- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Converting a Personnel+ business asset (car) to personal use- How report this and recapture the depreciation?

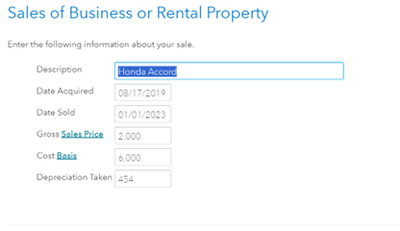

The car used for business activity was purchased as a personal car back in 2011. Then in 2019 I started using it for my rental activity and also personnel use, which is multi-member LLC. Because I cannot report the mileage in the 1065 (Sch K), I have been reporting mileage expense in my personal tax return. I have been taking a standard mileage deduction all these years. In 1/1/2023, I converted this vehicle to personal use. All these years, I drove total of 34281 miles for personnel use and 1719 miles for business use. Business use miles is only 5% over these years. When reporting the turbo I feel I'm doing something wrong in my following selections

Wages & Income >Other Business Situations > Sale of Business Property >Start or Revisit > Enter your sale

No selected for the next screen shot

Yes selected for the next screen shot

Back in 2019 cost basis is $6000. Because I have 5% of total miles used for business, I am not 100% sure of cost basis that I should enter when I put this vehicle for both the business and personal use.