in Investing

- Community

- Topics

- Community

- :

- Discussions

- :

- Investing

- :

- Investing

- :

- Re: Do I need to report/amend if I sold my robinhood-stock 5 dollars?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to report/amend if I sold my robinhood-stock 5 dollars?

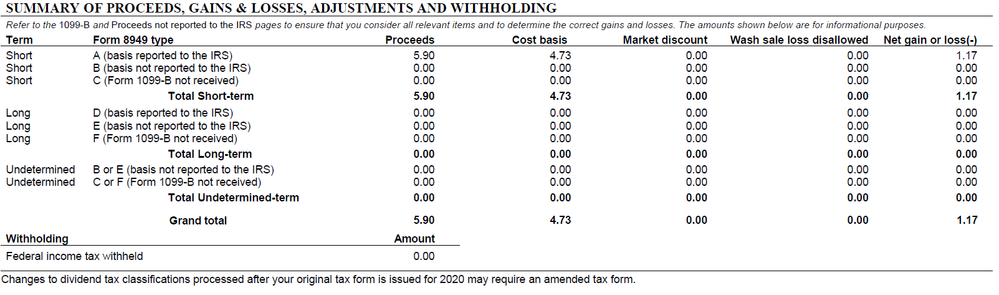

Robinhood sent me this information for last year.

1099-Div = $0.00

1099-Misc = $0.00

1099-B = $0.00

And the form 8949? says as shown.

I already filed my 2020 tax, do I need to submit amending forms 1040x?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to report/amend if I sold my robinhood-stock 5 dollars?

In theory, you must report all income however small.

But in this case, you have a 1099-B form with sales proceeds of $6 and a gain of $1. With these de minimis numbers, I would not bother filing an amended return as this will not change your taxes. And the IRS would not send you a letter for such small amounts.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to report/amend if I sold my robinhood-stock 5 dollars?

In theory, you must report all income however small.

But in this case, you have a 1099-B form with sales proceeds of $6 and a gain of $1. With these de minimis numbers, I would not bother filing an amended return as this will not change your taxes. And the IRS would not send you a letter for such small amounts.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to report/amend if I sold my robinhood-stock 5 dollars?

follow up question. If I do 1040x, is it cumbersome? I mean if it is not too hard, I can also just do it.

But if it is a lot of steps and fees, then I will just let it be.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to report/amend if I sold my robinhood-stock 5 dollars?

It is a very easy process with TurboTax and Free. However, the amount you are talking about is deminimus by the IRS standards. You can not amend just for that, however if you would like to amend, here are the instructions.

If your e-filed return was rejected (you got a specific reject code), go here instead.

Looking for a prior year return? Go here.

You can amend e-filed returns if they've been accepted; paper-filed returns may be amended once they've been mailed.

If your e-file is still pending, you won't be able to make changes until the IRS either accepts or rejects it. Don't know your e-file status? Here's how to look it up.

Select your tax year for amending instructions:

For more information: How to amend My 2020 Tax Return

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Duon

Level 2

VAer

Level 4

in Investing

jepoulsen

Level 1

in Investing

Frobwer

Level 1

in Investing

jafarz

New Member

in Investing