- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Education

- :

- Lifetime Learning Credit / 1099-T Form

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Lifetime Learning Credit / 1099-T Form

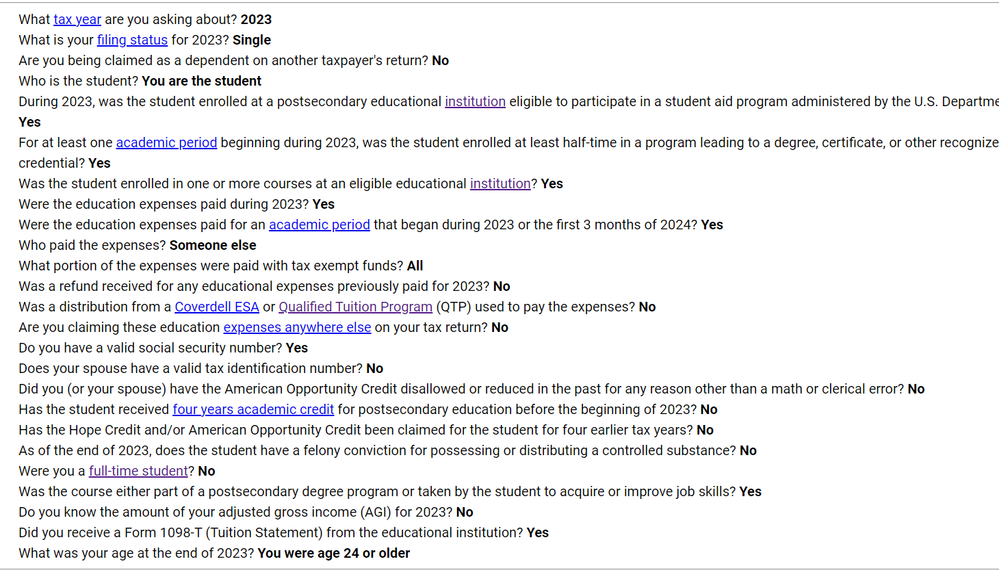

I have a question, I recently go into a graduate program where my company pays through the Educational Scholar Program (ESP). I still received the 1099-T form from my university in my name. I'm confused if I can/have to report my 1099-T form since my company pays for the classes (Unless I leave or get fired which then I have to pay it myself).

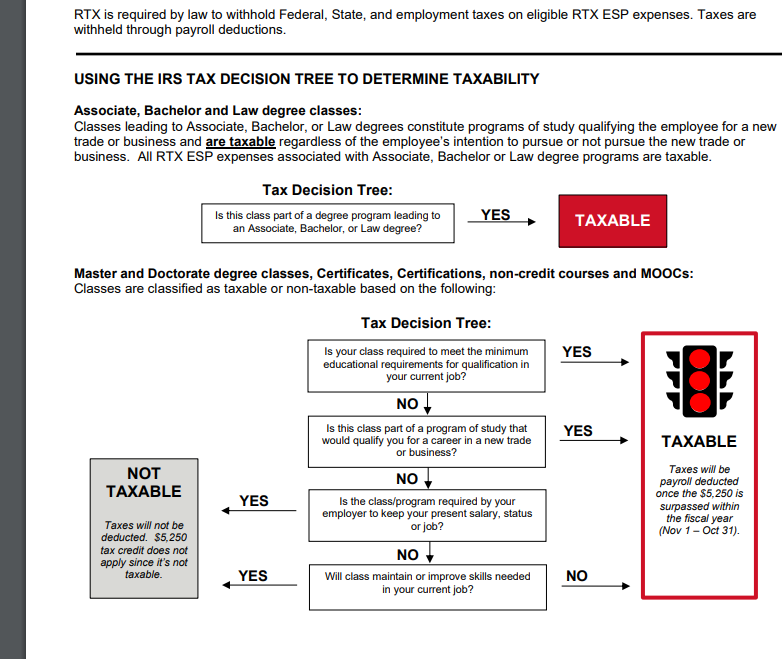

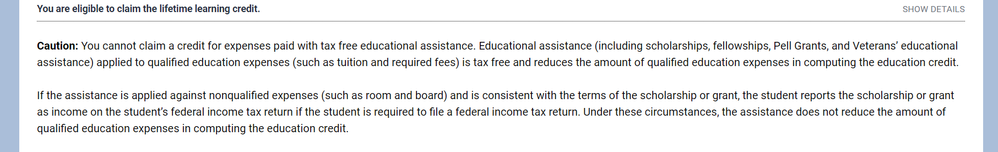

I did an IRS survey with theses results in the attached pictures. Also ESP deemed the class Non-Taxable

In that case can I report my 1099-T form and obtain the LLC benefit?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Lifetime Learning Credit / 1099-T Form

You only get a tax credit when you spend your money that has been taxed. Since you did not spend your money, there is no tax credit.

The IRS states:

Expenses Cannot Be Paid with Tax-Free Funds

You cannot claim a credit for education expenses paid with tax-free funds. You must reduce the amount of expenses paid with tax-free grants, scholarships and fellowships and other tax-free education help.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Lifetime Learning Credit / 1099-T Form

Q. Can I or do I have to report my 1098-T form?

A. No.

The 1098-T is only an informational document. The numbers on it are not required to be entered onto your tax return. However receipt of a 1098-T frequently means you are either eligible for a tuition credit or possibly you have taxable scholarship income. So, you only enter it if you know one of those is true.

If you claim the tuition credit, you do need to report that you got one or that you qualify for an exception (the TurboTax interview will handle this).

By law your employer can only give you $5250 maximum, tax free. If your tuition was less than that, and you employer reimbursed it all; it’s safe to assume it does not need to be reported. You do not even need to enter your 1098-T. You have nothing to claim.

If you got more than $5250, the amount above $5250 is usually already included in box 1 of your w-2 and you do not need to enter any additional income on your tax return. Since you have essentially paid tax on that part, it is considered your after tax money and that amount (above $5250) can be used to claim the tuition credit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Lifetime Learning Credit / 1099-T Form

In this case the class cost 8K but it was deemed Non-Taxable. So in that case I don't report it correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Lifetime Learning Credit / 1099-T Form

Q. In this case the class cost 8K but it was deemed Non-Taxable. So in that case I don't report it correct?

A. That's correct.

Q. But if the limit is $5250, how do they get to say it's not taxable?

A. If they determine, under IRS rules, that the education/training helps improve the employee's current job skills, they can declare it as a business expenses (as opposed to just being tuition reimbursement).

Reference: https://www.irs.gov/pub/irs-pdf/p5137.pdf

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Lifetime Learning Credit / 1099-T Form

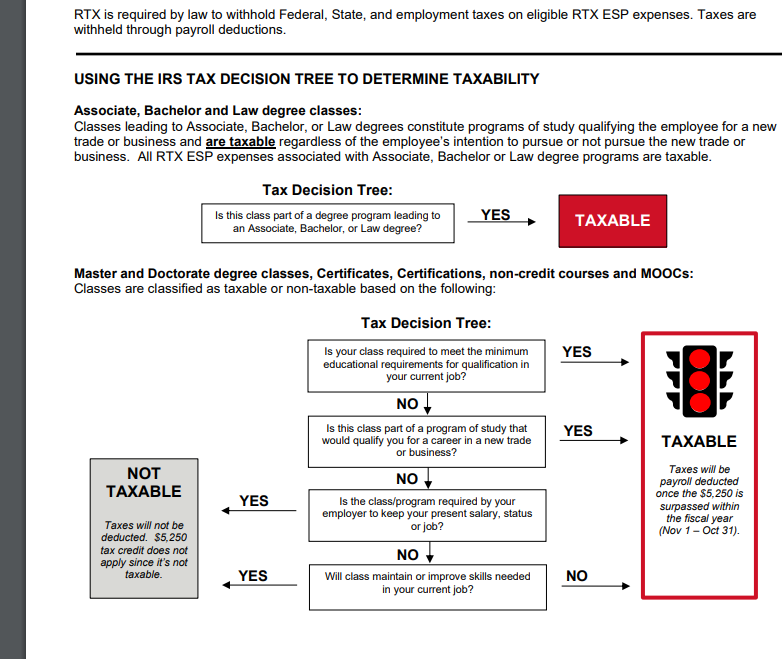

Under IRS guidelines is deemed Non-Taxable but its still help to improve skills for current job like shown here:

So do I just don't report anything or can I report something? Can it be reported somewhere else? Or do I just ignore this?

Sorry if I keep going in circles i'm quite confuse with this all process

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Lifetime Learning Credit / 1099-T Form

You just leave the 1098-T off of your return if it is not at all taxable. The 1098-T is one of those forms that can be ignored if it is not creating taxable income. So in your case, since it is not creating taxable income...because this is to improve your skills by your current employer so they are paying for it for you to be better for them...you do not need to do anything with this form other than keep it for your records.

You cannot report any of it and then take a tax credit since you did not pay for it, in case you are asking if you can report it somewhere else. This is not taxable and not eligible for credits.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Lifetime Learning Credit / 1099-T Form

Let's go back to the beginning. I just noticed that the decision tree document you posted appears to come from your employer. At the top it says:

"RTX is required by law to withhold Federal, state and unemployment taxes on eligible RTX ESP expenses. Taxes are withheld through payroll deductions".

Note, they further say "taxes will be payroll deducted once the $5250 is surpassed". If that is what happened, you paid tax on $2750 (8000 - 5250 = 2750), then the answer is different. You get to claim the $2750 to calculate the Lifetime Learning Credit (LLC) on your tax return . That's worth an (up to) $550 credit.

Do enter the 1098-T on your tax return. After entering the 1098-T, the TurboTax (TT) interview will eventually ask about employer assistance. That's where you enter $5250 (not $8000). Review the 1098-T, sometimes the school (erroneously) puts employer assistance in box 5. The short cut is to enter the 1098-T with $2750 in box 1 and box 5 blank.

I

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

mahad88

New Member

eriebabe2017

New Member

haohu-mesry-com

New Member

aeptax1010

New Member

heath.hines94@gm

New Member