- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Education

- :

- So if I pay interest on my child's student loan I can't take it on my taxes?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

So if I pay interest on my child's student loan I can't take it on my taxes?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

So if I pay interest on my child's student loan I can't take it on my taxes?

Yes, unfortunately, if the child is not a dependent on your tax return, then you cannot claim the student loan interest that you paid.

If the child is a dependent on your tax return, you must also be legally obligated to pay the loan in order to deduct it. So, if the loan is in your child's name, then you can't deduct the interest even if the child is your dependent.

The only way you can report student loan interest as a parent is if you are claiming the child as a dependent and you are legally responsible for the loan, meaning that you are the signer or co-signer.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

So if I pay interest on my child's student loan I can't take it on my taxes?

Yes, unfortunately, if the child is not a dependent on your tax return, then you cannot claim the student loan interest that you paid.

If the child is a dependent on your tax return, you must also be legally obligated to pay the loan in order to deduct it. So, if the loan is in your child's name, then you can't deduct the interest even if the child is your dependent.

The only way you can report student loan interest as a parent is if you are claiming the child as a dependent and you are legally responsible for the loan, meaning that you are the signer or co-signer.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

So if I pay interest on my child's student loan I can't take it on my taxes?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

So if I pay interest on my child's student loan I can't take it on my taxes?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

So if I pay interest on my child's student loan I can't take it on my taxes?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

So if I pay interest on my child's student loan I can't take it on my taxes?

Continuing on this topic. I have two daughters, both are dependents on my tax return. They go to a private high school and I needed to take a loan out for the tuition. The loan is in my name. Would this qualify as a deduction for the interest expense for me?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

So if I pay interest on my child's student loan I can't take it on my taxes?

@jmbrooks100 wrote:

Continuing on this topic. I have two daughters, both are dependents on my tax return. They go to a private high school and I needed to take a loan out for the tuition. The loan is in my name. Would this qualify as a deduction for the interest expense for me?

No. That applies only to higher (college level) education.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

So if I pay interest on my child's student loan I can't take it on my taxes?

I was wondering if interest on a student loan is deductible on my children, still paying those student loans even after they grow up and become independent and I can no longer claim them as a dependent. Goggle led me to this topic...

The answer is yes, deducting the interest is appropriate as long as the student was a dependent when the loan was taken out. The answer at the top is incorrect, current dependent status is immaterial.

Per IRS Topic Number 456:

You can claim the deduction if all of the following apply:

- You paid interest on a qualified student loan in tax year 2019;

- You're legally obligated to pay interest on a qualified student loan;

- Your filing status isn't married filing separately;

- Your MAGI is less than a specified amount which is set annually; and

- You or your spouse, if filing jointly, can't be claimed as dependents on someone else's return.

A qualified student loan is a loan you took out solely to pay qualified higher education expenses that were:

- For you, your spouse, or a person who was your dependent when you took out the loan;

- For education provided during an academic period for an eligible student; and

- Paid or incurred within a reasonable period of time before or after you took out the loan

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

So if I pay interest on my child's student loan I can't take it on my taxes?

deducting the interest is appropriate as long as the student was a dependent when the loan was taken out.

Since my child is no longer a dependent, how/where on my tax form do I claim this interest?

On the return it gives me a drop down box of my dependents but that one is no-longer listed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

So if I pay interest on my child's student loan I can't take it on my taxes?

Deducting the interest is appropriate as long as the student was a dependent when the loan was taken out and you are legally obligated to pay it (loan was in your name or you were a co-signer).

You must be in the wrong place (1099-Q instead of 1098-E???). There is no drop down box of dependents at student loan interest.

In TurboTax (TT), enter at:

Federal Taxes Tab (Personal for H&B version)

Deductions & Credits

-Scroll down to:

--Education

-Student Loan Interest paid (form 1098-E)

You're only asked for the loan company name and amount of interest paid

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

So if I pay interest on my child's student loan I can't take it on my taxes?

Thank you.

I had figured it out. Unfortunately, we just don't qualify for it

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

So if I pay interest on my child's student loan I can't take it on my taxes?

It says I "can" add if I cosigned the loan. But the first question "Whose name is on this 1098-E?". My son's name is the name because I cosigned. Do I say "yes" since I cosigned?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

So if I pay interest on my child's student loan I can't take it on my taxes?

You need to answer the questions in TurboTax truthfully in order to adhere to their accuracy guarantee and to insure that your tax return is completed accuratly. When asked for the name on the 1098-T, you should enter the name as it is stated there.

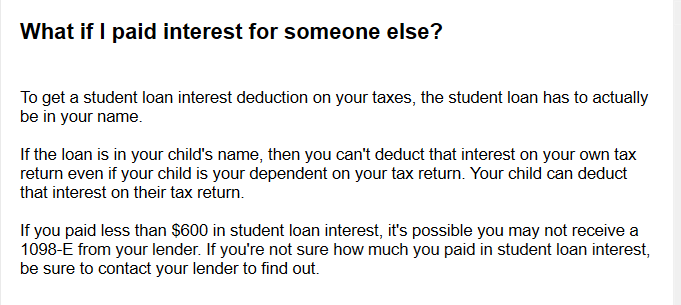

If you look on the screen in TurboTax where you enter the interest, you will see questions highlighted in blue that say What if I paid Interest for someone else? When you click on that box, you will see this explanation that indicates that TurboTax will not guarantee the allowability of the deduction unless the loan is in your name: @AR1806

@AR1806 {edited 2/12/23 at 7:28 AM PST)

@AR1806 {edited 2/12/23 at 7:28 AM PST)

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

So if I pay interest on my child's student loan I can't take it on my taxes?

I don't get that question ("Whose name is on this 1098-E?") in my desktop Deluxe. It only asks who the lender (loan company) is.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

tianwaifeixian

Level 4

AndrewA87

Level 4

she21

New Member

edjoloya

New Member

mlvalencia78

New Member

in Education