- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Converting a business + personal asset (car) to personal use- How to report it and recapture the depreciation?

The car used for business activity was purchased as a personal car back in 2011. Then in 2019 I started using it for my rental activity along with personal use. I have been taking a standard mileage deduction all these years. In 1/1/2023, I converted this vehicle to personal use. Business use miles is 1719 and personal use is 34281 miles. Only 4.7% of miles is business use.

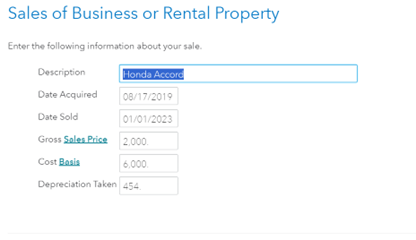

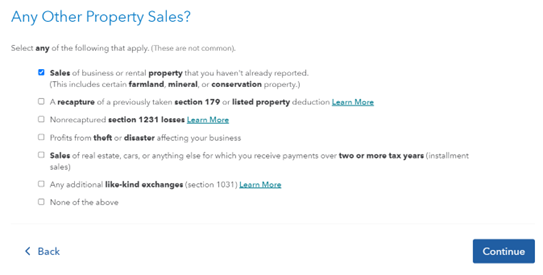

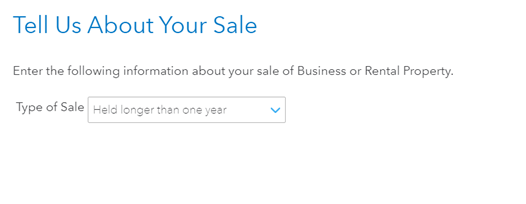

I am not sure If I am making the correct selection in Turbo Tax to recapture the depreciation. I followed the guidance as posted in the other questions. Wages & Income >Other Business Situations > Sale of Business Property >Start or Revisit > Enter your sale

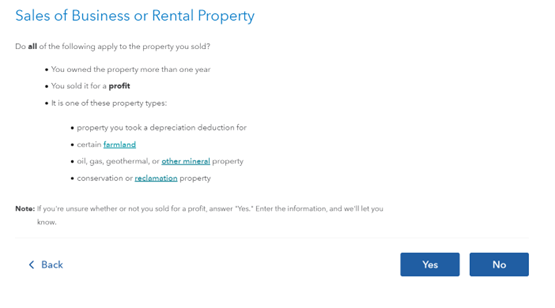

No for the below screenshot

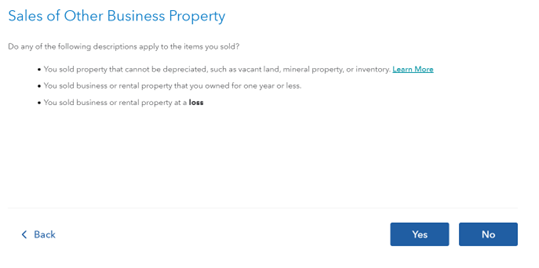

Yes for the below screenshot

When this vehicle was to added to the business along with the personal use, the cost basis was around $6000.00. Because I had 4.7% of total miles driven is for business use, I am not sure if should be entering $6000 cost basis.