- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Education

Hmm I tried putting the $1,549 next to "books required to be purchased from the school" instead and TT still says I cannot claim it. I went back and even re-entered the 1098-T.

Did You Receive Any of the Following Tax-Free Benefits Last Year? > no

Was Any of Your Financial Aid Already Included as Income? > no

Was Your Enrollment Status for 2023 At Least Half-Time? > yes

Did You Receive a Form 1098-T from [school] in 2022? > yes, no amount in box 2

Scholarships/Grants (for all schools):

Did You Receive a Scholarship or Grant in 2023? > yes, $6,759 is stated next to scholarships/grants

**I do question, if Hazlewood's payment from box 1 is being lumped with Pell into this total, is that creating an issue potentially? One of the 4 reasons listed in TT for why I may not qualify is "Scholarships, grants, and other tax free assistance exceed the education expenses"

Did Your Aid Include Amounts Not Awarded for 2023 Expenses? > no

Did You Pay for Room and Board with a Scholarship or Grant? > no

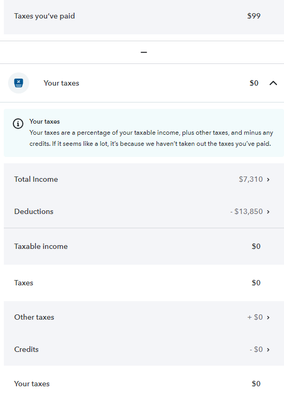

Edit: TT is also saying that I have $0 in taxable income, which could also be why I don't qualify