- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Education

- :

- CO 529 deduction

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CO 529 deduction

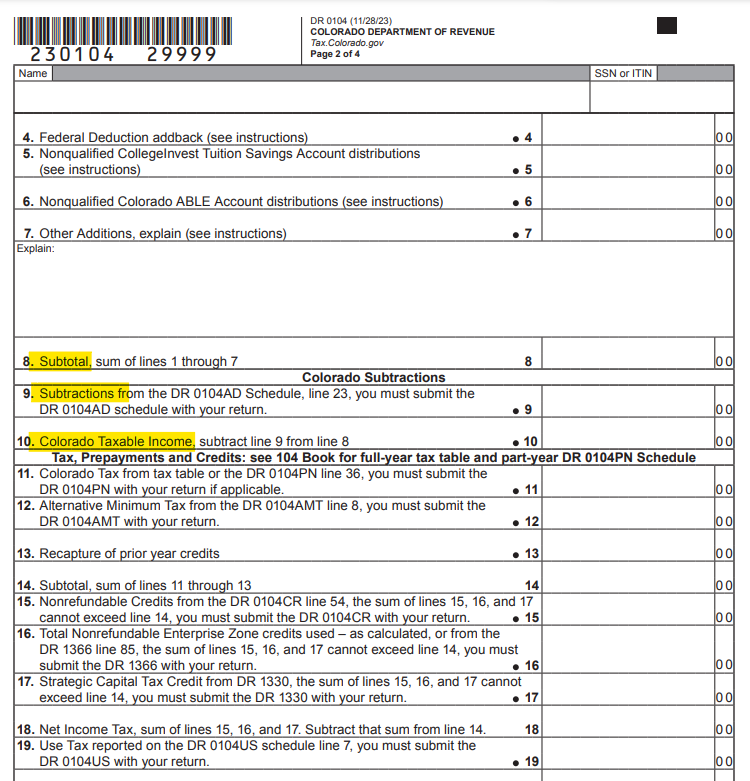

I claimed the 529 deduction on my Colorado tax form DR0104AD line 8 and it does show up. However, it made no difference at all on my refund amount. What am I missing?

Thanks

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CO 529 deduction

If you have zero taxable income, adding deductions will not affect your refund. Otherwise, you should be seeing a deduction and increased refund. See 529 Contribution Subtraction.

Are you saying that the subtotal is not subtracting the amount on the line to get the total tax? Do you have no taxable income or other credits affecting your return?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CO 529 deduction

Thanks so much for the quick reply, I did recheck my form and have negative taxable state income. Solved.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

tbduvall

Level 4

cramanitax

Level 3

dafeliks

New Member

Rprincessy

New Member

asrogers

New Member