- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 4562 - Rental property depreciation and amortization

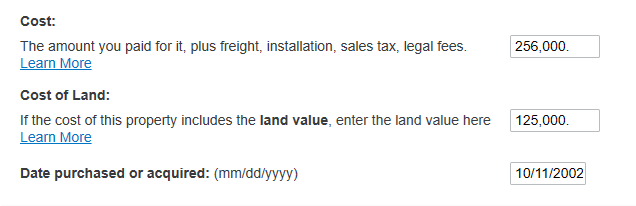

For 2019, i had form 4562 with my rental property depreciation and amortization that i can add but i dont see the form anywhere so, i am wondering if someone can explain if this is the same in the pic and what information is required because TT doesn't really explain what amount goes in this section? I understand the cost of Land and i can get that from county site and date purchased will be date this property was purchased...correct? What about the cost? What's this cost? I just put in some numbers below but that's not accurate. Thanks

Topics:

March 15, 2021

4:21 PM