- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- For the "How did you receive this investment" field, why isn't "Return of capital for fractional shares or cash in lieu" an option?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For the "How did you receive this investment" field, why isn't "Return of capital for fractional shares or cash in lieu" an option?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For the "How did you receive this investment" field, why isn't "Return of capital for fractional shares or cash in lieu" an option?

Reporting this transaction is like reporting a sale of stock.

How to Report Cash in Lieu of Fractional Shares

- The IRS considers cash for a fractional share to be money received as the result of a stock sale.

- This transaction must be reported on IRS tax form Schedule D Capital Gains and Losses.

- The date of the sale (when cash was received) and the date of the original stock purchase is needed to complete the tax form.

Tax Basis Example: Assume a shareholder has an aggregate $100 basis in 50 shares of ABC stock ($2 per share), and the fair market value of one share of ABC stock is $66.65. Following the ABC Merger, the shareholder should have an aggregate $100 basis in 64.1 shares of ABC stock (50 shares x 1.2820, or $1.56 per share), and should be treated as having sold 0.1 shares of ABC stock with a tax basis of $0.156 ($1.56 x 0.1 shares) for $6.67 ($66.65 per share fair market value x 0.1 fractional shares).

Once you have your information you will complete the entry in TurboTax using the following steps.

- Open (continue) your return if it isn't already open.

- In TurboTax, search (upper right) > Type 1099-B (include dash) Press enter > then select the Jump to link

- Answer Yes to Did you sell stocks, mutual funds, bonds, or other investments in 2020?

- If you see Here's the info we have for these investment sales, select Add More Sales.

- Answer NO to Did you get a 1099-B or brokerage statement for these sales? Or answer YES if you want to try to import it.

- Follow the instructions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For the "How did you receive this investment" field, why isn't "Return of capital for fractional shares or cash in lieu" an option?

Reporting this transaction is like reporting a sale of stock.

How to Report Cash in Lieu of Fractional Shares

- The IRS considers cash for a fractional share to be money received as the result of a stock sale.

- This transaction must be reported on IRS tax form Schedule D Capital Gains and Losses.

- The date of the sale (when cash was received) and the date of the original stock purchase is needed to complete the tax form.

Tax Basis Example: Assume a shareholder has an aggregate $100 basis in 50 shares of ABC stock ($2 per share), and the fair market value of one share of ABC stock is $66.65. Following the ABC Merger, the shareholder should have an aggregate $100 basis in 64.1 shares of ABC stock (50 shares x 1.2820, or $1.56 per share), and should be treated as having sold 0.1 shares of ABC stock with a tax basis of $0.156 ($1.56 x 0.1 shares) for $6.67 ($66.65 per share fair market value x 0.1 fractional shares).

Once you have your information you will complete the entry in TurboTax using the following steps.

- Open (continue) your return if it isn't already open.

- In TurboTax, search (upper right) > Type 1099-B (include dash) Press enter > then select the Jump to link

- Answer Yes to Did you sell stocks, mutual funds, bonds, or other investments in 2020?

- If you see Here's the info we have for these investment sales, select Add More Sales.

- Answer NO to Did you get a 1099-B or brokerage statement for these sales? Or answer YES if you want to try to import it.

- Follow the instructions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For the "How did you receive this investment" field, why isn't "Return of capital for fractional shares or cash in lieu" an option?

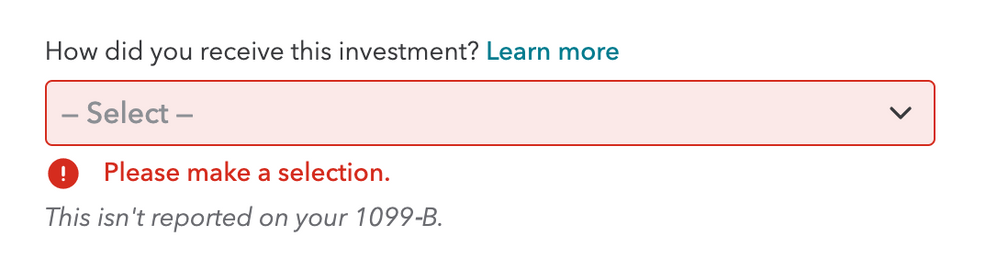

Having the same issue after import. Directions in "Learn more" state there should be an option available for "Return of Capital...." but it is missing from the drop down menu. This is a programming error. How do we get support to have an Engineer correctly display drop down menus?

Also seeing horrible formatting to filling in gaps if you have a brokerage firm with X number of sales. You cannot edit the correct information with an overlay showing up on the screen. So much money spent to have pop ups to pay more to have "live help" almost forcing people to no longer use Turbo Tax because the product is broken.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For the "How did you receive this investment" field, why isn't "Return of capital for fractional shares or cash in lieu" an option?

Reporting this transaction is like reporting a sale of stock. Please use the information below to help you complete your tax return.

How to Report Cash in Lieu of Fractional Shares

- The IRS considers cash for a fractional share to be money received as the result of a stock sale.

- This transaction must be reported on IRS tax form Schedule D Capital Gains and Losses.

- The date of the sale (when cash was received) and the date of the original stock purchase is needed to complete the tax form.

Tax Basis Example: Assume a shareholder has an aggregate $100 basis in 50 shares of ABC stock ($2 per share), and the fair market value of one share of ABC stock is $66.65. Following the ABC Merger, the shareholder should have an aggregate $100 basis in 64.1 shares of ABC stock (50 shares x 1.2820, or $1.56 per share), and should be treated as having sold 0.1 shares of ABC stock with a tax basis of $0.156 ($1.56 x 0.1 shares) for $6.67 ($66.65 per share fair market value x 0.1 fractional shares).

Once you have your information you will complete the entry in TurboTax using the following steps.

- Open (continue) your return if it isn't already open.

- In TurboTax, search (upper right) > Type 1099-B (include dash) Press enter > then select the Jump to link

- Answer Yes to Did you sell stocks, mutual funds, bonds, or other investments in 2020?

- If you see Here's the info we have for these investment sales, select Add More Sales.

- Answer NO to Did you get a 1099-B or brokerage statement for these sales? Or answer YES if you want to try to import it.

- Follow the instructions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For the "How did you receive this investment" field, why isn't "Return of capital for fractional shares or cash in lieu" an option?

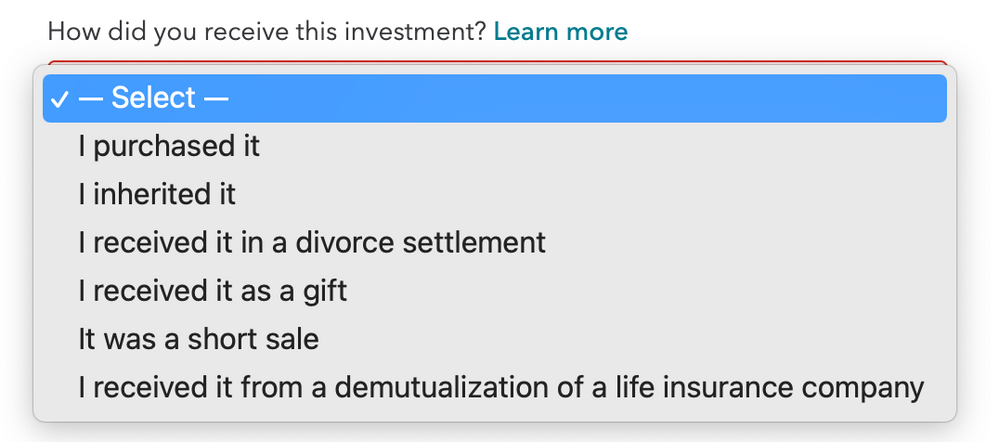

Your instructions are great - but there is no option within the dropdown menu to select "Return of capital for fractional shares or cash in lieu." The dropdown menu is also missing "Other" as an option regarding how we received the shares. I received cash from a merger. It was not purchased, inherited, received after divorce, gift, short sale (?!), or Demutualization of life insurance company.

Please - before answering this question again with the same instructions, PLEASE look at the dropdown menu to see what the options are. It appears two options are missing in the dropdown menu - and when you click on LEARN MORE, it shows you what options should be available to select for how did you receive this investment?

I LUV TurboTax, but this "glitch" might force my hand to move to a competitor.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For the "How did you receive this investment" field, why isn't "Return of capital for fractional shares or cash in lieu" an option?

The question is how did you receive the shares, not how did you dispose of them.

You probably originally purchased the shares. That would be the appropriate response.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For the "How did you receive this investment" field, why isn't "Return of capital for fractional shares or cash in lieu" an option?

lmao

does anyone even READ what the question is ASKING before posting their “expert” answer?

there is a crucial piece of information missing in the drop down menu...

i received CASH IN LEIU OF SHARES from a merger. that means I received cash instead of shares of a company. But I am unable to select that reason in the drop down menu. If any of these “experts” attempting to answer the question would take a moment to LOOK AT what selections are offered... but that has yet to happen.

bye turbo tax!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For the "How did you receive this investment" field, why isn't "Return of capital for fractional shares or cash in lieu" an option?

I have exact same problem. Just look at these options(non-sense):

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For the "How did you receive this investment" field, why isn't "Return of capital for fractional shares or cash in lieu" an option?

While I agree that 'Other Method' should appear in that drop down as an option (especially since it appears in the list of options!) and its non-appearance is annoying it doesn't apply to you.

Cash in lieu of shares is a SALE. You sold something.

When these companies merged they bought you off to not have to give you shares of the new company by buying the fractional shares that were generated in the merge. They were generated by the shares you had pre merge. You sold some of that investment.

How you got the investment that you sold in order to get cash in lieu of shares is the question here. One of the options that IS in the dropdown menu covers it.

You will also probably receive a 1099-B for this sale. Keep an eye out for it. You're going to need to figure out your own basis for the shares you sold here.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For the "How did you receive this investment" field, why isn't "Return of capital for fractional shares or cash in lieu" an option?

In my opinion, having the same problem as the original poster, you completely failed to answer the question. We all understand that this cash-in-lieu is from the sale of fractional shares. The question is how to answer the required question of how did I _acquire_ the stocks that came as a spin-off of shares bought in a _different_ company. You said " One of the options that IS in the dropdown menu covers it." Ok, WHICH ONE?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For the "How did you receive this investment" field, why isn't "Return of capital for fractional shares or cash in lieu" an option?

Thank you. You expressed my frustration perfectly. Sorry I don't have an answer for you. I keep trying to contact customer support, but, while they are very nice, they don't seem to be able to help, and I refuse to pay an extra $80 to get access to a tax expert who can tell me how to get around a basic software bug generated by the apparent carelessness of the programmers.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For the "How did you receive this investment" field, why isn't "Return of capital for fractional shares or cash in lieu" an option?

Ok, after reading through the various comments more carefully, I think I finally get it. It seems that the answer to the question is that even if the cash in lieu of shares is technically for the shares of a company formed by merger or spin-off and NOT for the shares of the original company, the shares sold should be considered as those of the original company, since these were "sold" to "purchase" shares in the new company (which were then "bought" as fractional shares by the new company and "paid for" by cash in lieu). Therefore, the answer to the question about how the shares were acquired is not how the fractional shares that were sold were acquired (i.e. merger or spin-off) but how the original shares were acquired. Is that correct?

A related question. some of the stocks I owned in the original company from which the spin-off company arose were purchased incrementally by dividend reinvestment, so, when asked whether any of the shares were purchased over a year before the date of "sale" of the stocks, should I chose the option that they were all purchased prior, or that none of them were purchased prior to a year ago, since these are the only two options (and not "part of the shares were and part were not)?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For the "How did you receive this investment" field, why isn't "Return of capital for fractional shares or cash in lieu" an option?

@anujm You're using the original purchase date of the original shares that you bought for both of these questions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For the "How did you receive this investment" field, why isn't "Return of capital for fractional shares or cash in lieu" an option?

I had similar situations of partial shares sale due to the spin offs , but the old turbo tax program asked if the partial shares sales are from merger/spin off, and it was processed accordingly. This year's program asks to enter information exactly same as 1099-B, then it does not accept the blank for date acquired (box 1b) and $0.00 for cost basis (box 1e) where those are the values in the boxes. The original company declared this distribution of spin-off shares is tax-free, and I don't think I need to pay tax for the partial shares.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For the "How did you receive this investment" field, why isn't "Return of capital for fractional shares or cash in lieu" an option?

Many things have been corrected in the latest updates to TurboTax. Are you still experiencing this problem?

Make sure you have ran all updates.

If using TurboTax Online: Clear your cache and cookies. See this FAQ, for your particular browser.

If using TurboTax Desktop: Please see this FAQ.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

mlvalencia78

New Member

sts_66

Level 2

sts_66

Level 2

tonyallegrezza254

New Member

nicolsanders

New Member