- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Education

- :

- I have used the American Opportunity fund 2 times previously but I answered once how do I change this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have used the American Opportunity fund 2 times previously but I answered once how do I change this?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have used the American Opportunity fund 2 times previously but I answered once how do I change this?

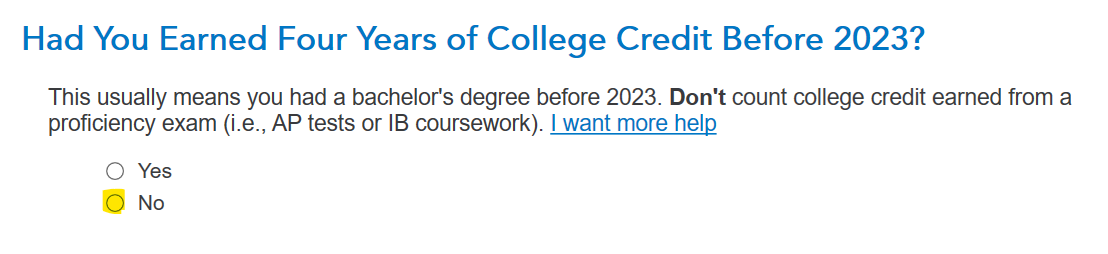

Your answer would not change - the question is Have You Earned Four Years of College before 2023? So the answer would be NO, either way.

You can use the American Opportunity Tax Credit (AOTC) for the first four years of college when working towards a degree.

- Maximum credit is $2,500 per eligible student

- Must be enrolled at least half-time for at least one semester during the tax year at an eligible educational institution

- Up to $1,000 can be refunded to you

To change any of your answers, step back through the Education section questions. Search for 1098-T and you'll be taken to that section. Click through the 1098 questions, and you can change any of your answers before you file.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have used the American Opportunity fund 2 times previously but I answered once how do I change this?

Q. I have used the American Opportunity fund 2 times previously but I answered once how do I change this?

A. It actually doesn't matter. You can leave it as it is.

If you have not filed yet, Go through the entire education interview until you reach a screen titled "Your Education Expenses Summary". Click edit next to the student's name. That should take you to a screen “Here’s your Education Summary”. Click edit next to “Education Information”. Thar question will come up and you can change it.

If you have already filed, do nothing. TurboTax only uses that question to check the yes or no box on line 23 of form 8863, "Has the American opportunity credit been claimed for this student for any 4 prior tax years?". Since changing from 1 to 2, on your answer, does not change the IRS form, do nothing.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

garne2t2

Level 1

Robert420

Level 1

lily32

New Member

in Education

knoelle

Returning Member

cyoes

Level 1