you are using the desktop TT it appears you can go into forms mode and set adjustment code L in the "Cap Asset Sales Adjustments Worksheet"

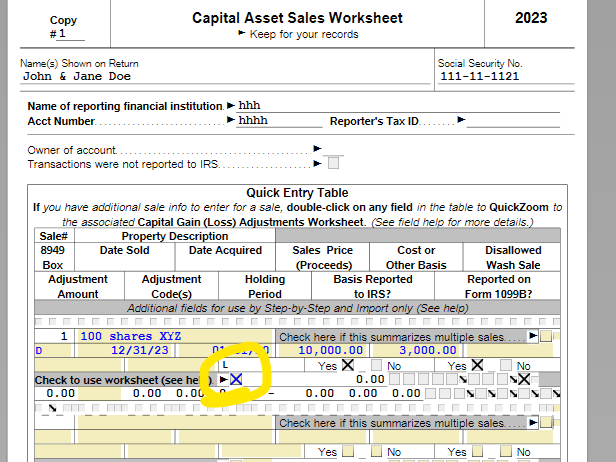

Start in the Capital Asset Sales Worksheet check the checkbox next to "check top use worksheet"

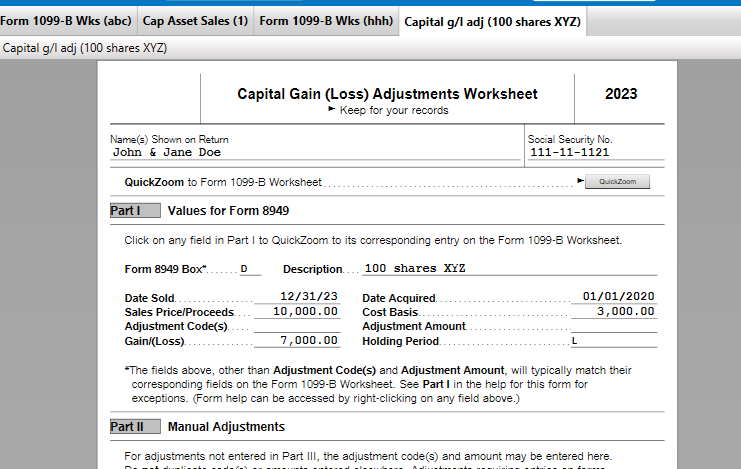

then click on any of those boxes and the magnifying glass (or just double click) to get to

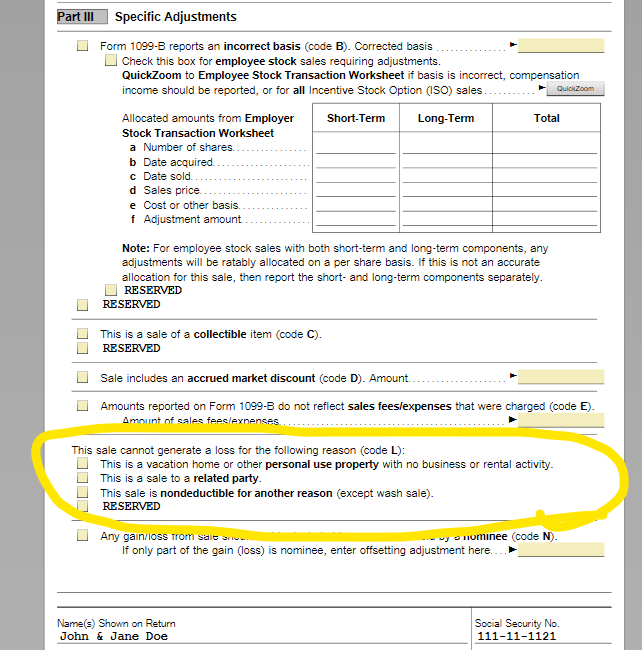

and down in Part III, you will find the code L adjustments

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 11, 2024

9:14 AM