- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- How do we report income we made off of a sublet from an apartment (in which we have no ownership) that we rented from a landlord (with permission, of course)?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do we report income we made off of a sublet from an apartment (in which we have no ownership) that we rented from a landlord (with permission, of course)?

My understanding is that TurboTax has an option only for owners of the property to report income. However, we did not own the apartment. We rented it from a landlord and during the summer we sublet it while we were out of town. How do we report this income?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do we report income we made off of a sublet from an apartment (in which we have no ownership) that we rented from a landlord (with permission, of course)?

You should report your rental income in the same section where someone would if they owned their home. In both situations, the income is reported as passive income from a rental activity on schedule E.

Since you don't own the home, you won't add the house in the Asset and Depreciation section. Alternatively, you can deduct the costs of renting your home, while it was being a subleased, under the expenses section.

Since you don't own the home, you won't be able to take a loss (even if your expenses exceed the income), but you will be able to reduce, or eliminate, the income.

To enter your rental income for your apartment that you rent:

- Under Wages and Income, select to add income and then to see the list

- Scroll down to Rentals, Royalties, and Farm and click Show More

- Select Start next to Rental Properties and Royalties (Sch E)

- The questions in this section are directed toward a home owner, but this is the correct place to enter your rental. Answer the questions, but look out for the following three:

- You'll be asked Was This Property Rented For All of 2017 and this is where you'll say No and enter the dates it was available to be rented and you weren't living it (which may be greater than the time you rented it)

- On the Property Ownership screen, answer No. and on the next select No, I will calculate my own allocation. This means you'll need to enter your expense totals for the time you rented the property. This is best since you don't own the property.

- On the next screen about Active Participation, be sure to select No I am not an active participation.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do we report income we made off of a sublet from an apartment (in which we have no ownership) that we rented from a landlord (with permission, of course)?

You should report your rental income in the same section where someone would if they owned their home. In both situations, the income is reported as passive income from a rental activity on schedule E.

Since you don't own the home, you won't add the house in the Asset and Depreciation section. Alternatively, you can deduct the costs of renting your home, while it was being a subleased, under the expenses section.

Since you don't own the home, you won't be able to take a loss (even if your expenses exceed the income), but you will be able to reduce, or eliminate, the income.

To enter your rental income for your apartment that you rent:

- Under Wages and Income, select to add income and then to see the list

- Scroll down to Rentals, Royalties, and Farm and click Show More

- Select Start next to Rental Properties and Royalties (Sch E)

- The questions in this section are directed toward a home owner, but this is the correct place to enter your rental. Answer the questions, but look out for the following three:

- You'll be asked Was This Property Rented For All of 2017 and this is where you'll say No and enter the dates it was available to be rented and you weren't living it (which may be greater than the time you rented it)

- On the Property Ownership screen, answer No. and on the next select No, I will calculate my own allocation. This means you'll need to enter your expense totals for the time you rented the property. This is best since you don't own the property.

- On the next screen about Active Participation, be sure to select No I am not an active participation.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do we report income we made off of a sublet from an apartment (in which we have no ownership) that we rented from a landlord (with permission, of course)?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do we report income we made off of a sublet from an apartment (in which we have no ownership) that we rented from a landlord (with permission, of course)?

What should you say on the "number of days owned in 2019" page?

Its either "yes- i owned this rental property all year" or

" no, i owned this rental property only part of the year"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do we report income we made off of a sublet from an apartment (in which we have no ownership) that we rented from a landlord (with permission, of course)?

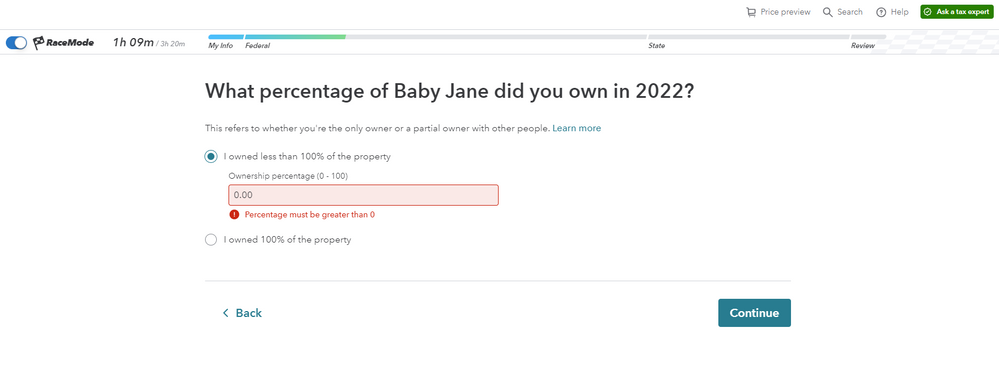

The Schedule E doesn't seem to have the 'Owner' question "On the Property Ownership screen, answer No.".

It asks if I'm partial or full owner (percentage) and if I own it part of the year or the full year, but I don't get the question on 'property ownership'.

At the end (if I indicate we own 100%) it check marks the 'Asset': New rental property.

Could someone confirm that for 2022 in this situation the 'New rental property' checkbox needs to be unchecked?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do we report income we made off of a sublet from an apartment (in which we have no ownership) that we rented from a landlord (with permission, of course)?

So when you get to this screen, you'll enter 0

next screen you'll enter no I entered less than 100% of the property

in the next screen, you'll enter ownership percentage to be 0% like this

then continue, continue . This should take you seamlessly to the forms like this

which is ultimately your desired effect. you don't want to show any ownership of the property.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do we report income we made off of a sublet from an apartment (in which we have no ownership) that we rented from a landlord (with permission, of course)?

Thank you.

The userflow you describe does not seem to be available anymore or certainly not for me. I am not allowed to say 0%

Please help on how to file if I am subleasing the apartment

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do we report income we made off of a sublet from an apartment (in which we have no ownership) that we rented from a landlord (with permission, of course)?

Try checking the box that you will calculate your own allocation of expenses. Then you will not be asked to enter your percentage of ownership.

Since you do not own the property, pay close attention to the questions as you go through them. There may be one that comes up later asking how you acquired the property where you can select 'other' instead of 'purchase' or the other choices offered. Also, be sure to skip entering anything such as the cost of the property to avoid having depreciation included.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

AnnLea

New Member

Think57

Level 3

juggalo4000

New Member

CThunder

Returning Member

burgerguy14

Level 4