- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- How do I calculate the depletion allowance on Oil royalties earned in 2018 as a result of mineral rights that I own?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I calculate the depletion allowance on Oil royalties earned in 2018 as a result of mineral rights that I own?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I calculate the depletion allowance on Oil royalties earned in 2018 as a result of mineral rights that I own?

The depletion allowance is 15% and is calculated on the followup page Enter Your Depletion Information in TurboTax when you enter the oil royalty information.

For example, if you have $1,000 in oil royalties, the depletion allowance is 1,000 x .15 (15%) or $150. You would enter that amount in the box if TurboTax does not calculate it for you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I calculate the depletion allowance on Oil royalties earned in 2018 as a result of mineral rights that I own?

The depletion allowance is 15% and is calculated on the followup page Enter Your Depletion Information in TurboTax when you enter the oil royalty information.

For example, if you have $1,000 in oil royalties, the depletion allowance is 1,000 x .15 (15%) or $150. You would enter that amount in the box if TurboTax does not calculate it for you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I calculate the depletion allowance on Oil royalties earned in 2018 as a result of mineral rights that I own?

TT does not even ask me for depletion info after entering royalties.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I calculate the depletion allowance on Oil royalties earned in 2018 as a result of mineral rights that I own?

Enter the information under

Federal

Deductions & Credits

Rentals, Royalties, and farms

Rental Properties and Royalties

Yes

Type of property - Royalty

Continue through the interview to the Depletion Screen.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I calculate the depletion allowance on Oil royalties earned in 2018 as a result of mineral rights that I own?

There is no Rental, Royalties, and farms section under Federal Deductions & Credits. Why wouldn't it ask for this information when you enter the royalties under the Wages & Income section. I'm just sick, apparently I have missed this deduction since 2014 costing me hundreds of dollars! What good is TurboTax when it misses a major deduction like this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I calculate the depletion allowance on Oil royalties earned in 2018 as a result of mineral rights that I own?

Depletion allowances (and calculations) are addressed in the Rental Properties and Royalties interview of TurboTax Self-employed (and Home & Business), under the Business > Business Income and Expense section.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I calculate the depletion allowance on Oil royalties earned in 2018 as a result of mineral rights that I own?

I use the Deluxe version which doesn't have that section. When the Deluxe version specifically accepts the 1099 entry for oil royalties it should automatically enter the 15% deduction in the schedule E which is included in the Deluxe version. At the very least, it should advise you that the deduction exist and tell you it is in the Home and Business version. I have lost all confidence in TurboTax at this point and will not be using it again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I calculate the depletion allowance on Oil royalties earned in 2018 as a result of mineral rights that I own?

I have also missed out because of lack of this information until now! I even purchase the on up from deluxe just to help and it still did not cover this. Shame on you Turbo Tax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I calculate the depletion allowance on Oil royalties earned in 2018 as a result of mineral rights that I own?

I am using TurboTax Business to do my S-Corp taxes. How do I enter Oil & Gas Royalty Income but particularly, how do I enter Oil & Gas Depletion allowance? I understand Oil & Gas Depletion Allowance is a Disallowed deduction in my S-Corp Tax Return and must be accounted for appropriately for my K-1. I don't see see the option to enter Depletion under Rentals, Royalties as you described.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I calculate the depletion allowance on Oil royalties earned in 2018 as a result of mineral rights that I own?

You are correct that depletion is deducted by the Shareholders and not the S-Corp.

Each shareholder must determine the allowable amount to report on his or her return. See the IRS Instructions for Form 1120S Schedule K-1, box 17, code R for the information on oil and gas depletion that must be supplied to the shareholders by the corporation.

In TurboTax Business, you can generate the Supplemental Information attachment for Schedule K-1 using Forms Mode.

Note: you will be making entries to more than one worksheet. Be sure you're in the correct worksheet for each step.

- Click the Forms icon in the TurboTax header.

- Look for "K-1 Partner" in the left column. Click the form name to open it in the large window.

If you don't see this form in the list, you may need to open a new copy by clicking on Open Form and typing in "k-1". Name the worksheet the same as your partnership name. Then fill in the partnership info at the top of the worksheet before you continue. - Scroll down to Line 20.

- Click the drop-down under Code and select "T". TurboTax automatically enters the description for depletion with an asterisk. Enter the total amount to be allocated to the partners.

- Now open Schedule K-1 for the first partner. Scroll down to Line 17. Enter "R" in the first code box. TurboTax automatically enters "STMT" to indicate additional information to follow.

- Scroll down below Line 19 to the Supplemental Information Smart Worksheet. Enter "Line 17-R" and a description. Then enter the amount allocated to this partner. (TurboTax does not calculate this for you.)

- Repeat Step 5 & 6 for each partner. Leave all forms open until you review the results.

- To see Schedule K-1 and the attachment, print preview the form (in the menu bar, click File >> Print (Schedule K-1 will appear) >> Print Preview). Additional information will appear on a separate sheet after Schedule K-1, with the information you entered.

- When you're finished, click "Step-by-Step" in the header to return to the interview.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I calculate the depletion allowance on Oil royalties earned in 2018 as a result of mineral rights that I own?

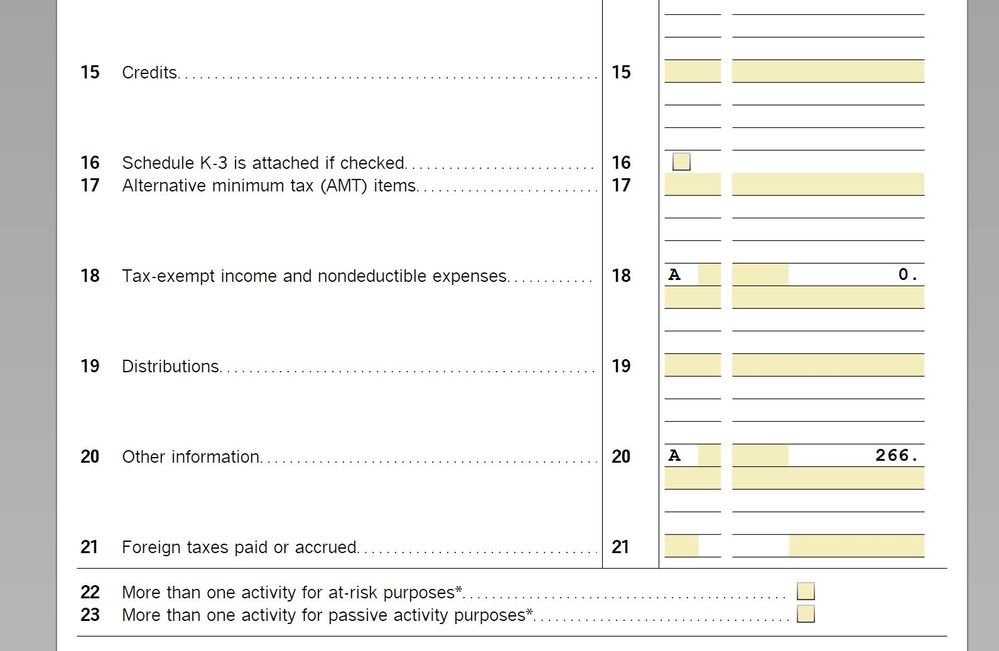

I had to create a K1 Partner form for the partnership, but when I get to Step #5, I go into the individual Schedule K-1 for each partner, but I see the following view below with no "Line 20" dropdown "Code" box - only the AMT. Whats the best way to get to this dropdown box yous pecify?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I calculate the depletion allowance on Oil royalties earned in 2018 as a result of mineral rights that I own?

@SandSpider

The instructions above were for Form 1120S (S-Corp) and not Form 1065 (Partnership), so some of the line numbers are different.

However, the K-1 Partner worksheet for both types of returns does have a drop-down to select Code T on Line 20 (screenshot below). On Schedule K-1 (1065), you will need to enter (type in) Code R in the box on Line 20 to have the asterisk and "STMT" appear (screenshot #2). Then enter the info needed for each partner under the Supplemental Information Worksheet.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I calculate the depletion allowance on Oil royalties earned in 2018 as a result of mineral rights that I own?

Thanks @PatriciaV ! Is there even a need to have the Supplemental Information section in there as for some reason I dont get the "K-1 PARTNER" entries on the left side like you do, instead I just get the "Schedule K-1 (XYZ Name)" entries which dont offer dropdowns. However, it does allow me to stick in the 20(T) section in there, which is the IRS code for the Depletion entries and would allow partners to use their K-1s to deduct depletion on their personal returns.

It would be a lot more work to create the K-1 PARTNER entries and then add the supplemental information, is there much benefit to that?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I calculate the depletion allowance on Oil royalties earned in 2018 as a result of mineral rights that I own?

That's up to you. The K-1 Partner worksheet is used to document the info allocated to partners. If you enter that info directly on Schedule K-1, you don't need the worksheet.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I calculate the depletion allowance on Oil royalties earned in 2018 as a result of mineral rights that I own?

Thank you so much for your timely response. I was totally stuck as to how to enter non-deductible Oil & Gas Depletion in Turbo Tax. I must say that Turbo Tas Business is not very clear on how to enter Oil & Gas Royalties Income. (It gives me to enter Royalties but then treats it as Portfolio Income). How do I go back to the Intervew and edit the Income so that it registers as Oil & Gas Royalties. And you said earlier it also computes the 15% Depletion automatically. I don't see how to get there. I want to enter the Oil & Gas Royalties as Depletable Assets rather than Other Assets.

Also, when I go to Balance Sheet Reconciliation It DOES NOT give me a choice in the Book and Tax Difference to pick Disallowed Oil & Gas Depletion. It downloads my Quickbooks file wherein I have added Oil& Gas Depletion as a separate Expense item after calculating the 15% amoiunt. Now I want to show that for Rax purposes that Deduction on Quickbooks should be disallowed. How to do all this? Or just because I have entered the Oil&Gas Depletion in Oine 17 R the Income flow through to my Personal Tax Return will be properly done?

THe Tax Return 1120-S is still showing Book Income as the Tax Return Income although I added Line 17 Code R disallowed depletion amount. The Tax Return Net Income should have increased by this Depletion Amount but somehow I don't seem to be able to connect it. Is there a Form M-1 and M-2 that does it?

BTW, I have tried several times to go back to the Interview to see if I can change the Income category as Oil&Gas Income but have not been able to do so.

Thank you , once again! You are a life-saver!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Dcharrison1

New Member

rowepsy1

New Member

Teri241

New Member

brianbeagles3

New Member

tbatson

New Member