- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Education

- :

- Is the hazlewood benefit reflected on 1098-T?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the hazlewood benefit reflected on 1098-T?

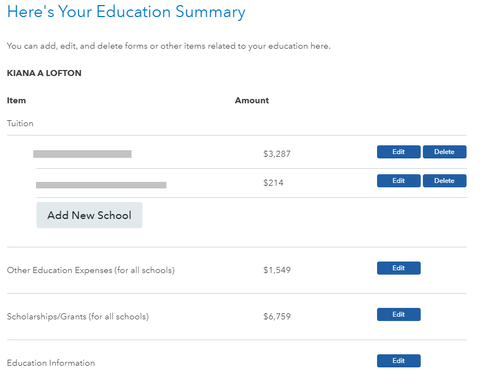

I received a 1098-T for the college I attended last year. I use the Texas Hazlewood Act to cover tuition. Hazlewood covered all of my tuition, and I did not have to pay any of it out of pocket, nor did any other scholarship or grant contribute. I did, however, receive a Pell Grant of $3,447 that ended up being refunded to me since Hazlewood already covered my tuition. I will need to report this as taxable income since I did not use any of it for qualified educational expenses. Now, I am a bit confused on how to enter in my 1098-T on TT. Box 1 shows $3,287. I am assuming here that this would be from Hazlewood, as they covered all of my tuition. Box 5 shows $6,759. I am also assuming that a portion of that is the $3,447 Pell Grant. In TT, there is a question asking: "Did you receive any of the following tax-free benefits last year?" with GI Bill benefits and Veterans' benefits listed under it. Would I say yes? If I say yes, it is followed by: "What portion of the $6,759 from Box 5 on your 1098-T is from veterans' benefits and/or tax-free employer provided assistance?" If the Pell Grant ($3,447) was part of this, would I enter the remaining $3,312 as being from veterans' benefits? I don't know what else could possibly be lumped into that total other than Hazlewood. Would Hazlewood therefore be included in both boxes 1 and 5? I have called the payment office at this school to ask and they were not helpful, unfortunately.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the hazlewood benefit reflected on 1098-T?

Q. Okay, great. Now, for the question: "Did you pay for room and board with a scholarship or grant" do I say "yes" and put the total of the Pell Grant, so that it gets counted as taxable income since I did not use it for qualified educational expenses?

A. No. See the next question.

Q. Or would this be calculated by TT even without me doing that?

A. Yes. More importantly, you want to enter any other qualifying expenses, e.g. books and a computer, to reduce the amount of the Pell grant that gets taxed. Anything you enter for room & board, at that question, gets taxed regardless of other expenses entered.

We haven't talked about the education credit. Since your tuition is paid by Hazelwood, there is no tuition to claim for the credit. Books and a computer would be qualifying expenses, for the credit, if you are an undergrad.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the hazlewood benefit reflected on 1098-T?

Q. Is the hazlewood benefit reflected on 1098-T?

A. Not usually, so you want to try to verify with the school what they did, because in this case maybe they did.

If so, you could handle it the way you described. But, the simple this is don't enter any additional amounts. The Hazelwood amount in box 1 is already balanced by the Hazelwood amount in box 5.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the hazlewood benefit reflected on 1098-T?

I tried asking the office, but that wasn't much success. Since only Hazlewood was used to cover tuition, I am making the guess that the school did include it on the form. If that's the case, would I say "Yes" to receiving help from veterans' benefits? If I did, I would have to enter in what portion of box 5 is veterans' benefits. Otherwise, do I just say no? I also have to take in account that the Pell Grant has to be listed as taxable income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the hazlewood benefit reflected on 1098-T?

Q. If that's the case, would I say "Yes" to receiving help from veterans' benefits?

A. No. Hazelwood is already included in both box 1 and box 5.

Q. I also have to take in account that the Pell Grant has to be listed as taxable income.

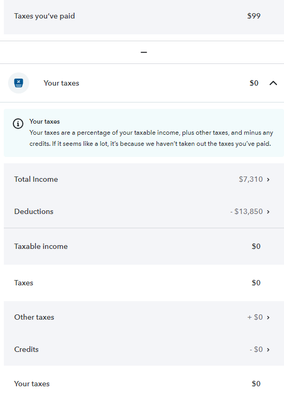

A. That will happen automatically after entering the 1098-T. TT will enter $3472 as taxable income (6759 - 3287 = 3472) as taxable scholarship income (on line 8r of Schedule 1), unless you enter some additional expenses, e.g. books and a computer (but not room & board) to reduce the taxable amount.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the hazlewood benefit reflected on 1098-T?

Okay, great. Now, for the question: "Did you pay for room and board with a scholarship or grant" do I say "yes" and put the total of the Pell Grant, so that it gets counted as taxable income since I did not use it for qualified educational expenses? Or would this be calculated by TT even without me doing that?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the hazlewood benefit reflected on 1098-T?

Q. Okay, great. Now, for the question: "Did you pay for room and board with a scholarship or grant" do I say "yes" and put the total of the Pell Grant, so that it gets counted as taxable income since I did not use it for qualified educational expenses?

A. No. See the next question.

Q. Or would this be calculated by TT even without me doing that?

A. Yes. More importantly, you want to enter any other qualifying expenses, e.g. books and a computer, to reduce the amount of the Pell grant that gets taxed. Anything you enter for room & board, at that question, gets taxed regardless of other expenses entered.

We haven't talked about the education credit. Since your tuition is paid by Hazelwood, there is no tuition to claim for the credit. Books and a computer would be qualifying expenses, for the credit, if you are an undergrad.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the hazlewood benefit reflected on 1098-T?

Ah, I see. Thanks! That second question does bring up a good point. In 2023, I did purchase computer parts/hardware to build my own computer. These parts are expensive. Now, I do own my own Etsy business and have to pay taxes on the income I make. When I went through the wages & income section in TT, I did choose to write off a portion (20%) of those parts/computer as an office expense. My business does require my computer and a portion of my usage comes from it. I made a purchase of $891.03 worth of parts on Amazon and therefore wrote off 20% ($178.21) of that. I just now realized, however, that I also made a purchase of $658.89 for that PC's graphics card on Newegg in 2023, which I have not included when I wrote off a portion of that other purchase. Would I be able to write off a portion of either this second purchase or the total of these two purchases as a qualifed education expense? I would say that I use my PC even more for school than for business, especially since a good portion of my classes taken in 2023 were online.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the hazlewood benefit reflected on 1098-T?

Simple answer: Yes. A computer is a qualified expense for calculating your tuition credit. But, taxes aren't simple. For a full discussion see:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the hazlewood benefit reflected on 1098-T?

Be aware that you are only allowed to claim the AOTC four times in your undergraduate years. If there's a chance the credit will be worth more, in future years, you may not want to waste one of those four times on a low credit. On the other hand, if you expect to qualify for the Hazelwood all four years, a low credit may be the best you can do.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the hazlewood benefit reflected on 1098-T?

Would adding a portion of this expense then be beneficial in at least bringing down how much of that Pell Grant can be taxed? If so, would it be better for me to add up these two purchases ($1,549.2) and write off a portion of that for my business use and a portion for school use? If I then do 20% of that total for business, it's $309.98 and, say, 40% for school (I use 40-50% of my PC for school use), it's $619.97. The remaining 40% or so usage is for personal use and therefore wouldn't write that remaining $ off.

Edit: For your last reply, I'll add that I plan on completing college next year, in (hopefully) spring 2025. I have only used Hazlewood to pay my tuition all this time and will for the remaining time. I have not claimed the AOTC once in my time thus far. I mainly just want to lower the amount of the Pell that will be taxed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the hazlewood benefit reflected on 1098-T?

The AOTC is 100% of the first $2000 of expenses (and 25% of the next $2000). So, you're better off claiming the first $2000 of computer cost for the AOTC rather than making the Pell less taxable. Likewise, you're better off claiming the first $2000 of computer cost for the AOTC rather than as a business deduction. $1549 of computer expenses = $1549 credit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the hazlewood benefit reflected on 1098-T?

Okay, do I put that $1,549 next to "books and materials not required to be purchased from the school" in the section: "did you pay for books or materials to attend school," since this wasn't paid directly to the school? If so, when doing that, TT says that I cannot claim an education tax break. Unless I entered something wrong?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the hazlewood benefit reflected on 1098-T?

Yes, you entered something wrong, in the qualifying interview. I just tested it, it works when entered as "books and materials not required to be purchased from the school".

Before going thru the whole interview, first try entering it as books required to be purchased from the school. Lying to TurboTax to get it to do what you want does not constitute lying to the IRS

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the hazlewood benefit reflected on 1098-T?

Hmm I tried putting the $1,549 next to "books required to be purchased from the school" instead and TT still says I cannot claim it. I went back and even re-entered the 1098-T.

Did You Receive Any of the Following Tax-Free Benefits Last Year? > no

Was Any of Your Financial Aid Already Included as Income? > no

Was Your Enrollment Status for 2023 At Least Half-Time? > yes

Did You Receive a Form 1098-T from [school] in 2022? > yes, no amount in box 2

Scholarships/Grants (for all schools):

Did You Receive a Scholarship or Grant in 2023? > yes, $6,759 is stated next to scholarships/grants

**I do question, if Hazlewood's payment from box 1 is being lumped with Pell into this total, is that creating an issue potentially? One of the 4 reasons listed in TT for why I may not qualify is "Scholarships, grants, and other tax free assistance exceed the education expenses"

Did Your Aid Include Amounts Not Awarded for 2023 Expenses? > no

Did You Pay for Room and Board with a Scholarship or Grant? > no

Edit: TT is also saying that I have $0 in taxable income, which could also be why I don't qualify

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the hazlewood benefit reflected on 1098-T?

It appears to be sensing that you have too much scholarship.

When it asks Did You Pay for Room and Board with a Scholarship or Grant?

Answer yes and enter the Pell grant amount. That reallocates the scholarship from qualified expenses (the computer) to non qualified expenses (R&B).

Going for the AOTC, makes the "automatic box 5 minus box 1"calculation no longer enough.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Jeff C1

Level 2

KLU44

Level 1

essence2358

New Member

robawsc

Level 1

prouleau

Level 1