- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Education

- :

- Re: 1098T not recognizing dependent as student, showing parent as student

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098T not recognizing dependent as student, showing parent as student

I am trying to enter my son's (my dependent) 1098t but TurboTax keeps showing me, the parent, as the student. It will not recognize my son/dependent as the student. I tried to "add" a student and enter a 2nd one, still doesn't work, I tried to edit the 1098t, that doesn't work either. Deleted everything and tried a fresh start, nothing. HELP!!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098T not recognizing dependent as student, showing parent as student

Here's how to edit the 1098-T in TurboTax:

From Deductions & Credits

Expenses and Scholarships (form 1098-T) hit Update

From the page that says Now Let's Gather The Additional Education Expenses

Hit Continue. You will need to continue through several screens until you get to the screen that says Your Education Expenses Summary click Edit

At Here's Your Education Summary you can Edit, Delete or Add New School.

If you are listed here as the Student select delete.

On the next screen it will ask about deleting you as a student. Select yes and then select Add New Student.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098T not recognizing dependent as student, showing parent as student

This did not work. I deleted the 1098T but when I try to add new student it still shows me (the parent) automatically, it doesn't give me an option to choose my son, the dependent as the student. Plus there is no where to enter the name on the 1098T. It just defaults to me but 1098T is in his name.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098T not recognizing dependent as student, showing parent as student

Is your son showing up as a dependent? Please make sure:

- On the Do You Have Children or support someone? screen, answer Yes.

- On the Who Do You Support? screen, answer one of the first two options.

- On the Tell Us About Your Child screen, verify the birth date and citizenship status.

- On the How many months did XXX live with you in 2019 screen, select the whole year or the right number of months lived with you.

- At the How many of those months were in the U.S.? box, select the whole year or the right number of months lived with you.

- On the We know XXX is a baby/child, but we have to ask: Did she pay for most of her living expenses? answer No if she did not.

- Continue with the onscreen questions.

- Go to the end of the dependent entry section of TurboTax.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098T not recognizing dependent as student, showing parent as student

Once you have entered or re-entered your child as a dependent, then the program should prompt you to select him as a recipient of the Form 1098-T

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098T not recognizing dependent as student, showing parent as student

Yes he is. I rechecked all these questions and they were already correct.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098T not recognizing dependent as student, showing parent as student

Should I try to delete and re add him as a dependent? He's been on my return for years (using TurboTax) and it just auto fills everything. I just check it each year to make sure everything pre filled is correct.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098T not recognizing dependent as student, showing parent as student

I deleted him and re added him as my dependent. Tried again to add the 1098T & it shows:

Type in the info from Tracy's 1098-T, NO option to choose my son.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098T not recognizing dependent as student, showing parent as student

After you entered Tracy's dependent information in MY INFO, make sure Turbo Tax indicates that he is an eligible dependent. Go through the dependent information, including Social Security number information and then at the end of that interview, turbo tax will let you know he is an eligible dependent. If it is determined he is a eligible dependent, then he is an eligible dependent. Also when you begin entering the information for the 1098T, see if there is an option to +add a student.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098T not recognizing dependent as student, showing parent as student

Dave I have verified that he is an eligible dependent (TurboTax program told me he is). Also when trying to add the 1098T, there is a "add student" but once I click it, it asks: Did you get a 1098-T for the year 2019? and reply "yes" it asks to upload, I skip that section, it keep rejecting it, and then next screen says Type in the info from Tracy's 1098-T. I can't get it to recognize my dependent is the student! It is assuming I am the student. So frustrating!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098T not recognizing dependent as student, showing parent as student

I'm having exactly the same problem! I've gone through all the steps listed above and STILL cannot select my son as the student!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098T not recognizing dependent as student, showing parent as student

This may be redundent, but it is an attempt to tie everything together.

- First, delete the 1098-T screen, then delete your dependent.

To Delete a Form

Open your return in TurboTax.

- In the left side bar, select Tax Tools> Tools.

- In the pop-up window Tool Center, choose Delete a form.

- Select Delete next to the form/schedule/worksheet and follow the onscreen instructions

I have done this next step numerous times (after not finding the dependent listed) and it always works. Since I practice different scenarios, I clear and start over many times on this practice return. The dependent will be in the drop down box along with both taxpayers.

In the drop down box in the Education Credit section, I can see the dependent, along with both taxpayers.

You can't claim education expenses for a person who isn't your dependent. If you don't see one of your dependents listed here, we recommend you visit My Info and enter them as your dependent, then their name will show up here and we'll be able to work on their education expenses.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098T not recognizing dependent as student, showing parent as student

I'm having the exact same problem and none of the solutions have worked. Tracy, have you found a solution that worked for you?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098T not recognizing dependent as student, showing parent as student

Try this and see if this helps. It is something that has worked for other users so hoping it works for you as well!!!

I understand some steps may be repetitive but it should fix whatever is going on and let you proceed with your return.

- Go to the input section for the 1098-T.

- You will probably skip to the section titled books and supplies. Just continue as you probably will not be able to enter any information here. Just continue through the screen.

- Do Not enter any scholarship amounts when it asks if the scholarship is listed in Box 5 of the 1098-T. We want to avoid potentially doubling up any input already made. Hit continue instead.

- Continue through all the screens.

- You may get a message which says you can't maximize because there are no expenses. Just select continue until it takes you back to the Wages & Income screen.

- Now, Go back into the "Education Credit" section.

- Select "Edit" next to the student.

- It will ask you if you had an education credit and show you the summary.

- Select "Edit" to the right of Tuition.

- It will ask you if you received a 1098-T. Select Yes and continue.

- The next page should show you your input on the 1098-T.

- Continue through the screens

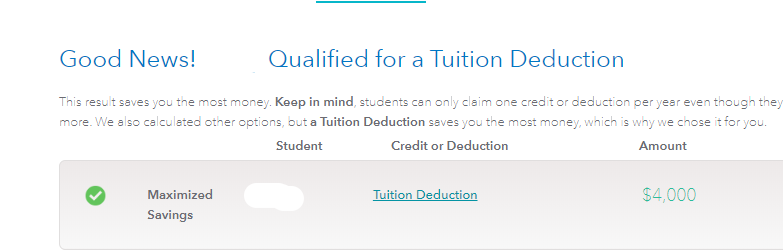

This should eventually take you to the screen showing which deduction you can take.

After you pass this screen, run a review. The issue should resolve itself allowing you to proceed with your return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098T not recognizing dependent as student, showing parent as student

None of the suggestions here are working for me. Please fix this bug in the website. I'll be using another tax service since I'm so frustrated.

My dependent IS confirmed my dependent, and yet I don't get any option to choose him as the student on the 1098 T form - the site keeps auto-selecting me.

Edit: After using a competitor site, I discovered that my income is too high to qualify for tuition deductions. The limit is $90,000 for single filers and $180,000 for joint filers. This might be the reason the 1098-T form isn't working for many people - TurboTax just isn't handling the error appropriately.

More info on how to qualify for tuition credit: https://www.irs.gov/credits-deductions/individuals/education-credits-questions-and-answers

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

noncheto2005

Returning Member

rmilling3165

Level 3

in Education

user17581249623

Level 1

Majk_Mom

Level 2

in Education

anonymouse1

Level 5

in Education