- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Education

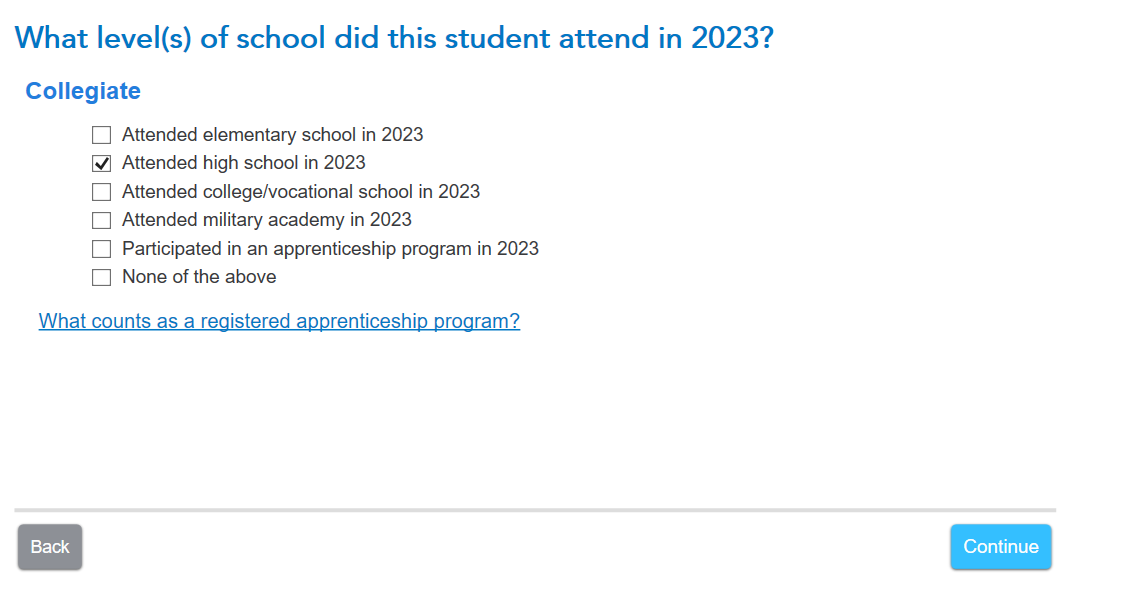

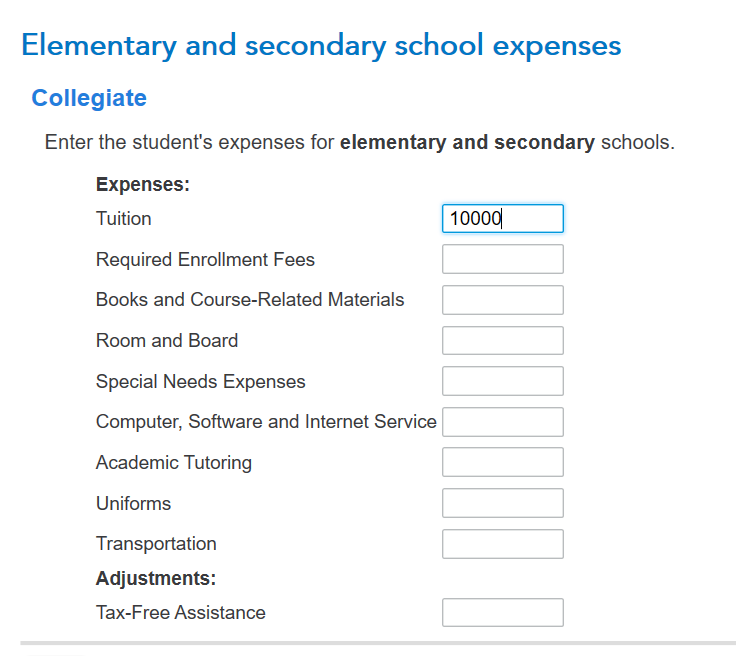

The program should exempt the federal portion allowed and move to the state. Federally, p to $10,000 is not taxed. Any amount over that is taxable. You must enter what it was used for and enter the expenses. If all of it was used on qualified expenses, it does not have to be entered at the federal level.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 14, 2024

11:51 AM