in Education

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Education

- :

- Re: 1098-T and 529 Distribution

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: 1098-T and 529 Distribution

To help pay for my daughter's college tuition, I requested and received a distribution from the 529 account I have set up for my daughter. I requested the distribution on 12/20/2019, and paid her tuition on 12/26/2019 via EFT through the college payment site. However, the college apparently did not receive the payment until 1/3/2020, which is when I see the payment taken out of my account.

So, the 1099-Q form from the 529 administrator shows the distribution for 2019, but the 1098-T form does not reflect the payment for 2019. Am I subject to the 529 distribution being taxed and having to pay the 10% penalty in this case?

Thanks!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: 1098-T and 529 Distribution

No, as long as you made the payment within the year 2019, you should not be subject to the penalty. To avoid the penalty, you can adjust the tuition paid amount on the Form 1098-T by following these steps:

In TurboTax online,

- Sign in to your account, select Pick up where you left off

- At the right upper corner, in the search box, type in "1098t" and Enter

- Select Jump to 1098t

- Follow prompts

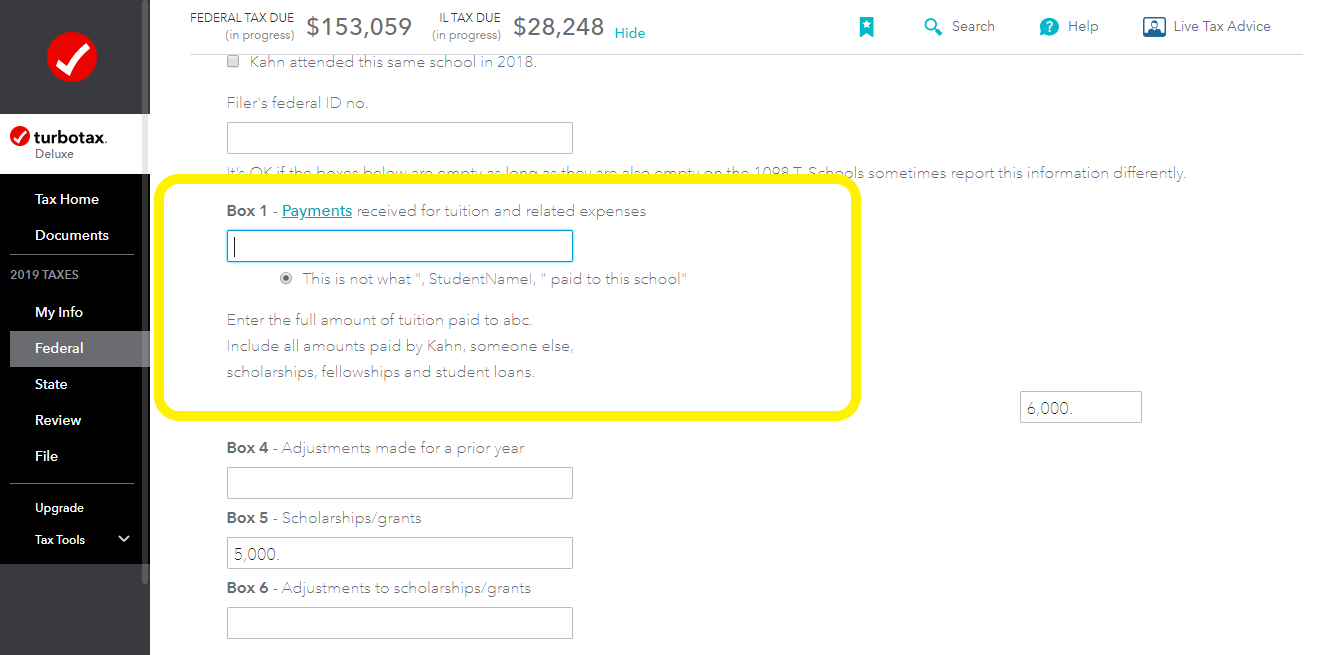

- On the screen, Type in the info from your 1098-T, check the box This is not what," Student' Name paid to school"

- Enter the actual amount you paid

- See the image below

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: 1098-T and 529 Distribution

Great - thank you for the information!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: 1098-T and 529 Distribution

I have a follow-up question regarding this that I want clarified. I was just looking at a similar issue with my son's 529 account. I requested a distribution from his 529 on 12/30/2019, and paid his college on 1/5/2020. Do I need to pay the tax and penalty on that distribution in this situation, even though it was just a week between the 529 distribution and the payment to the college?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: 1098-T and 529 Distribution

No, you shouldn't have to pay the penalty. The distribution was made and paid for qualified 529 expenses.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: 1098-T and 529 Distribution

"I requested a distribution from his 529 on 12/30/2019, and paid his college on 1/5/2020". When did the 529 plan send the money (when did it leave your account) ad when did you receive it?

You basically have the same situation, as with the other distribution. Claim what you need to claim and hope you can explain it to the IRS, if they contact you because the paper work doesn't match.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: 1098-T and 529 Distribution

I requested the withdrawal on 12/30/2019 and that is what shows as when it was sent, and I received it on 1/2/2020.

Thanks for the info.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: 1098-T and 529 Distribution

I have entered the 1098-T information into my child's return. I did not know to enter the additional tuition that is reported on the 1099-Q - distributed late December 219, but not received by the University until 2020. I cannot get back to enter the total tuition paid in Turbo tax - using the 1099T Jump. the original tuition amount is hard coded with my original entry. How do I fix this? Do I delete the original 1098 T form information and re-enter?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: 1098-T and 529 Distribution

This does not work, once you have previously entered the 1098T information. The original amount is hard coded.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: 1098-T and 529 Distribution

Go through the entire education interview until you reach a scree titled "Your Education Expenses Summary". Click edit next to the student's name. That should take you to a screen “Here’s your Education Summary”. Click edit next to the section you want to change; tuition, in your case.

Details:

To enter your Form 1098-T information (even when TurboTax thinks it has already been entered and is showing $0), go through the entire education expenses section of your return until you reach the screen titled “Your Education Expenses Summary”, then follow these steps:

- Click Edit next to the student name.

- On the screen titled “Here’s your Education Summary”, click Edit beside Tuition.

- Enter the information from your Form 1098-T.

To go directly to the Education section of your return, use these steps:

- On the top row of the TurboTax online screen, click on Search (or for CD/downloaded TurboTax locate the search box in the upper right corner)

- This opens a box where you can type in “education” (be sure to enter exactly as shown here) and click the magnifying glass (or for CD/downloaded TurboTax, click Find)

- The search results will give you an option to “Jump to education”

- Click on the blue “Jump to education” link

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

richardm-oloughlin

New Member

user17706582918

New Member

in Education

lane-p-brian

New Member

corksonya

New Member

in Education

luisputzeys

New Member

in Education