- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

so, what should i enter below for cost and cost of land?

COST: What you paid for the property when you originally purchased it in 2002.

COST OF LAND: whatever percentage of the amount you entered in the COST box, that is allocated to the land.

To determine what percentage to enter for land, look at your most recent property tax bill. It will have a breakdown one way or another, and using simple math you get get the percentage. Take note that under no circumstances and with no exceptions will you "ever" use any dollar amount on the property tax bill as a cost basis. Confused now? Good. That means you're paying attention.

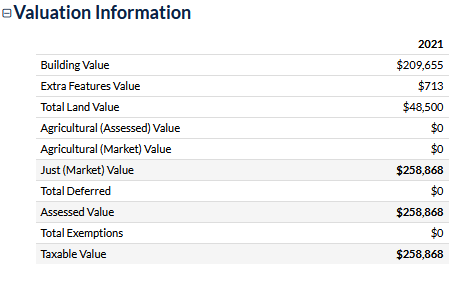

Lets look at a sample property tax bill.

Above we see that the structure has a tax value of $209,655. Other features has a value of $713. These "other features" are probably a fence most likely. But it's something on the property that has value and is most likely depreciated. So add those two together and I get a total value of $210,368 for everything "on" the land.

Next, the land is valued at $48,500.

So my total "value" for this property as assessed by the property appraiser is $258,868

Doing the math, $48,500 divided by $258,868 equals 0.187. So the value of the land is approximately 19% of my total value.

Now I paid $500,000 for the property when originally purchased (I'm picking numbers out of thin air here). So 19% of $500,000 is $95,000. that's the cost I will assign to the land.

Therefore, I will enter my data into turbotax as:

COST: $500,000

COST OF LAND: $95,000