- Community

- Topics

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- How do i enter into turbo tax investment capital loss with no 1099B (Co went out of business)

Announcements

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i enter into turbo tax investment capital loss with no 1099B (Co went out of business)

I have an Investment Certificate since 1995 the company is now closed. How do I claim that capital loss in TT with no 1099?

Topics:

posted

March 4, 2023

11:23 AM

last updated

March 04, 2023

11:23 AM

Connect with an expert

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

1 Best answer

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i enter into turbo tax investment capital loss with no 1099B (Co went out of business)

To enter the stock sale without a 1099-B follow these instructions:

- Click on Income & Investments

- Scroll to Investments and Savings and click on Start (or Edit or Review)

- Click on Add Investments. And then Continue on the next page

- Choose to Enter a different way

- Pick Stocks, Bonds, Mutual Funds and Continue

- Which bank or brokerage sent you a 1099-B for these sales?, Enter name of brokerage or something descriptive

- Answer questions on next page and Continue

- Now, Choose how to enter your sales, One by one, Continue

- Continue past the page Look for your sales on your 1099-B

- You can enter your sales on the next page.

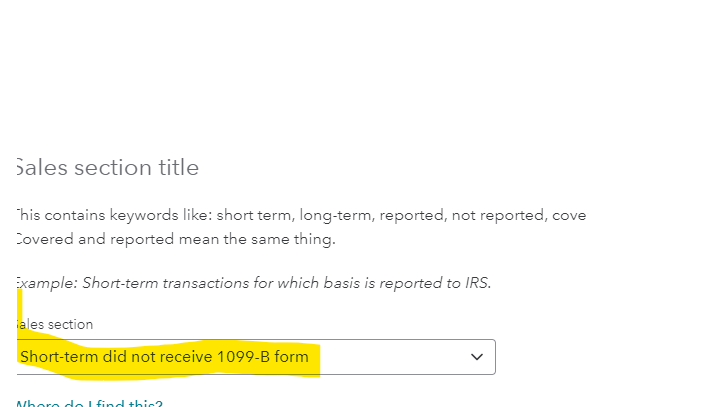

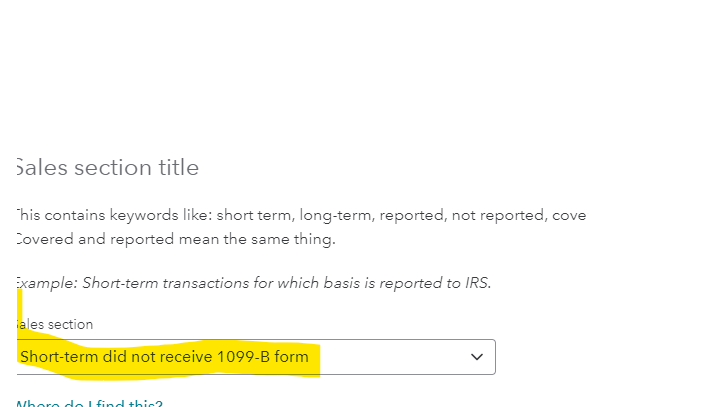

- In the first box, Sales section, Choose Short-term (or long-term) did not receive 1099-B form

Continue with the information for your sales

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 5, 2023

6:05 PM

479

1 Reply

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i enter into turbo tax investment capital loss with no 1099B (Co went out of business)

To enter the stock sale without a 1099-B follow these instructions:

- Click on Income & Investments

- Scroll to Investments and Savings and click on Start (or Edit or Review)

- Click on Add Investments. And then Continue on the next page

- Choose to Enter a different way

- Pick Stocks, Bonds, Mutual Funds and Continue

- Which bank or brokerage sent you a 1099-B for these sales?, Enter name of brokerage or something descriptive

- Answer questions on next page and Continue

- Now, Choose how to enter your sales, One by one, Continue

- Continue past the page Look for your sales on your 1099-B

- You can enter your sales on the next page.

- In the first box, Sales section, Choose Short-term (or long-term) did not receive 1099-B form

Continue with the information for your sales

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 5, 2023

6:05 PM

480

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

SCswede

Level 3

atn888

Level 2

cherylsatt

New Member

Ian B

New Member

fineIlldoitmyself7

Level 1