- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Lifetime Learning Credit / 1099-T Form

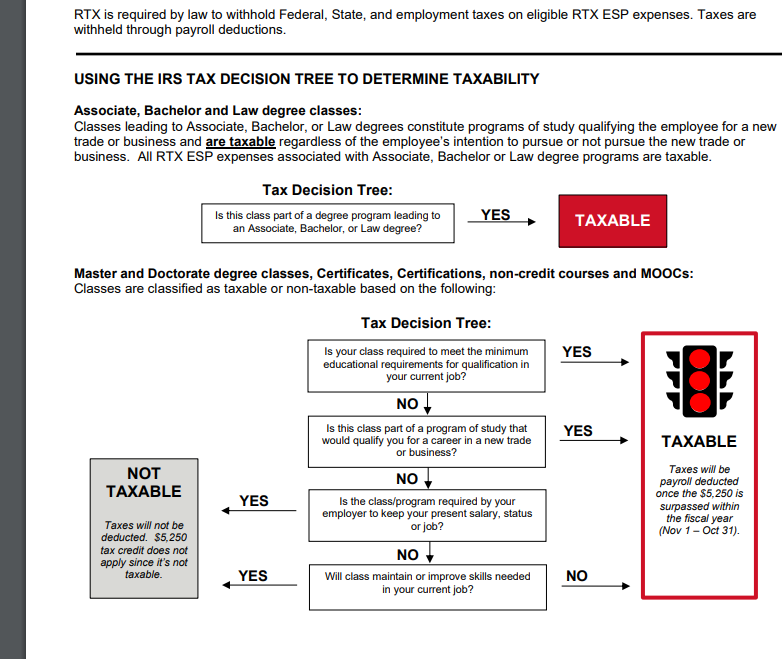

I have a question, I recently go into a graduate program where my company pays through the Educational Scholar Program (ESP). I still received the 1099-T form from my university in my name. I'm confused if I can/have to report my 1099-T form since my company pays for the classes (Unless I leave or get fired which then I have to pay it myself).

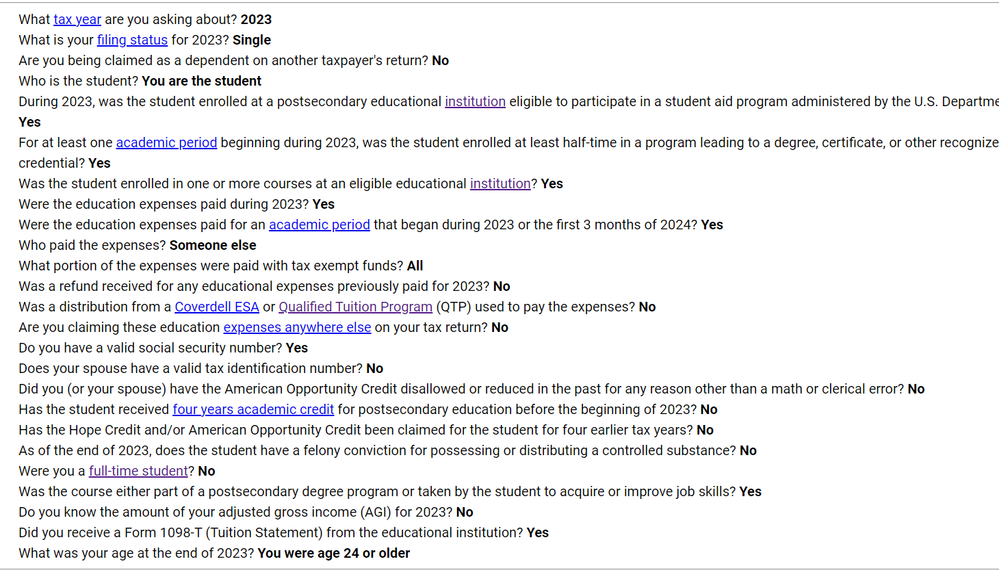

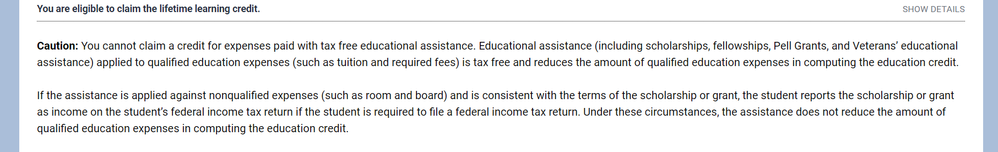

I did an IRS survey with theses results in the attached pictures. Also ESP deemed the class Non-Taxable

In that case can I report my 1099-T form and obtain the LLC benefit?

Topics:

February 14, 2024

8:25 AM