in Education

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Education

- :

- Re: Scholarship and 1098-T

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Scholarship and 1098-T

Box 5-19,200

- Box 1-16,400

= $2800 Potential taxable scholarships

- 1200 additional qualified expenses

= 1600 Taxable scholarship income before claiming credit

+ 4000 Expenses used to claim AOTC (on your return)

$5600 Net taxable income to be reported on the student's return

Since you know your numbers, you can use a work around in TurboTax (TT), to simplify entry. Here's how I would do it. Enter the 1098-T, on your return, but only enter $4000 in box 1. No other numbers. You only enter the 1098-T to get TurboTax to check the proper box on form 8863. Lying to TurboTax to get it to do what you want does not constitute lying to the IRS.

On the student's return, enter $5600 in box 5 and 0 in box 1.

You say, disregard the trip since it is not qualified expenses. Yes, you disregard it if that grant was included in box 5 of the 1098-T. If it was , in addition to the box 5 amount, it needs to be added to the $5600.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Scholarship and 1098-T

My daughter received 1098T show box 1 $53000 tuition and box 5 scholarship show $20500 and when I fill out the tuition statement and we not qualify for credit instead my daughter has to file income for $20500 she received from scholarship. I don't know did I do something wrong, I look back last year we got 2500 credit for eduction. Please help.

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Scholarship and 1098-T

@Chung11358 - You've done something wrong. Based on the info provided, you are eligible for another $2500 credit and your daughter has no taxable scholarship income.

You may have to delete your student and start over, but try this first:

Go through the entire education interview until you reach a scree titled "Your Education Expenses Summary". Click edit next to the student's name. That should take you to a screen “Here’s your Education Summary”. Click edit next to the section you want to change; tuition (most likely), in your case.

Details:

To enter your Form 1098-T information (even when TurboTax thinks it has already been entered and is showing $0), go through the entire education expenses section of your return until you reach the screen titled “Your Education Expenses Summary”, then follow these steps:

- Click Edit next to the student name.

- On the screen titled “Here’s your Education Summary”, click Edit beside Tuition.

- Enter the information from your Form 1098-T.

To go directly to the Education section of your return, use these steps:

- On the top row of the TurboTax online screen, click on Search (or for CD/downloaded TurboTax locate the search box in the upper right corner)

- This opens a box where you can type in “education” (be sure to enter exactly as shown here) and click the magnifying glass (or for CD/downloaded TurboTax, click Find)

- The search results will give you an option to “Jump to education”

- Click on the blue “Jump to education” link

Also see: https://ttlc.intuit.com/community/entering-importing/help/how-do-i-enter-form-1098-t/00/26336

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Scholarship and 1098-T

Hi , Thank you for your help. I deleted 1098 -T and reenter the form 1098-t again but still show like this and the

summary 2019 deductions & credits show education expenses allowed 53000. I think it should be example 53000 tuition - 24000 scholarship = 29000 should show on the page 2019 total right.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Scholarship and 1098-T

Why the Turbo tax not caculated the Education expenses (Box #1) minus to the Scholarships or Grants (Box #5)

and that the total Education expenses allowed.

Did I do some thing wrong. Thank you for your help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Scholarship and 1098-T

Hi,

On Turbo tax show " That because scholarships and other education assistance are considered taxable income if they exceed education expenses, if the money was used to pay for nonqualified expense or was not enrolled in a degree, certificated or credential program at an eligible school. she will need to file a tax return to include this 20500 amout taxable income."

I don't understand form 1098T should cauculated the tuition 53000 (Box #1) to minus the Scholarships or grants 20500 (Box #5) but in this case is something not right.

I did reenter the form 1098-T but it not work. Please help/ Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Scholarship and 1098-T

Hi, where can I see the step-by step form 8863 Eduction credits on Turbo Tax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Scholarship and 1098-T

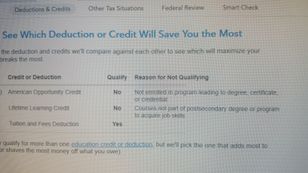

The screen shots indicate that you're nit getting a credit because you have indicated your student is not a degree candidate.

Go through the entire education interview until you reach a scree titled "Your Education Expenses Summary". Click edit next to the student's name. That should take you to a screen “Here’s your Education Summary”. Click edit next to the section you want to change; education information, in this case.

Details:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Scholarship and 1098-T

Thanks Hal Al for your help,

I reenter the 1098-T but it tell the box 5 scholarship 20500 had to report to child income and I don't know it the software is not cauculating on 1098-T I said early the Box #1 was 53000 and Box#5, 20500 and the education Expenses summary 2019 show the total 53000, because it show the note it my daughter have to report the Scholarships is 20500 for the income tax return. and she is student a degree candidate.

I will try to go thought the screen again and see what is wrong.

Thanks again

- « Previous

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Majk_Mom

Level 2

Stevie1derr

New Member

in Education

anonymouse1

Level 5

in Education

postman8905

New Member

janayia0

New Member

in Education