- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- How do I report my commercial and residential real estate?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report my commercial and residential real estate?

Hi. How do I report my commercial and residential real estate in Turbo Tax 2021 desktop edition?

The walk through is only asking about residential properties. It doesn't show anywhere else where to put commercial properties. I read on Publication 527 that they're depreciated at different rates though no table is given for the commercial property.

Additional questions if anyone else knows:

Do they go mixed together in Schedule E?

What are my loss limitations for so-called passive income?

How much can I carry over in losses next year?

Additional info to make sure I'm putting them in the right place (Schedule E not Schedule C):

I have 4 commercial properties rented out, 2 residential properties rented out, and 3 vacant residential properties. Though I actively manage and repair them, renting is not my primary source of income.

Thanks for any and all help.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report my commercial and residential real estate?

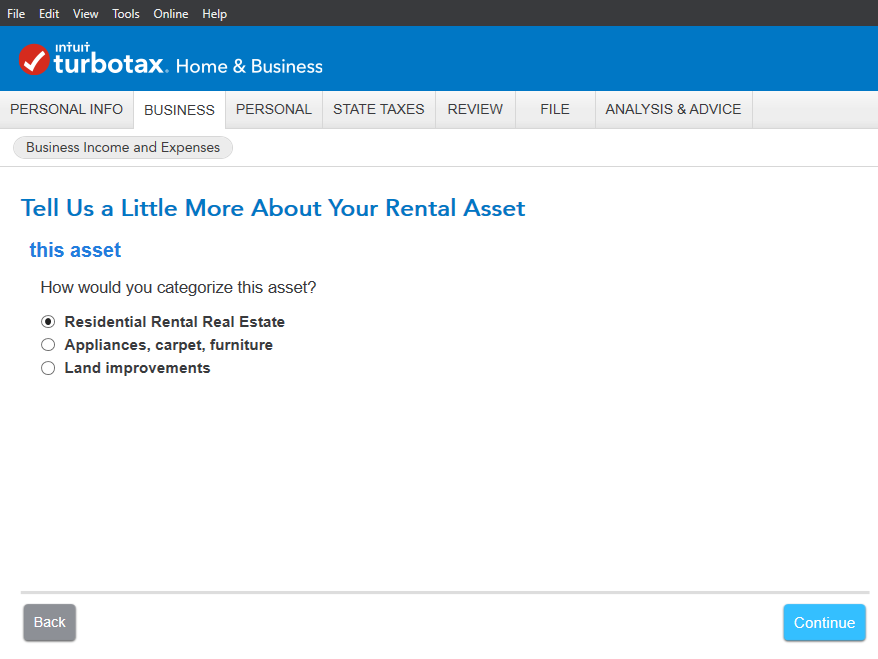

The screen you posted appears to be from the "other" asset types. If so, you're in the wrong area. Start over and select "commercial" as indicated in the screen shot below.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

misstax

Level 2

atn888

Level 2

atn888

Level 2

nelspaul13

New Member

rhalexda

Level 3