- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Converting a Personnel+ business asset (car) to personal use- How report this and recapture the depreciation?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Converting a Personnel+ business asset (car) to personal use- How report this and recapture the depreciation?

The car used for business activity was purchased as a personal car back in 2011. Then in 2019 I started using it for my rental activity and also personnel use, which is multi-member LLC. Because I cannot report the mileage in the 1065 (Sch K), I have been reporting mileage expense in my personal tax return. I have been taking a standard mileage deduction all these years. In 1/1/2023, I converted this vehicle to personal use. All these years, I drove total of 34281 miles for personnel use and 1719 miles for business use. Business use miles is only 5% over these years. When reporting the turbo I feel I'm doing something wrong in my following selections

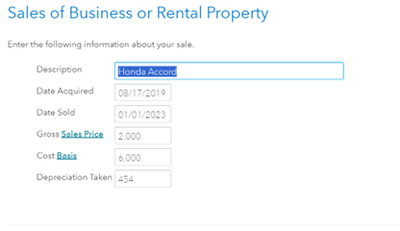

Wages & Income >Other Business Situations > Sale of Business Property >Start or Revisit > Enter your sale

No selected for the next screen shot

Yes selected for the next screen shot

Back in 2019 cost basis is $6000. Because I have 5% of total miles used for business, I am not 100% sure of cost basis that I should enter when I put this vehicle for both the business and personal use.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Converting a Personnel+ business asset (car) to personal use- How report this and recapture the depreciation?

If you sold the car, based on your entries, then you must recapture the depreciation portion of the business miles used as a deduction on your personal tax returns.

Follow the instructions below to enter your sale and calculate the depreciation portion of the standard mileage rate (SMR). It appears you may already be on track.

The chart below will show you the SMR depreciation portion for all years. Calculate your depreciation total amount for your sale. Five percent of the car is business use as you indicated by the numbers of total miles and business miles for the life of the vehicle. Use only the business percentage of cost and sales price (including purchase and sales expenses). Then enter your sale in the screen you indicated in your screen images and steps are noted below.

- Wages & Income at the top

- Scroll down to Other Business Situations

- Select Sale of Business Property

- Select Sales of business or rental property that you haven't already reported.

- Answer 'Yes' to Do all of the following apply...?

- Enter your sales information, do not make an entry for depreciation (no zeros)

- Description of the Property (Second Home/Previous Rental Home)

- Sales Price/Sales Expenses

- Date acquired and date sold

- Sales Price

- Cost

- Depreciation

If your personal use portion is a loss, there is nothing to enter in TurboTax for that because a personal loss is not allowed to be used.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

taxquestion222

Returning Member

roypimjasmine2485

New Member

cparke3

Level 4

johnjames9

Level 2

HardtoKeepUp

Level 2