- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reduced Return due to Pension?

I retired in May from my school district. I did get paid for my district in June and July along with my pension starting. So I think that increased my income on my return but felt I had more deductions including paying for my health insurance.

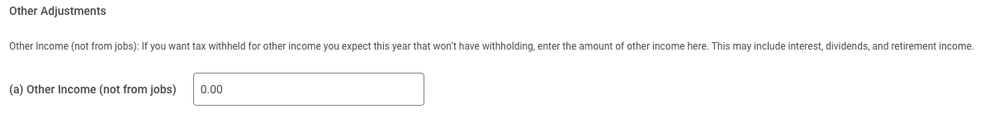

I started subbing and noticed on the election form for W-4, it asked if I had other income not from jobs. I did not put the pension in there because I did not know if that was monthly or yearly. It's less than $10K...would that have an impact? What should I put in there? I don't want to end up owing money this next year.

Are there other things to consider since I retired related to taxes with my pension.

Thanks!

Debbie

April 24, 2024

9:13 AM