in Education

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Education

- :

- Education Tax-Free Grants Claimed as Income to Qualify for American Opportunity Tax Credit

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Education Tax-Free Grants Claimed as Income to Qualify for American Opportunity Tax Credit

In the IRS 2019 Publication 970, it states that,

"It may benefit you to choose to include otherwise tax-free scholarships or fellowship grants in income. This may increase your education credit and lower your total tax or increase your refund."

How do I go about claiming this as income? I have a 1098-T, I just need to figure out which option in income forms this would fall under.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Education Tax-Free Grants Claimed as Income to Qualify for American Opportunity Tax Credit

Please follow these 15 simple steps:

- Log into your return

- Pick up where I left off

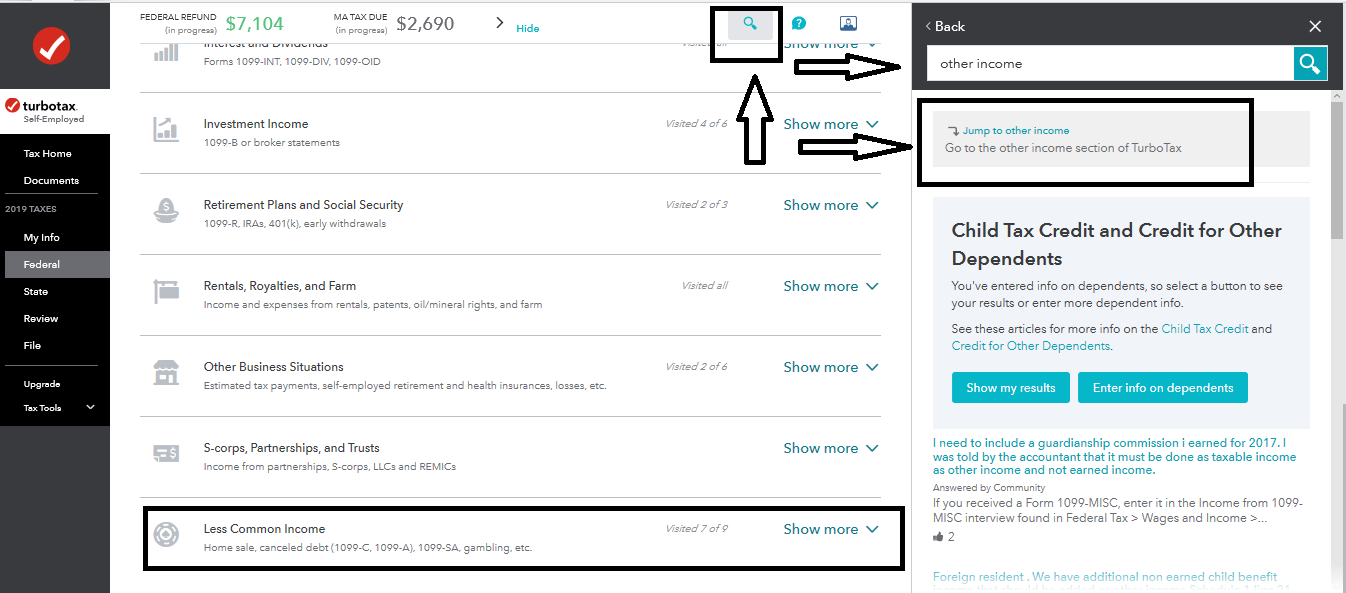

- Locate the search/magnifying glass

- Enter exactly other income

- Select the first entry Jump to other income

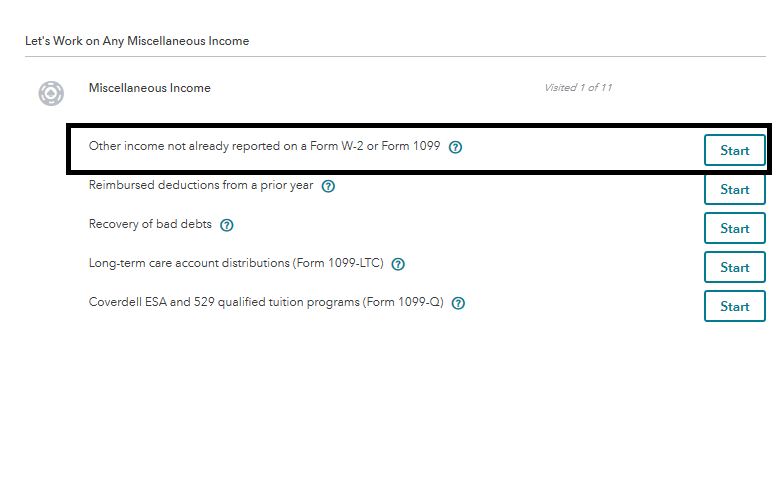

- Select the first entry, Other income not already reported on a Form W-2 or Form 1099

- Select START

- Did you receive any other wages? click Yes

- Household Employee, click Continue

- Sick or disability pay, click Continue

- Any Other Earned Income? Select Yes

- Enter Source of Other Earned Income, seclect Other

- Continue

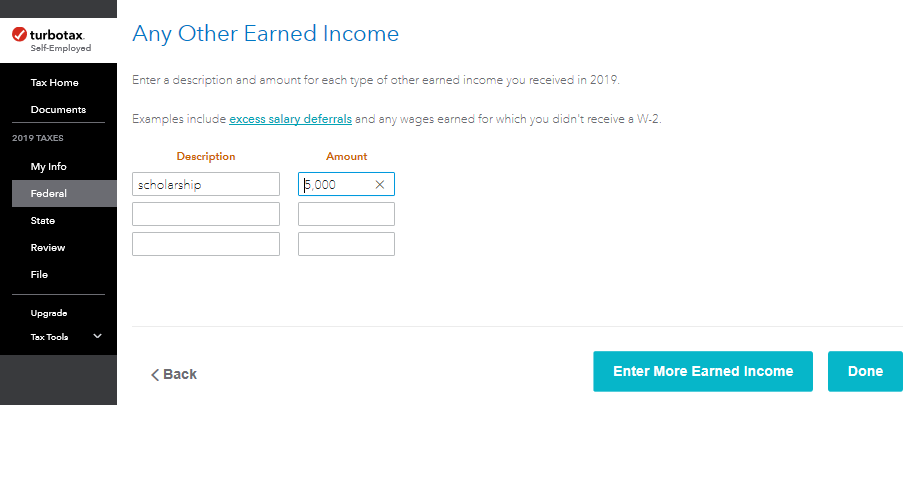

- Any Other Earned Income, enter Description, Scholarship and amount

- Done

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Education Tax-Free Grants Claimed as Income to Qualify for American Opportunity Tax Credit

That technique is usually used when the student is a dependent on the parent's tax return. The student dependent claims the income and the parent claims the tax credit. See write up below.

For a student to do that, he would have to already have sufficient income to have a tax liability or be over age 23 to claim the refundable credit.

It takes a wok around in TurboTax (TT). There are several ways to do it. Lying to TurboTax to get it to do what you want does not constitute lying to the IRS. Using the example below and assuming you need $4000 of qualified expenses to clam the maximum credit: At the 1098-T screen, enter $8000 in box 1 and $10,000 in box 5. Later, in the interview you will be asked if any of the scholar ships were used for non qualified expenses. Answer yes and enter $6000. Also indicate that the scholarship was used for room and board.

________________________________________________________________________

There is a tax “loophole” available. The student reports all his scholarship, up to the amount needed to claim the American opportunity credit, as income on his return. That way, the parents (or himself, if he is not a dependent) can claim the tuition credit on their return. They can do this because that much tuition was no longer paid by "tax free" scholarship. You cannot do this if the school’s billing statement specifically shows the scholarships being applied to tuition or if the conditions of the grant are that it be used to pay for qualified expenses.

Using an example: Student has $10,000 in box 5 of the 1098-T and $8000 in box 2. At first glance he/she has $2000 of taxable income and nobody can claim the American opportunity credit. But if she reports $6000 as income on her return, the parents can claim $4000 of qualified expenses on their return.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

QRFMTOA

Level 5

Taxes_Are_Fun

Level 2

DarrinK

Level 1

skylee_hall

New Member

in Education

Zimers

Level 1