- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- 1031 exchange on multiple properties

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1031 exchange on multiple properties

I sold 2 properties having the proceeds go to a 1031 company. I then bought one property with the proceeds from the 1031 exchanges and took on a mortgage for the remaining balance. How do I report this on my taxes? All of this is under a LLC so I am using TurboTax business software.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1031 exchange on multiple properties

@mamamian wrote:

All of this is under a LLC so I am using TurboTax business software.

TurboTax Business does absolutely no hand-holding nor provide specific guidance for this scenario.

You will have to start Form 8824 in Forms Mode and proceed from that point and you might want to seek guidance from a local tax professional for this scenario.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1031 exchange on multiple properties

if the LLC was a partnership (a single member LLC does not file a separate return and thus has no need of Turbotax Business unless the SMLLC elected S-Corp status.). did the partnership do the 1031 or only you? if only you. then certain 1031 rules probably have been violated. when there's a partnership and only one partner wishes to do a 1031, the partnership must distribute the property to the partners. then one partner can sell their interest while the other can do a 1031

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1031 exchange on multiple properties

The LLC is incorporated and files a 1065 so TurboTax business is needed. The LLC sold the properties as they were until its name as well as purchased the new property. The new purchase is a plot of land (one address) and a rental property (another address). They are next to each other but sold as a bundle.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1031 exchange on multiple properties

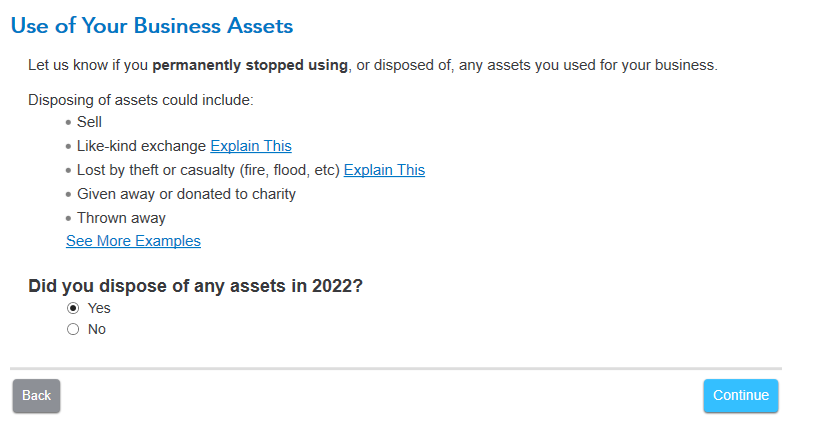

In the TurboTax Business program, you will enter the properties that you originally owned and disposed of during 2022. The program will ask you to enter the addresses and will ask about disposal/sold. Select the option when asked that you sold/ disposed of each rental. As you progress through the program, it will ask more questions and then come back to get full details on the rental property. You will select the like-kind exchange and create the 8824 needed. Switch to Forms mode so you can see the form 8824 and complete the information.

Reference:

About Form 8824, Like-Kind Exchanges - IRS

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Jeff-W

Level 1

lyle_tucker

New Member

Jeff-W

Level 1

atn888

Level 2

Gigi B

New Member