- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Reduced Return due to Pension?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reduced Return due to Pension?

I retired in May from my school district. I did get paid for my district in June and July along with my pension starting. So I think that increased my income on my return but felt I had more deductions including paying for my health insurance.

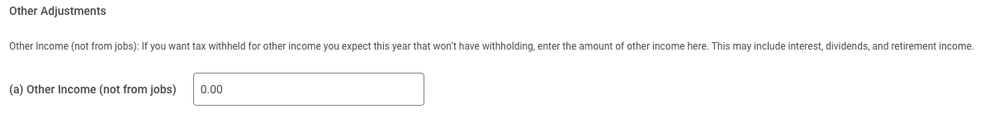

I started subbing and noticed on the election form for W-4, it asked if I had other income not from jobs. I did not put the pension in there because I did not know if that was monthly or yearly. It's less than $10K...would that have an impact? What should I put in there? I don't want to end up owing money this next year.

Are there other things to consider since I retired related to taxes with my pension.

Thanks!

Debbie

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reduced Return due to Pension?

I'm in Colorado.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reduced Return due to Pension?

For your federal return, you will still be taxed on your pension income. If the W-4 form is being completed for your federal withholdings, you will need to include the full amount you expect to receive from your pension.

For your Colorado return, it depends.

Colorado does allow a pension subtraction from your income if you are at least 55 years old at the end of the year or if you are receiving the pension as a beneficiary. The exclusion also depends upon your age. But the lowest amount that could be excluded from income is $20,000 if you are under 65 years of age.

Based upon you statement indicating that you expect to receive less than $10,000 for the year, as long as you meet one of the two requirements listed above, you would not need to report this income on your Colorado return.

Please see this link for more information as it relates specifically to Colorado.

As far as other items to consider, you should also keep an eye on any Social Security benefits you might be receiving. If your income exceeds a certain amount, your Social Security benefits could be subject to taxation as well. Please see this link for more details as it will vary based upon your filing status and overall income earned during the year.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

heartgems68

Level 2

Ranchlady

New Member

khwilliamson

Returning Member

RAF944

Returning Member

cdchrisibm

Level 1