- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Any Section 179, Passive or At-Risk Loss Carryovers?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Any Section 179, Passive or At-Risk Loss Carryovers?

Hello,

I answered yes to the question "do you have any section 179 expense deduction, passive losses, or at-risk losses that were not allowed last year? But the next it asks to enter the section 179 carry over. What is the correct amount?

1) i answered yes

2) Enter 177 carryover

3) Form 3885A has two sections Depreciation and Amortization - and each have a total under them? DO I add both and enter that here or how does this work?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Any Section 179, Passive or At-Risk Loss Carryovers?

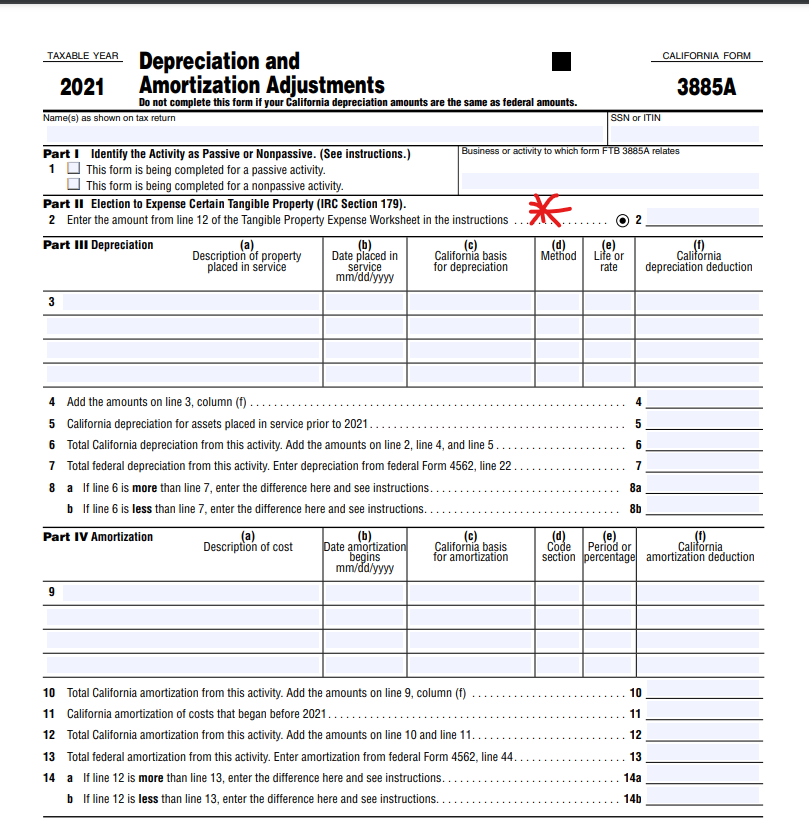

Part II of CA Form 3885A is Election to Expense Certain Tangible Property (IRC Section 179). If you have an amount on this line you will enter it on this screen in your screenshot.

Part III is Depreciation and Part IV is Amortization.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Any Section 179, Passive or At-Risk Loss Carryovers?

Hello AliciaP1

Thank you!! Which line are you referring to in the screen attached as I am not clear on your response! Please advice:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Any Section 179, Passive or At-Risk Loss Carryovers?

It looks like you got your information in a different format than I expected. When I look up the form it looks like this and I have starred the line where the information would be for a Section 179 carryover.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Any Section 179, Passive or At-Risk Loss Carryovers?

Hello @AliciaP1

Thanks for the response. I would need to find that form correct? Where do I find it?

Or what exactly is 179, Passive or At-Risk Loss Carryovers?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Any Section 179, Passive or At-Risk Loss Carryovers?

No, it's the same form information just in a different format it looks like. Since there is not a line for Section 179 on your 3885A you should answer the first question from your original post as "No".

Section 179 is a deduction of the full cost of qualified property used in a trade or business. You can have a Section 179 deduction carryover (because it has limits), Passive Activity Loss Carryovers, and/or At-Risk Loss Carryovers. They are all dependent on different scenarios about your business income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Any Section 179, Passive or At-Risk Loss Carryovers?

Hello @AliciaP1

Thank you for the response. I actually answered yes because I did have a profit loss from my rental last year!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

alex1907

Level 2

vol2Smile

Level 1

superbean2008

Level 2

wcn

Level 1

sgk00a

Level 1