- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Education

- :

- Re: I have entered the amount from 1099Q and high school and grade school tuition (exceed the distribution), but it is still showing a taxable amount - why?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have entered the amount from 1099Q and high school and grade school tuition (exceed the distribution), but it is still showing a taxable amount - why?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have entered the amount from 1099Q and high school and grade school tuition (exceed the distribution), but it is still showing a taxable amount - why?

You can just not report the 1099-Q, at all, if your student-beneficiary has sufficient educational expenses, including K-12 tuition, to cover the distribution. When the box 1 amount on form 1099-Q is fully covered by expenses, TurboTax will enter nothing about the 1099-Q on the actual tax forms. But, it will prepare a 1099-Q worksheet for your records.

On form 1099-Q, instructions to the recipient reads: "Nontaxable distributions from CESAs and QTPs are not required to be reported on your income tax return. You must determine the taxability of any distribution."

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have entered the amount from 1099Q and high school and grade school tuition (exceed the distribution), but it is still showing a taxable amount - why?

My understanding is that the distribution when used for high school tuition is non-taxable for federal taxes , but not in my state (CA). When I enter the 1099Q info in TurboTax it raised my federal taxes. How do I get it included in the state calculation but not the federal one?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have entered the amount from 1099Q and high school and grade school tuition (exceed the distribution), but it is still showing a taxable amount - why?

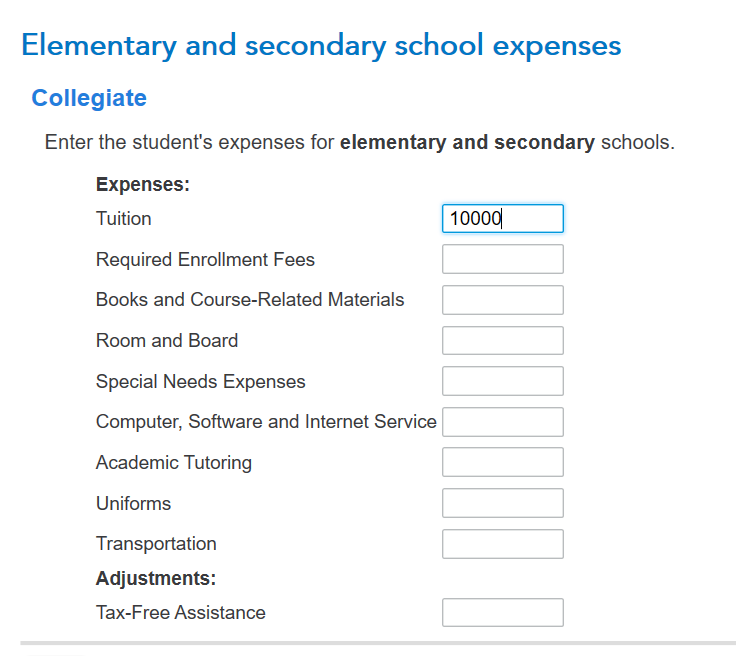

The program should exempt the federal portion allowed and move to the state. Federally, p to $10,000 is not taxed. Any amount over that is taxable. You must enter what it was used for and enter the expenses. If all of it was used on qualified expenses, it does not have to be entered at the federal level.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have entered the amount from 1099Q and high school and grade school tuition (exceed the distribution), but it is still showing a taxable amount - why?

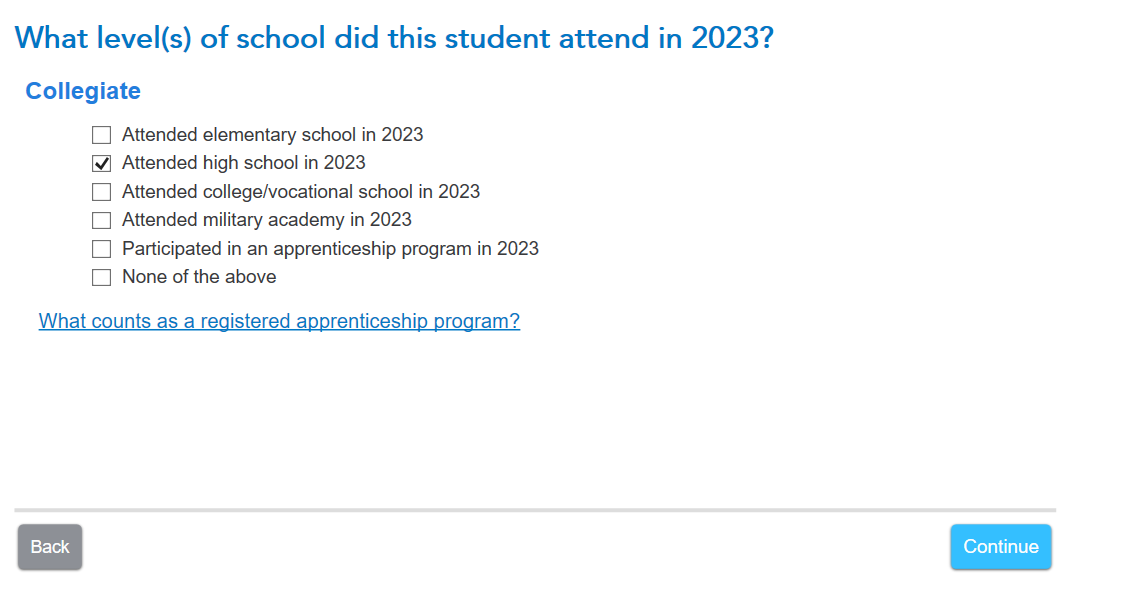

Yes - thanks. I just hadn't gotten further through the Q&A where it prompted me to enter the educational expenses. Works as expected.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17539892623

Returning Member

user17549435158

New Member

tianwaifeixian

Level 4

anonymouse1

Level 5

in Education

Th3turb0man

Level 1