- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Converting a business + personal asset (car) to personal use- How to report it and recapture the depreciation?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Converting a business + personal asset (car) to personal use- How to report it and recapture the depreciation?

The car used for business activity was purchased as a personal car back in 2011. Then in 2019 I started using it for my rental activity along with personal use. I have been taking a standard mileage deduction all these years. In 1/1/2023, I converted this vehicle to personal use. Business use miles is 1719 and personal use is 34281 miles. Only 4.7% of miles is business use.

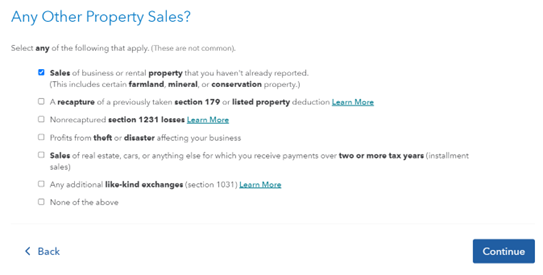

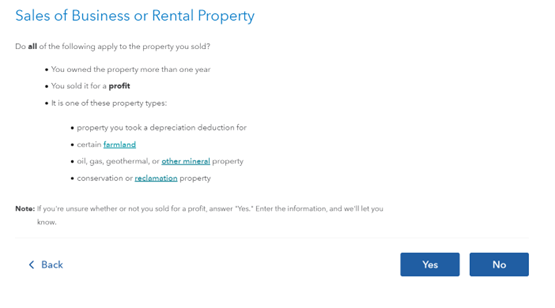

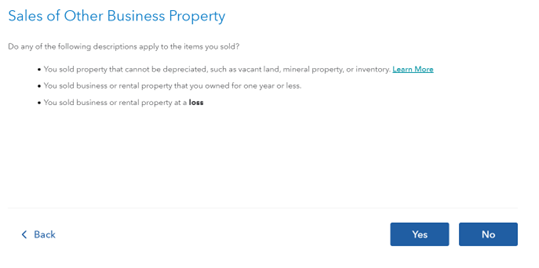

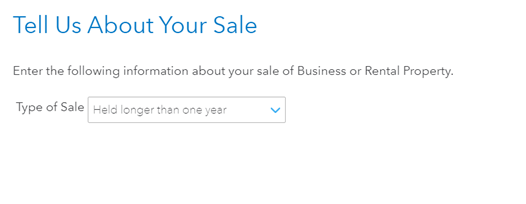

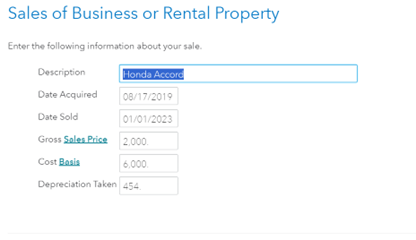

I am not sure If I am making the correct selection in Turbo Tax to recapture the depreciation. I followed the guidance as posted in the other questions. Wages & Income >Other Business Situations > Sale of Business Property >Start or Revisit > Enter your sale

No for the below screenshot

Yes for the below screenshot

When this vehicle was to added to the business along with the personal use, the cost basis was around $6000.00. Because I had 4.7% of total miles driven is for business use, I am not sure if should be entering $6000 cost basis.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Converting a business + personal asset (car) to personal use- How to report it and recapture the depreciation?

First of all, you would report that the vehicle was converted to personal use.

There is no depreciation recapture (or Capital gain/Loss) until you actually sell the vehicle.

The depreciation you claimed is calculated yearly when you use the standard mileage rate. Each year a potion of the standard rate includes a "Depreciation Equivalent".

2023 it was .28 per mile

2022 it was .26 per mile

2021 it was .26 per mile

2020 it was .27 per mile

2019 it was .26 per mile

So you would need to multiply the miles claimed each year by the Depreciation Equivalent of that year and add them all together. That is the depreciation claimed.

Subtract the depreciation claimed from the basis of the vehicle, so 6,000 less the deprecation. (lets say 6,000 - 447 = 5,553)

$5,553 would be your "Adjusted Basis".

If SOMEDAY you sell the vehicle for more than 5,553, the first 447 over that would be depreciation recapture which is Ordinary Income. Anything over 6,000 would be Capital gain.

Since the vehicle is converted to personal use, there can never be a loss claimed.

Again, this is not addressed until the vehicle is sold or traded in (where the trade-in value would be the sale proceeds)

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Converting a business + personal asset (car) to personal use- How to report it and recapture the depreciation?

@KrisD15 That makes sense. Just to confirm, I don't have to report about this in the 2023 tax year.

Most likely, I don't have to report even when I have to sell it because the car value is only $2000.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Converting a business + personal asset (car) to personal use- How to report it and recapture the depreciation?

If the car is not sold yet do not report anything on your 2023 tax return. The taxable event occurs when the car is actually sold.

When it is sold, you will have a taxable event and taxable gain or loss depending on the business use percentage of cost, purchase expenses, sales price, sales expenses and depreciation used on the car. As pointed out by our Tax Expert @KrisD15 the standard mileage rate (SMR) has a depreciation component that is used to calculate the total depreciation on the car for business miles each year.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Converting a business + personal asset (car) to personal use- How to report it and recapture the depreciation?

I am struggling with the same issues.

I do not know how to calculate the basis of the vehicle (converted to personal use and then sold it in 2023). I followed previous posts NOT to report it as a sale but a conversion to personal use in Business Income & expenses. Further, my % business use varied year to year and was told TurboTax can't calculate that. Then posts directed me to go to Other Business Situations- Sale of Business Property -Other Property Sales, Recapture. I followed instructions to calculate the business use % over the years the car was used for business (business miles divided by total miles = .099). The sale price (trade in) was 17,500. So 17,500 x .099 = $1,732 'business portion of the sale price. The original purchase price BEFORE it was used for a business vehicle was $58,000 in 2016. My FMV estimate at the time I started using it for business is $50,000. What is my basis?

I have all the depreciation for each year and the total is $1,780. I used standard miles every year.

When I switch to Forms and look at the worksheet for this vehicle and also Form 4797, it gets very confusing,

I am using desktop Premier for Mac

Please HELP and thank you!

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

obeteta

New Member

taxquestion222

Returning Member

roypimjasmine2485

New Member

cparke3

Level 4

johnjames9

Level 2