- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Education

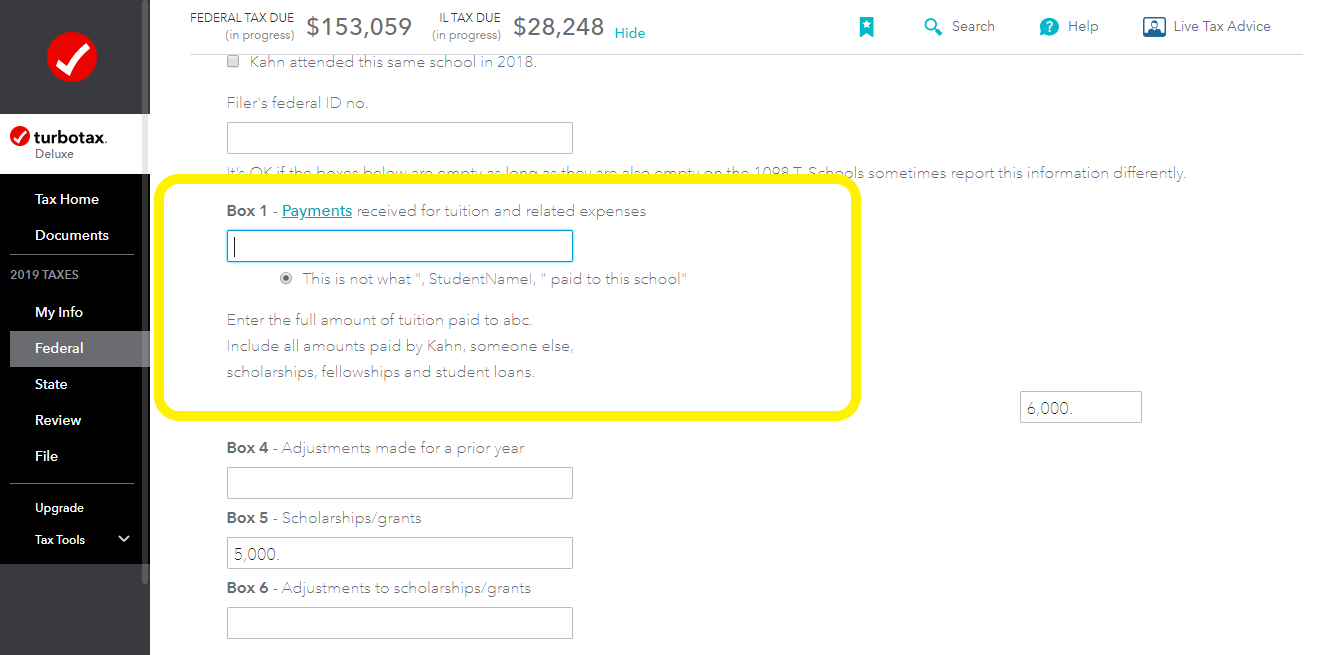

No, as long as you made the payment within the year 2019, you should not be subject to the penalty. To avoid the penalty, you can adjust the tuition paid amount on the Form 1098-T by following these steps:

In TurboTax online,

- Sign in to your account, select Pick up where you left off

- At the right upper corner, in the search box, type in "1098t" and Enter

- Select Jump to 1098t

- Follow prompts

- On the screen, Type in the info from your 1098-T, check the box This is not what," Student' Name paid to school"

- Enter the actual amount you paid

- See the image below

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 2, 2020

10:16 AM