- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Form 4562 - Rental property depreciation and amortization

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 4562 - Rental property depreciation and amortization

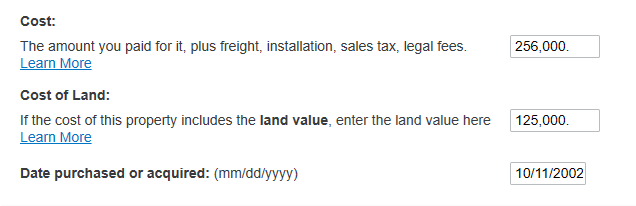

For 2019, i had form 4562 with my rental property depreciation and amortization that i can add but i dont see the form anywhere so, i am wondering if someone can explain if this is the same in the pic and what information is required because TT doesn't really explain what amount goes in this section? I understand the cost of Land and i can get that from county site and date purchased will be date this property was purchased...correct? What about the cost? What's this cost? I just put in some numbers below but that's not accurate. Thanks

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 4562 - Rental property depreciation and amortization

Can anyone help with this question? Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 4562 - Rental property depreciation and amortization

@rm1177 If you transferred your info from 2019, TurboTax fills in the 2020 depreciation amount for you; you don't need to enter anything.

The Accumulated Depreciation is shown on Form 4562, which is for your information each year.

If the Accumulated Depreciation amount did not transfer for you into 2020, use the amount from your 2019 Form 4562, Deprciation Report.

If you are re-entering your Rental Property as an Asset (because it did not transfer), use the same amounts for Cost Basis/Land as you did when you started renting in 2002.

You can find this info on your Asset Entry Worksheet for 2019 (screenshot), and also on your 2019 Depreciation Report.

Click this link for more info on Rental Property Cost Basis.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 4562 - Rental property depreciation and amortization

The only time you enter the property and/or any other assets in the assets/depreciation section, is in the tax year that property and/or asset is first placed "in service" as rental property or rental property asset. You do not enter the same asset each year.

After you enter the property that first year, it will be "automatically" imported into the turbotax program in the next year *IF* you use the same exact account that you used the previous year, to prepare the previous year tax return. This is a "MUST" in order to import anything from the prior year's tax return.

If using the CD version of the program, then the prior year tax file (will have a .tax2019 filename extension) must be in the documents/turbotax directory of the computer you installed TurboTax 2020 on. Then the CD version of the 2020 program will automatically import last year's data from that .tax2019 file.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 4562 - Rental property depreciation and amortization

It did not enter this info from 2019 but added other data such as expenses etc. for rental from 2019. I am not sure why but here is the thing, I bought this property in 2002 and started renting in 2019 so, what should i enter below for cost and cost of land? Should i enter the appraised 2020 value from county site including land value? Thanks a lot

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 4562 - Rental property depreciation and amortization

so, what should i enter below for cost and cost of land?

COST: What you paid for the property when you originally purchased it in 2002.

COST OF LAND: whatever percentage of the amount you entered in the COST box, that is allocated to the land.

To determine what percentage to enter for land, look at your most recent property tax bill. It will have a breakdown one way or another, and using simple math you get get the percentage. Take note that under no circumstances and with no exceptions will you "ever" use any dollar amount on the property tax bill as a cost basis. Confused now? Good. That means you're paying attention.

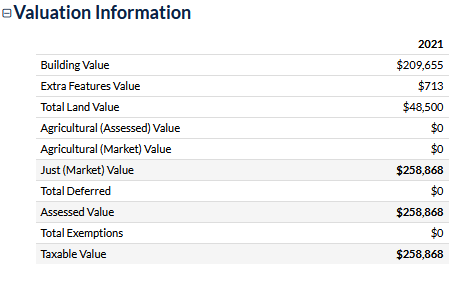

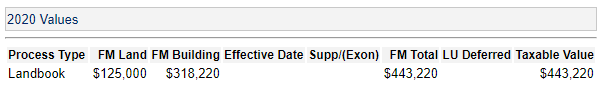

Lets look at a sample property tax bill.

Above we see that the structure has a tax value of $209,655. Other features has a value of $713. These "other features" are probably a fence most likely. But it's something on the property that has value and is most likely depreciated. So add those two together and I get a total value of $210,368 for everything "on" the land.

Next, the land is valued at $48,500.

So my total "value" for this property as assessed by the property appraiser is $258,868

Doing the math, $48,500 divided by $258,868 equals 0.187. So the value of the land is approximately 19% of my total value.

Now I paid $500,000 for the property when originally purchased (I'm picking numbers out of thin air here). So 19% of $500,000 is $95,000. that's the cost I will assign to the land.

Therefore, I will enter my data into turbotax as:

COST: $500,000

COST OF LAND: $95,000

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 4562 - Rental property depreciation and amortization

I think i got it but want to make sure...this is 2020 value screenshot and i paid 256k in 2002. Using your formula and below nos. i am 28% land value...which is 125k divided by 443k. So cost is 256k (original buy price) and 28% of that is 71k and that should be cost of land. Did i get this right? Just wanted to double check. Thanks a lot for your help and detailed explanation.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 4562 - Rental property depreciation and amortization

Using your 2020 tax values I also get 28% of total value is for the land. That makes 28% of your $256K purchase price at $71K. Now neither of our numbers are "spot on", as it's obvious we're using rounded figures. But for this, the IRS has no issues with that. My favorite quote on that one is "close enough for government work". 🙂

So the bottom line is, you'll be depreciating roughly $185K over the next 27.5 years.

Now just a personal note here, and it's just for your consideration "only" if you want to.

Since residential rental property will by nature operate at a loss every year "on paper" at tax time (if there's a mortgage on the property), I try to keep the depreciation I'm required to take each year, as low as I legally can. This is because in the tax year you sell (or otherwise dispose of) the property, you are required to recapture that depreciation and pay taxes on it. Also, that recaptured depreciation increases your AGI in the tax year you sell, which has the potential to bump you into the next higher tax bracket.

So were I in your scenario, I would allocate $72K to the land if my state taxes personal income. But if my state does not tax personal income, and would therefore have no reason to check the valuation I gave the land and structure on any state tax return, I'll allocate $75K to the land.

I am of the opinion (and we all know what opinions are like.) that the state would be 90% more likely to "check up" on that, than the IRS would. That's because the IRS deals with more than 300,000,000 tax returns every year. They don't have time for the piddly stuff. Even though they do perform "random" audits every year, all the time. But my chances of getting picked randomly are 1 in more than 300,000,000 plus. Whereas a state that taxes personal income will only deal with a fraction of that, depending on the population of that state.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 4562 - Rental property depreciation and amortization

I have always used The CD version. In all past years the new year searches for previous year file and transfers all info. The year 2021 the only thing that transferred for my rental was the net income. Nothing shows up as an existing rental property.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 4562 - Rental property depreciation and amortization

@John4347 please contact us via phone so one of our customer service representatives can walk you through transferring your previous return. They can assist with issues that may arise.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 4562 - Rental property depreciation and amortization

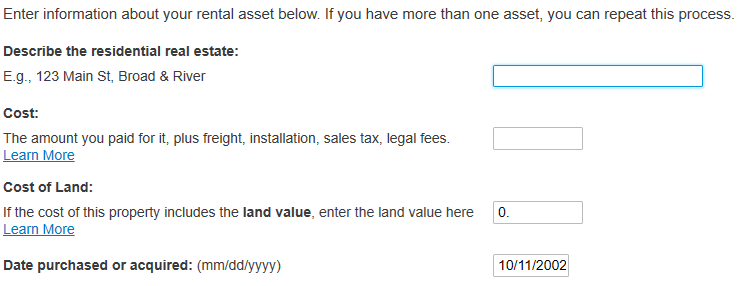

i have used turbo tax disc for years but this is first time I have downloaded turbo tax. I have to populate everything on rental depreciation from past years. I am unable to locate how to put in info on Form 4562 and I don't know if it will automatically fill in information in rental area for this year

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 4562 - Rental property depreciation and amortization

If your Rental Property assets and depreciation didn't transfer properly from your 2020 return, you may need to re-enter them in the Sale of Property/Depreciation section under Rental Property. Make sure your property info carried over to the Property Profile section first.

Use your original 'Date in Service' and 'Cost' and TurboTax will calculate depreciation for you on Form 4562 for each asset. The 'Depreciation and Amortization Report' (landscape form) from 2020 can help you.

The download version of TurboTax operates the same as the CD version.

@cecile hanus

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 4562 - Rental property depreciation and amortization

@MarilynG Hello, I would really appreciate some advice. I had a rental property from 2006. The depreciation form 4562 for the last 15 years had 0 in the Land value. The Cost (net land) value is lower than the purchase cost. The property was sold in 2021. Is there any way to add the land value now to include in calculation of Cost Basis?

Also, where to add the expenses, related to the original purchase of the house?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 4562 - Rental property depreciation and amortization

The property was sold in 2021. Is there any way to add the land value now to include in calculation of Cost Basis?

There's a work-a-round of sorts. What you do is add the value of the land to the figure already in the "COST" box. Then enter the value of the land in the COST OF LAND box. Since land is not depreciated, doing it this way will not screw up your depreciation history.

Also, where to add the expenses, related to the original purchase of the house?

You "should" have already claimed those expenses either in the year you purchased the property, or in the tax year you converted the property from personal use to rental use. You can't claim them again. If you didn't claim the original acquisition expenses in the tax year you were allowed to, then you can not claim them in a later year, including the year you sell the property.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 4562 - Rental property depreciation and amortization

Carl, thank you so much for your reply.

I tried to change the value in the Cost box, and it worked for the Federal. However, the smart check gives an error on the state, that depreciation is higher than federal. It seems that the state re-calculates the depreciation based on the value in that box. I can't find an option to split between the Land Value and the house value on any screen to make sure only the house value is included in depreciation calculation.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

alvin4

New Member

melillojf65

New Member

iqayyum68

New Member

flin92

New Member

SB2013

Level 2