- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- [Event] Ask the Experts: Amending Your Taxes

- :

- Ammending based on claiming Hurricane Damage from Hurricane Ian after seeing TV Commercial with FL Rep Stuebe saying there is new legislation

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Ammending based on claiming Hurricane Damage from Hurricane Ian after seeing TV Commercial with FL Rep Stuebe saying there is new legislation

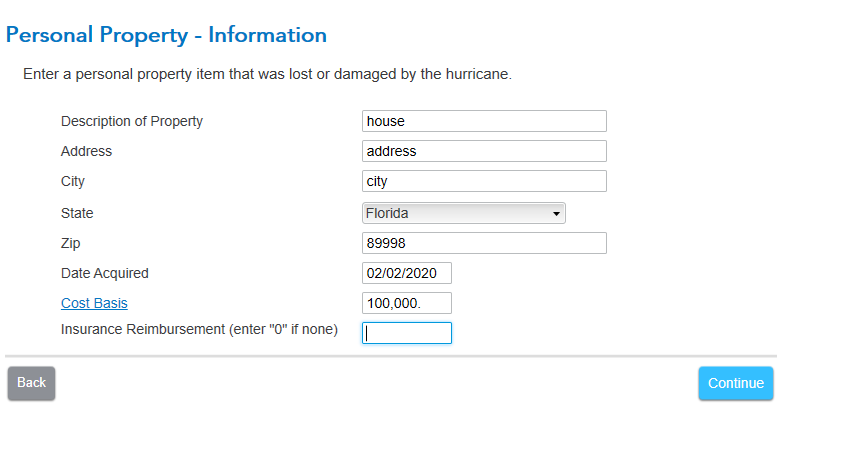

I have the insurance company's documentation after examining our hurricane damage but stating it was less than the hurricane deductible. I had not claimed any of those expenses. I hired handymen and contractors who could work on the damage piece meal because it was impossible to get major vendors to do the work because the individual damages were so small & they were all working on larger projects where the hurricane did greater damage. Much of the work was cash and I do not have any receipts. Can I file an amendment based on the Insurance Company's documentation?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Ammending based on claiming Hurricane Damage from Hurricane Ian after seeing TV Commercial with FL Rep Stuebe saying there is new legislation

Yes and no. When you say small losses, how small? The casualty and loss claim isn't a $1 for $1 deduction all the time. It is about the loss. So if your house was damaged and the FMV of your house was $150,000 before the storm and $100,000 after the storm, before repairs, your deduction would be $50,000. If you paid someone $100,000 to do the repairs, you would still only be able to claim the $50,000. The deduction is to put you back to whole.

So if your deck was destroyed and needed replaced, you would need to come up with the FMV before and after the deck was damaged. Realtors can help with this information by doing competitive market analysis.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

dean0jones

Level 1

jeepnrandy

New Member