- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Education

- :

- Entering New York 529 contribution. no limit in the turbotax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

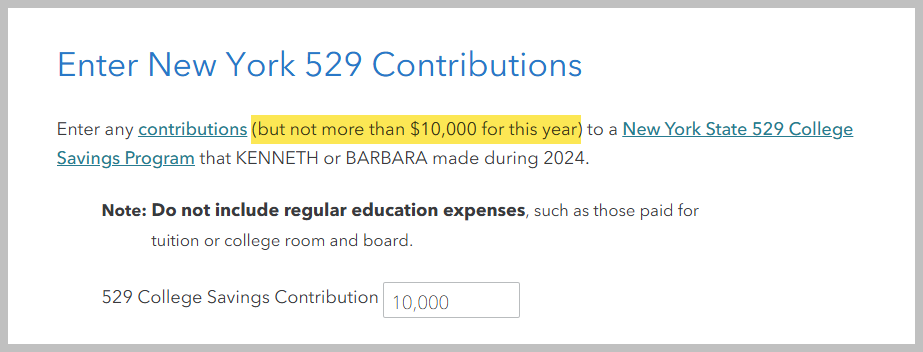

Entering New York 529 contribution. no limit in the turbotax

My understanding is $10,000 is maximum number I put on New York 529 contribution but when I enter $20, 000 the program actually took it and my NY state refund jumped up. I compare the NY state refund between $10K VS. $20K and the $20K contribution NY state refund are significantly higher. Is this program bug that it should be same amount of refund between $10K VS. $20K New York 529 contribution since $10K is the maximum contribution for married joint filing or I am missing something?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering New York 529 contribution. no limit in the turbotax

You are correct, the maximum contribution to a New York 529 is $10,000 for people filing a Married filing joint return ($5,000 for others). Even if the program allows you to enter a larger amount, don't enter more than $10,000.

Direct Plan tax benefits

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

tcondon21

Returning Member

march142005

New Member

RyanK

Level 2

ellenbergerta

New Member

john-maneval

New Member